In another case of history repeating itself, investors have once again got caught up in the fleeting optimism that seems to grip the markets every time there is a “Merkozy” Summit underway. As Chancellor Merkel and President Sarkozy discussed more ways with which they could save the EUR, the common currency bounced from its lowest levels since September 2010. The Euro also managed to bounce from its lowest levels against the Japanese Yen since December 2000 and the Dollar Index fell for the first time in 4 days. The leaders said that they may finalise the new Euro-pean budget rule book a month ahead of schedule at the end of January and are looking to bring forward contributions to the bailout fund. The EUR opens the morning higher at 1.2760.

The Australian dollar remains under pressure trading below 1.0150 after the release of weaker than expected retail sales figures before a recovery instigated by a rising EUR. The weaker than expected retail sales figures have bolstered the case for another official rate cut from the RBA at its next meeting in February. The Swiss National Bank Chairman resigned after the disclosure of his wife's currency trading activities and the Swiss France gained almost 0.5% despite its “unofficial” peg against the EUR. In what could be interpreted as either a bad or good sign for the US econ-omy, consumer borrowing surged in November by the most in a decade as households took on more debt and banks increased lending. The AUD opens the morning as 1.0230 while USD/CHF trades at 0.9500.

Global equity markets were once again mixed with European bourses falling while American equities held their ground. The start of the US earn-ings reporting season kicks off with the announcement of fourth quarter results from Alcoa. US companies finished 2011 with the slowest profit growth figures in two years as a slowing Europe impacted on companies with global sales. The S&P 500 has closed the session higher by 0.23% to 1,281. Earlier in Europe, the bourses continued to weaken with the DAX losing 0.67% to 6,017 while the FTSE incurred similar losses down 0.66% to 5,612. Italy's largest bank, UniCredit, fell 13% as rights to buy its stock collapsed in their first day of trade.

Commodity prices were stronger led by a broad rally in soft commodities with the CRB gaining 2.04 points to 311.52. Crude oil weakened margin-ally by 0.3% to $101.26 as the concerns that Iran may block crude shipments through the Strait of Hormuz eased. The easing of geopolitical ten-sions may see WTI crude drift below $100.00. Precious metals were mixed with gold marginally lower at $1,609 while silver futures gained 0.76% to $28.90. Soft commodities were broadly higher lead by gains of almost 7% in cocoa futures. Copper eased 0.52%. Today we have the release of the high impact Australian Building Approvals and Chinese Trade Balance figures. Overnight we have Canadian Housing Starts and speeches by two FOMC members.

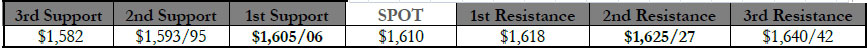

GOLD moved modestly lower in offshore trade as profit taking remains after the recovery from the lows over the holiday period and major shortterm resistance continues to cap which is putting traders on edge as to wether or not we will see a break higher. Prices remained well supported and above $1,.600 as the Euro strengthened on the night and US equities posted small gains. Gold finished US trade weaker by 0.30% at $1,612.

Consolidation is the only word that comes to mind in the precious metals complex right now as currencies remain pressured and Europe's problems

are not going away. It looks as though we will see a big move higher this year as fundamentals remain in tact but form a te4chnical view we need to see a breach through major short-term resistance at $1,640/42. Above here and $1,700 come back into play. Today, initial resistance lies at $1,627 will cap with a breach targeting major levels at $1,642. Support remains solid down towards $1,600/05 and presents a good buying opportunity with stops under $1,580 to start.

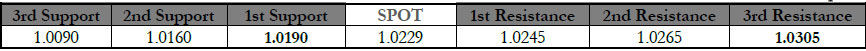

AUD/USD fell during the Asia session yesterday as the market’s expectations for the Retail Sales number were not met with Victoria suffering the most in November. However, the price didn’t last long below 1.0150 as the expected

meeting between Merkel and Sarkozy gave a positive spin to the risk currencies on the improved Euro also. The jump back above 1.0190/00 offers saw intraday shorts squeezed with the price jumping to meet new offers at 1.0250. Since the European afternoon the price has remained between 1.0190 and 1.0240 as the North American equity market haven’t given any leads to traders. Australian Building Approvals is to be released during the late morning and with an expected recovery to 6.6% from last months terrible –10.7%, we could be in for a little sharp action. A solid number should lead to a short lived bounce which would be more about stop hunting than any else. We are looking to reset shorts if the pair manages to reach the high 1.02’s with stops above 1.0305 for safety.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fleeting Euro Optimism, Mixed Equity Markets

Published 01/10/2012, 02:05 AM

Updated 07/09/2023, 06:31 AM

Fleeting Euro Optimism, Mixed Equity Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.