The markets rallied on the back of the coordinated action by six central banks led by the Federal Reserve to reduce the swap rates and China’s move to reduce its banks’ reserve requirements for the first time since 2008. Investor sentiment has picked up significantly and the majors have held onto the majority of their gains against the USD despite the expected correction today after such a big move overnight. The EUR/USD is closing the afternoon at 1.3450 while the GBP/USD has fallen below 1.5700.

Further highlighting the need for monetary stimulus was the release of weakest Chinese manufacturing data since 2009. The purchasing manag-ers index compiled by the China Federation of Logistics and Purchasing fell to 49 in a sign of contraction. In Australia, the Australian dollar fell from close to 1.0300 after the release of data showed that building approvals dropped and consumer spending slowed. The data has reinforced the case for further interest rate cuts by the RBA and the AUD/USD fell. It closes the afternoon at 1.0224 after trading as low 1.0185.

The MSCI Asia Pacific Index has gained 3.5% with nine shares declining for every one that fell. The Nikkei gained 2.08% to 8,610 while the Hang Seng surged 5.6% to 18.997. The ASX 200 gained 2.64% to 4,228.60 sparking a $30 billion rally despite disappointing data releases. The silly season is truly upon us as global investors followed the lead of American consumers by going on a buying spree. BHP and Rio Tinto gained more than 4% while the NAB led the banks by rising 3.3%.

Commodity prices continued to rise today after the euphoria surrounding the coordinated central bank efforts overnight. WTI Crude has gained 0.47% to $100.83. Precious metals consolidated with gold higher by 0.4% to $1,725 while silver fell 0.13% to $31.91. Soft commodities were broadly lower while copper lost 1.5% in response to a contraction in Chinese Manufacturing. Overnight, we have the release of the UK Manu-facturing PMI, US Unemployment Claims and Manufacturing PMI.

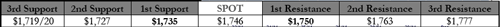

GOLD was range bound in Asian trade today as markets performed as expect and profit takers moved in after stellar gains in the offshore session. With US equity futures little changed and the USD steady it was going to be hard for commodities to push higher in Asia today. Further consolidation is seen on the lead up to Friday’s key payrolls data. Gold traded in a $1,744-50 range and finished the session unchanged at $1,746. It was ultimately a very quiet day in Asia for the precious metals markets with gold only seeing a $6 range on the day. Offers towards major short-term resistance at $1,750 are holding firm right now and we may be capped by this level until we see Friday’s pay-rolls numbers. We do still favour a much bigger move higher back towards $1,800 initially but we will need to firmly break through and close above $1,750 this week to trigger this move. On the downside, support sits initially at $1,735 and then lower at $1,727 and we expect this level to limit any losses from here. We have reduced short-term longs up here and look to buy again back don at $1,727/35. Watch $1,750 close-ly, this is very important and a break could trigger big gains. MT stops on longs should still remain below $1,700 for now until we close above $1,750.

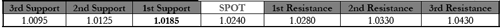

AUD/USD gave up some of the overnight gains during the Asia morning as the detail came into the markets about what it meant in the longer term and as many larger names across the markets believe the actions were a clear sign of last resort. The Australian data releases were much weaker than expected with the Building approvals number released at –10.7%. The Australian Dollar collapsed as the weight of bulls covering took the price to a 1.0185 low. Since the bottom the pair has re-covered during the afternoon as the majors have managed to rally with afternoon expecta-tions of risk sentiment rising. Chinese PMI data also helped the afternoon tone as the number was above the rumoured 48.

The Australian Dollar should remain heavy on bounces today unless the Central Banks have anymore surprises in store! We will be watch-ing the 1.0185 level on the downside and if the level breaks look for 1.0125. Topside should see plenty of resistance into 1.0330.

Further highlighting the need for monetary stimulus was the release of weakest Chinese manufacturing data since 2009. The purchasing manag-ers index compiled by the China Federation of Logistics and Purchasing fell to 49 in a sign of contraction. In Australia, the Australian dollar fell from close to 1.0300 after the release of data showed that building approvals dropped and consumer spending slowed. The data has reinforced the case for further interest rate cuts by the RBA and the AUD/USD fell. It closes the afternoon at 1.0224 after trading as low 1.0185.

The MSCI Asia Pacific Index has gained 3.5% with nine shares declining for every one that fell. The Nikkei gained 2.08% to 8,610 while the Hang Seng surged 5.6% to 18.997. The ASX 200 gained 2.64% to 4,228.60 sparking a $30 billion rally despite disappointing data releases. The silly season is truly upon us as global investors followed the lead of American consumers by going on a buying spree. BHP and Rio Tinto gained more than 4% while the NAB led the banks by rising 3.3%.

Commodity prices continued to rise today after the euphoria surrounding the coordinated central bank efforts overnight. WTI Crude has gained 0.47% to $100.83. Precious metals consolidated with gold higher by 0.4% to $1,725 while silver fell 0.13% to $31.91. Soft commodities were broadly lower while copper lost 1.5% in response to a contraction in Chinese Manufacturing. Overnight, we have the release of the UK Manu-facturing PMI, US Unemployment Claims and Manufacturing PMI.

GOLD was range bound in Asian trade today as markets performed as expect and profit takers moved in after stellar gains in the offshore session. With US equity futures little changed and the USD steady it was going to be hard for commodities to push higher in Asia today. Further consolidation is seen on the lead up to Friday’s key payrolls data. Gold traded in a $1,744-50 range and finished the session unchanged at $1,746. It was ultimately a very quiet day in Asia for the precious metals markets with gold only seeing a $6 range on the day. Offers towards major short-term resistance at $1,750 are holding firm right now and we may be capped by this level until we see Friday’s pay-rolls numbers. We do still favour a much bigger move higher back towards $1,800 initially but we will need to firmly break through and close above $1,750 this week to trigger this move. On the downside, support sits initially at $1,735 and then lower at $1,727 and we expect this level to limit any losses from here. We have reduced short-term longs up here and look to buy again back don at $1,727/35. Watch $1,750 close-ly, this is very important and a break could trigger big gains. MT stops on longs should still remain below $1,700 for now until we close above $1,750.

AUD/USD gave up some of the overnight gains during the Asia morning as the detail came into the markets about what it meant in the longer term and as many larger names across the markets believe the actions were a clear sign of last resort. The Australian data releases were much weaker than expected with the Building approvals number released at –10.7%. The Australian Dollar collapsed as the weight of bulls covering took the price to a 1.0185 low. Since the bottom the pair has re-covered during the afternoon as the majors have managed to rally with afternoon expecta-tions of risk sentiment rising. Chinese PMI data also helped the afternoon tone as the number was above the rumoured 48.

The Australian Dollar should remain heavy on bounces today unless the Central Banks have anymore surprises in store! We will be watch-ing the 1.0185 level on the downside and if the level breaks look for 1.0125. Topside should see plenty of resistance into 1.0330.