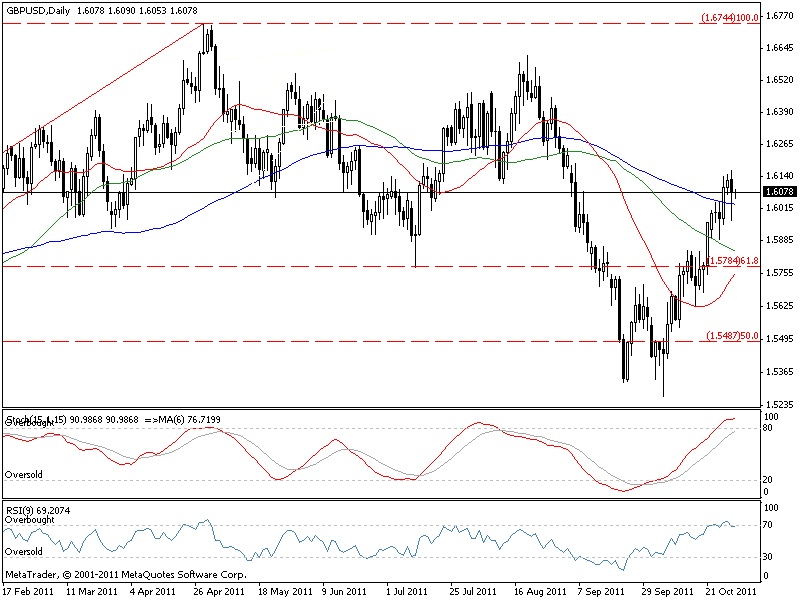

The currency pair regained part of its losses against the dollar, closing above the first major resistance at 1.5784 (61.8% Fibo retracement), followed by 1.6545 and the top from 02.05 at 1.6720. In the opposite direction first support would be the 50% Fibonacci level at 1.5487 followed by 1.5350.

| Support | 1.5784 | 1.5325 | 1.5190 |

| Resistance | 1.6545 | 1.6720 | 1.7030 |

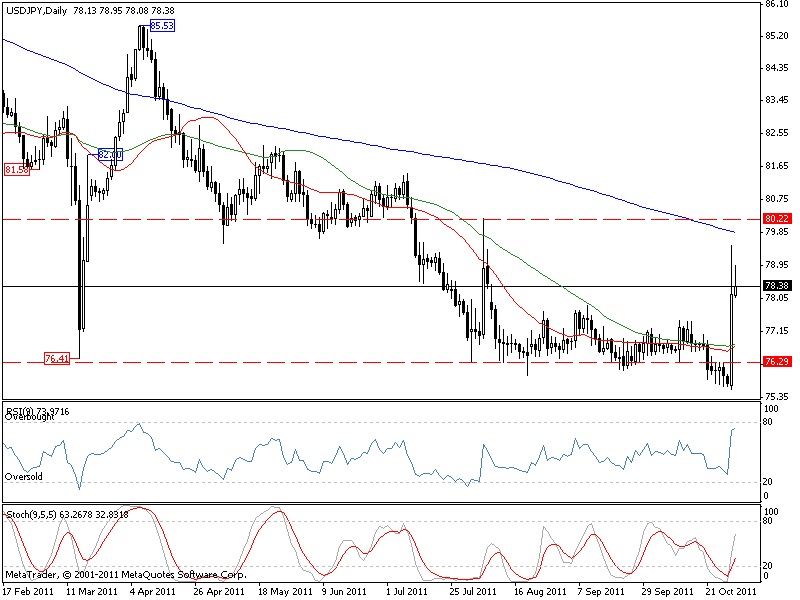

USD/JPY

Movement in the general area of consolidation continues. Correction after falling from 85.52 to 79.57 reached 38.2 percent, followed by a break in the downward direction, as the price moves in the range 75.70 - 80.22, repelling from 75.70. Currently, the appreciation of the Japan currency reached 75.65 yen, below the levels of 78,50 ¥, which was the start of the last intervention by the BoJ. While the upper level is near historic lows. Important levels are 82.00 (50-DMA and intervention after the G-7) 83.30-level before the earthquake and 85.80 peak in April.

| Support | 76.90 | 76.29 | 75.95 |

| Resistance | 80.22 | 82.11 | 85.53 |

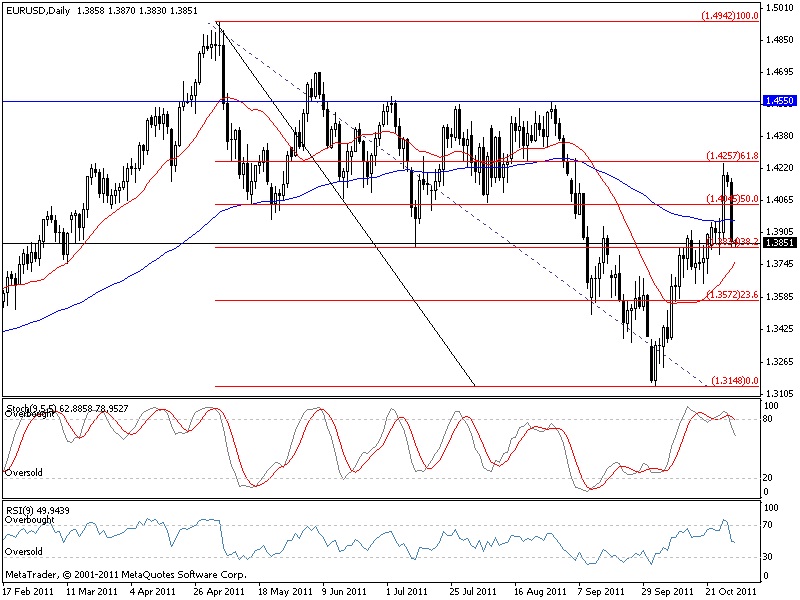

EUR/USD

The Euro ended the session with a significant appreciation which was capped below the resistance at 1.4257 – 61.8 % Fibonacci retracement of the fall from 1.4942 to 1.3148. In case of an upward breakthrough, next resistances lie at 1.4550 and 1.4942. In downward direction the initial support can be found at 1.4045 – 50% Fibonacci retracement of the fall, followed by 1.3834 and 1.3572.

| Support | 1.3047 | 1.2870 | 1.2200 |

| Resistance | 1.4150 | 1.4550 | 1.4700 |