Costco Wholesale Corporation (NASDAQ:COST) Consumer Discretionary - Food and Staples Retailing | Reports May 25, After Market Closes

Key Takeaways

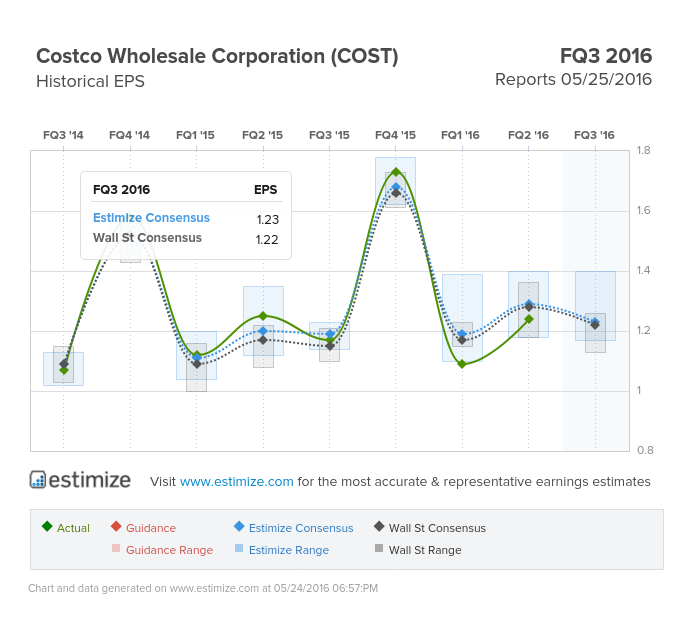

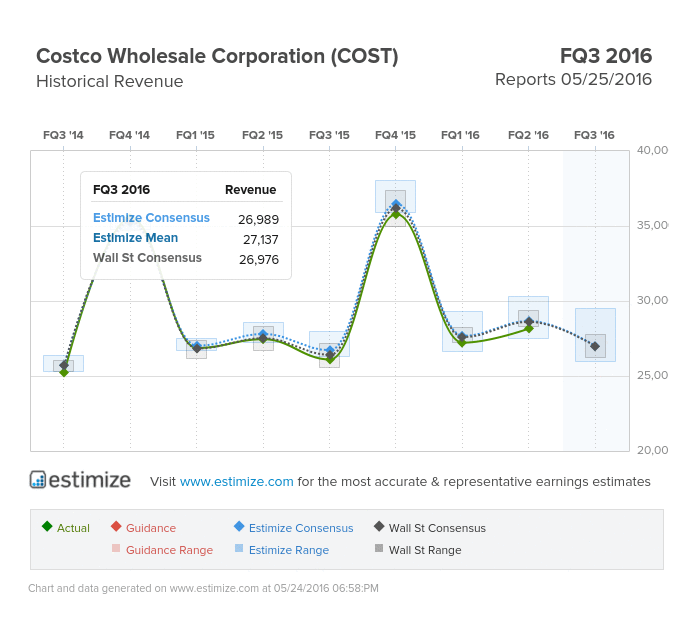

- The Estimize consensus is looking for earnings per share of $1.23 on $26.99 billion in revenue, 1 cent higher than Wall Street on the bottom line and $13 million on the top

- Costco’s March and April numbers signified a slowdown, but withholding negative impacts from gas and FX headwinds, sales were relatively flat

- Switching the company’s official credit card from American Express (NYSE:AXP) to Visa could hurt new subscribers

- What are you expecting for COST?

Headlining this week of earnings is wholesale retailer, Costco. Costco doesn’t keep very many secrets when it comes to earnings. On a monthly basis the company releases its sales numbers, taking away some of the mystery behind quarterly results. Costco has already reported slowdown in 2 of 3 months covered this quarter, but factoring out currency headwinds and gas prices, sales have been relatively flat.

Nonetheless, the Estimize consensus is looking for earnings per share of $1.23 on $26.99 billion in revenue, 1 cent higher than Wall Street on the bottom line and $13 million on the top. Compared to a year earlier this represents a 6% gain in earnings with sales expected to grow by 5%.

On average, Costco is a positive mover during earnings season. Shares typically increase 2% in the 30 days prior to results and maintain those gains until the month after. This should help reconcile the 11% dip shares have taken this year.

Excluding negative impacts from gas prices and foreign exchange rates, total comp sales increased 3% last month. This was driven by 2% gains in its domestic segment and 7% increase in Canada. Since the sales numbers have already been published, investors will be most interested to see if memberships grew. The switch of the company’s credit card from American Express to Visa through Citigroup (NYSE:C) could hurt new subscribers.

For the discount club, membership fees make up more a greater proportion of total revenue than in-store sales. Roughly 75% of sales come from fees and any reduction in price would be problematic for Costco. The company also faces stiff competition from other retailers specifically Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT).

On the bright side, Costco has resisted the overall weakness in the retail sector, delivering consistent earnings and revenue growth over the last three years.