USD/JPY has found a very good support above 106.20 following the NFP on Friday, where it inclined sharply, flirting with the key resistance levels of 107.60.

Still, the effect of the bullish divergence on RSI is in play along with bullish tendencies on ADX.

From here we will be bullish today, and a stable move above 107.60 will accelerate as far as 106.40-106.20 holds.

Support: 107.20-106.80-106.50

Resistance:107.80-108.20-108.80

Direction: Bullish

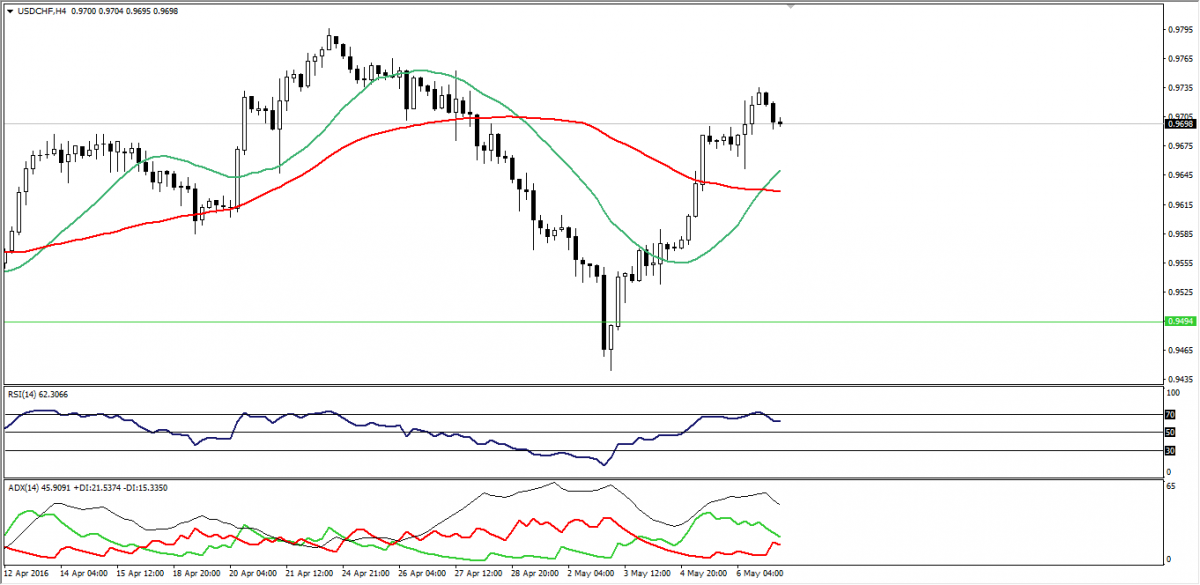

USD/CHF has reached the target we defined last week at 0.9725 and traded above it, but the overbought signs on H4 have caused some kind of correction.

We remain bullish since the bigger time frames looks positive, but we will avoid trading until the pair presents better entry signals.

All eyes should be on 0.9630 as a break below it will give us a rational reason for concern.

Support: 0.9680-0.9630-0.9600

Resistance: 0.9740-0.9780-0.9820

Direction: Bullish, but we will stand aside now

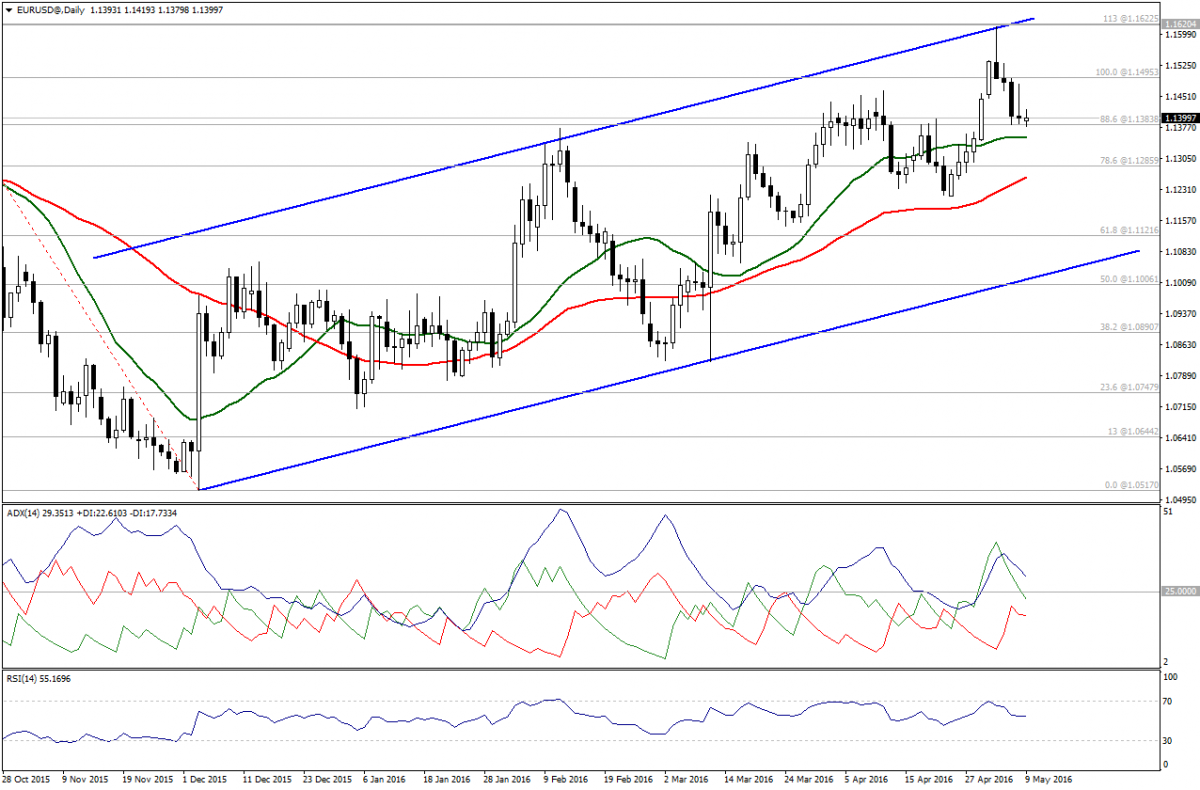

EUR/USD found support above 1.1380 - Fibonacci of 88.6% - which continues to prevent the pair from achieving additional debasement, while moving averages remain support around 1.1350.

Meanwhile, ADX shows decrease in bulls’ power and RSI trades above 50.00

Hence, we will be neutral now to see whether the pair will breach 1.1350 or not.

Support: : 1.1380 – 1.1350 – 1.1285

Resistance:1. 1.1445 –1.1495 – 1.1550

Direction: Neutral

GBP/USD continued to decline, breaching 1.4385 - Fib. of 50% - along with bearish signals on ADX and moving averages with a break below 1.4475.

These technical factors may assist bears to reach 1.4295 where 61.8% Fibonacci 1.4385 will accelerate.

Support: 1.4345 – 1.4295 – 1.4210

Resistance: 1.4400 – 1.4440 – 1.4480

Direction: Bearish