The smaller gold-mining and exploration stocks have enjoyed an amazing year, soaring with gold’s new bull market. Many have more than doubled since mid-January, and some have more than tripled at best in that short span. Are such spectacular gains fundamentally-justified, or merely the result of ephemeral sentiment that could vanish anytime? The gold juniors’ recently-reported Q1’16 results offer great insights.

The junior gold miners and explorers play a critical role in the world gold market. They bear the major costs and risks associated with discovering and sometimes developing new economically-viable gold deposits. They painstakingly find the new gold reserves to offset the constant depletion of the world’s existing gold mines, acting as the headwaters feeding the global mined-gold-supply pipeline vital to this industry.

The larger gold miners rely extensively on the juniors’ crucial exploration and early-development work to maintain and replenish their own operations. While the majors certainly do their own exploration, it is far from sufficient to offset existing gold mines exhausting. So gold juniors are constantly targeted by the larger miners, which acquire these companies outright, buy their projects, or partner with them for development.

These smaller gold miners and especially explorers are far riskier than the major gold miners. Gold juniors usually only have one operating mine or one major high-potential exploration project. With all their eggs often in one basket, they lack the major miners’ diversification across mines, projects, and their geopolitical jurisdictions. And naturally bearing much more risk, juniors must have higher potential returns.

It’s interesting to consider how juniors’ risk-reward dynamic has played out so far in 2016 in broad terms, through the lenses of the primary vehicles investors use to own precious-metals stocks. Today 3 leading ETFs dominate this industry. The GDX VanEck Vectors Gold Miners ETF (NYSE:GDX) includes the world’s biggest and best gold miners, the majors. At best between mid-January and late-April, it soared 107.1% higher.

The leading silver-stock ETF is the Global X Silver Miners (NYSE:SIL) ETF, which naturally focuses on the elite silver miners. It skyrocketed a staggering 144.3% higher at best between mid-January and mid-May, trouncing GDX’s gains! Silver outperforming gold and silver stocks outperforming gold stocks is exactly what you’d expect. Silver is a much-smaller market than gold, effectively leveraging capital inflows into it.

And the last dominant gold-stock ETF is of course the GDXJ VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ). Junior gold miners and explorers are much riskier than diversified gold or silver majors, so they should have higher returns to compensate. GDXJ has blasted an impressive 129.4% higher at best between mid-January and mid-May, so it has somewhat outperformed GDX but is lagging well behind SIL’s lead.

There are a couple likely reasons. Gold’s new bull market fueling these massive precious-metals-stock gains has barely begun after this metal slumped to a major 6.1-year secular low in mid-December the day after the Fed’s first rate hike in 9.5 years. Since gold juniors are riskier, they generally aren’t preferred early in bull markets when investors remain skeptical. Their popularity soars later as established bulls mature.

And as of the middle of this week, GDX, SIL, and GDXJ had net assets of $7.2b, $0.3b, and $2.7b. As SIL is so small compared to the much-better-known and established GDX and GDXJ, it takes less capital to catapult it higher. By the time we near the ends of these overdue mean-reversion bull markets in both gold and silver in a couple years or so, odds are the junior golds’ performance will again dwarf that of the majors.

As a speculator and investor, I need to understand which precious-metals stocks are likely to prove the top performers as gold and silver power higher. So after quarter-ends, I dig deep into the latest results of the world’s best gold and silver miners and explorers. These quarterly filings aren’t due until 45 days following quarter-ends, so I’ve spent recent weeks up to my eyeballs painstakingly analyzing dozens of 10-Qs.

The gold standard for precious-metals stocks is to be included in GDX, SIL, or GDXJ by their managers. These ETF companies have sizable dedicated research teams that wade through the many hundreds of precious-metals stocks out there to skim off the heaps of dross and uncover this industry’s best. So the component lists of these dominant ETFs are an excellent place to start when researching fundamentals.

Today’s essay is the third and final of a post-quarterly trilogy. Two weeks ago I dug into the GDX gold miners’ Q1’16 fundamentals in depth. Last week I applied a similar analysis to the SIL silver miners’ Q1’16 fundamentals. And now it’s the GDXJ junior gold miners’ and explorers’ turn. How did these companies actually fare in the first quarter, which was very important emerging out of Q4’s secular lows.

As of the middle of this week, GDXJ had a whopping 46 component companies! That’s problematic, heavily over-diversified. A smaller focused portfolio consisting of about 20 stocks with the most-superior fundamentals will greatly outperform a larger one padded with lesser stocks. I believe GDXJ’s investors would greatly benefit from a culling of this ETF’s excessive holdings. And it would actually be easy to do.

This week I looked at the top 34 GDXJ components’ Q1’16 quarterly reports filed by mid-May. That number fits in our standard-sized tables below. These 34 largest GDXJ component stocks accounted for 93.0% of this ETF’s total weighting. But as I analyzed them, I was struck by how many of these stocks are also included in GDX and/or SIL. These cross holdings seem counterproductive for all 3 of these leading ETFs.

Investors buy GDX because they want to own larger gold stocks, and GDXJ specifically for the smaller and riskier junior golds. They shouldn’t have the same holdings, as it is easy to make a distinction between larger and smaller gold miners. Both these ETFs are managed by the same company, so it would be pretty simple for their managers to agree on some definition to separate juniors from majors.

I’d make this production-based. If a company produced less than 200k ounces of gold over the latest 4 quarters for example, it could be considered a junior eligible for GDXJ inclusion if gold accounted for the majority of its trailing-twelve-month revenues. If a company produced more than 200k ounces over the rolling past year, it could instead be considered for potential GDX inclusion if gold was its primary business.

The holdings of GDX and GDXJ really should be mutually-exclusive, otherwise these ETFs are actively misleading investors with their names. I was very dismayed this week to find that 13 of GDXJ’s top 34 holdings were also included in GDX. Even worse, these 13 duplicate holdings accounted for a truly shocking 50.0% of GDXJ’s total weightings this week! GDXJ is now a half-GDX clone, not a junior vehicle.

VanEck runs both these ETFs and really needs to fix this so investors can have more-responsive options that hold true to these ETFs’ names and advertising. While VanEck doesn’t run SIL, I’d further argue that silver miners have no place in ETFs billed as gold-stock ETFs. 12 of GDXJ’s top 34 holdings are also included in SIL, and accounted for 35.7% of GDXJ’s weightings this week. But wait, it gets even crazier.

GDXJ’s top holding this week was the amazing First Majestic Silver (NYSE:AG), the world’s purest major silver miner as discussed last week in my look at SIL components’ Q1’16 fundamentals. And Pan American Silver (NASDAQ:PAAS), GDXJ’s fourth-largest holding this week, is the second-purest major silver miner that tops SIL’s recent weightings. Are investors buying an ETF specifically for junior golds wanting to own major silver miners instead?

And it’s not like GDXJ’s managers don’t actively manage its holdings. The differences between the weightings and even some of the companies between my last GDXJ analysis of Q4’15 fundamental data in early March and this week was enormous! With many dozens of excellent juniors to pick from out of the many hundreds out there, there’s no reason GDXJ should be laden with major gold and silver miners.

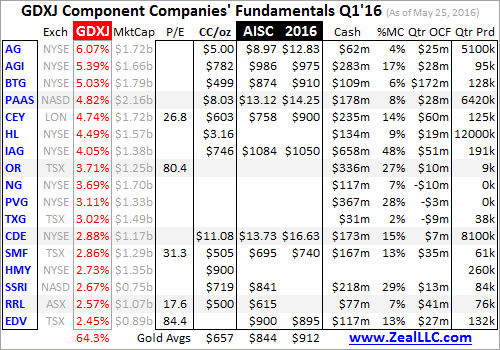

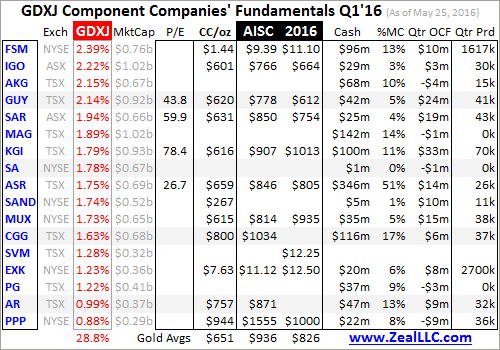

Nevertheless these GDXJ components are the definitive list of elite “junior golds”, so I dived into all of their Q1’16 reports just released by mid-May. Each of these top 34 components’ stock symbols, exchange listings GDXJ is using, GDXJ’s weightings as of this week, market caps, and P/E ratios are listed below. That’s followed by their cash costs and all-in sustaining costs per ounce in Q1’16, and full-year AISC guidance.

Next comes components’ cash balances at the end of Q1’16, cash’s percentage of their current market capitalizations, and first quarter’s cash flows generated from operations. Finally Q1’16’s production is listed in ounces. Numbers under 300k are gold, and all are in total equivalent ounces if reported by the companies for their primary metal. A gold miner also producing silver often converts it into gold-equivalent terms.

Thus if you compare these tables with my last couple essays on GDX and SIL components, there may be different production numbers. For GDX and SIL, I used pure gold and silver production whenever it was reported. But for GDXJ which is supposed to have a gold-junior focus, it made more sense to shift to gold-equivalent terms. If a company produced 0k ounces in Q1’16, it is still an explorer with no mining operations.

As the gold-stock “experts” CNBC brings on like to point out, the price-to-earnings ratios in this sector are crazy. The gold miners are either largely losing money or trading at extreme P/E ratios. But this critical valuation metric is very misleading today. As discussed in depth a couple weeks ago in my GDX essay, trailing-twelve-month GAAP earnings reflect large non-cash write-downs from last year’s secular gold lows.

Though such write-downs are required by accounting conservatism, they serve to obscure what is really happening on the operating front. Once those write-downs roll off the latest 4 quarters’ results, these trailing-twelve-month P/E ratios of the gold miners are going to collapse. I included this column today primarily as a reference for when this GDXJ-component fundamental research is furthered after future quarters.

Back in Q4’15 as gold slumped to that miserable 6.1-year secular low of $1051 by mid-December, its average price that quarter was just $1105. That was the worst seen since Q4’09! Such low gold prices fueled extreme bearishness, so junior golds’ stock prices were driven down to levels suggesting this whole industry was on the verge of bankruptcy. Somewhat paradoxically, Q1’16 wasn’t much of an improvement.

Though gold enjoyed a spectacular 16.1% rally in Q1, which was its best quarter since way back in Q3 1986, its average price still only climbed 7.3% to just $1185. Such levels still generate much unease, since as recently as last summer $1200 was erroneously believed to be the breakeven cost for the gold-mining industry. Yet again, the junior golds’ excellent Q1’16 operating results proved that was wildly off base.

Cash costs are gold miners’ acid test for survival, the breakeven level required to pay the ongoing operating expenses necessary to produce gold. They include all cash necessary to mine each ounce of gold. This includes all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. As long as gold trades above cash costs, miners face no existential threat.

In Q1’16 the elite GDXJ gold juniors’ cash costs averaged just $654 per ounce! While that’s up 4.1% from Q4’15’s average, it’s still radically below not only prevailing gold prices but gold’s major secular low of mid-December. Gold could fall to an apocalyptic level of $700, which seems all but impossible given today’s bullish supply-and-demand situation, and the junior gold miners could still weather it for a long time.

And don’t read too much into that Q1’16 rise in gold juniors’ cash costs. My last essay on the GDXJ components’ Q4’15 fundamentals only had data current to early March. The filing deadline for annual reports ending fiscal years is 90 days, twice the usual quarterly 45-day one, due to the need for fully-audited financial statements and challenging-to-prepare comprehensive 10-K reports required by the SEC.

I did that last analysis before all the year-end data was in because there was still serious concern about the fundamental state of the junior gold miners then. So the Q4’15 numbers for the junior golds aren’t as comprehensive as these new Q1’16 ones gathered after all but two companies reported. South Africa’s Harmony Gold (NYSE:HMY) only reports in 6-month intervals, and Silvercorp Metals’ (OTC:SVMLF) fiscal year ended on March 31st.

A more interesting comparison is the Q1’16 cash costs per ounce of the GDXJ components mining gold compared to the GDX components’ which averaged $583. It’s pretty impressive the juniors with their often-single-mine focus and non-existent economies of scale can operate at average cash costs only 12.2% higher than the elite majors’! The junior golds are doing an outstanding job managing their costs.

But cash costs are misleading, as it takes far more capital expenditures to run gold-mining companies as going concerns. All the gold mined is constantly depleting deposits, so new ones have to be found and developed to maintain current production levels. And old exhausted mines need to be reclaimed. So in June 2013, the World Gold Council introduced far-superior all-in sustaining costs to measure mining costs.

All-in sustaining costs include everything necessary to maintain and replenish gold-mining operations at current production levels. This includes all direct cash costs of mining gold, along with all corporate-level administration that always should’ve been included in cash costs. But AISC extend way beyond that to encompass the entire mining cycle, making them a far-more-realistic representation of true costs.

So AISC also include exploration for new gold to mine, the huge mine-development and construction expenses necessary to bring new mines online, remediation, and reclamation. As long as gold prices remain above all-in sustaining costs, the junior gold miners can continue to produce at current levels indefinitely. And GDXJ’s top 34 component companies reported impressively-low AISC in Q1’16.

They averaged just $893 per ounce, a massive $292 below the first quarter’s $1185 average gold price! That compares favorably with GDX’s top 34 components averaging $833 AISC in Q1’16. While it isn’t yet reflected in their P/E ratios, the elite junior gold miners are already very profitable. And they expect their AISC to fall considerably this year, with average 2016 projections running quite a bit lower at $866.

The primary thing that makes gold-stock investment so appealing is the great leverage to gold of these gold-mining profits. Gold-mining costs are largely fixed during each mine’s planning stages. That’s when mining engineers decide which ore bodies to extract, how to dig to them, and how to process that ore to recover the gold. So as prevailing gold prices rise, mining costs generally don’t climb along with them.

So far in Q2’16, gold has averaged $1253 per ounce. This is another 5.7% better than Q1’s average. And at $1253 gold and Q1’s $893 average AISC among the elite gold juniors, operating profits soar 23.3% to $360 per ounce. That’s 4.1x leverage to gold even on a minor move! Throughout the entire stock markets, stock prices ultimately migrate to some reasonable multiple of their underlying corporate profits.

The tough gold-price environment in recent years wasn’t normal, but an extreme anomaly driven by the Fed’s gross distortions of the financial markets. The last normal year for gold was 2012, which was not even particularly strong as this metal ground sideways to lower after peaking in 2011. Yet gold prices still averaged $1669 per ounce in 2012, a level they will almost certainly mean revert back to in the coming years.

Such totally-normal levels are highly likely again as the Fed’s artificial stock-market levitation inevitably fails and rolls over into the overdue new cyclical bear. Weaker stock markets will rekindle demand for alternative investments led by gold, which moves counter to stocks. Investors will flock back to gold for prudent portfolio diversification, something we’re already seeing this year. Regaining 2012 levels is no stretch.

At 2012’s average $1669 gold price and Q1’16’s average $893 AISC, gold juniors’ profits would rocket an incredible 165.9% higher on a mere 36.4% rally in gold from this week’s levels! This vast potential for extreme profits growth fueling radically-higher stock prices is why junior gold stocks are so alluring. The coming gains in this sector as gold mean reverts higher are going to be gigantic, multiplying investors’ wealth.

And Q1’16’s actual $292-per-ounce average operating profits among the junior gold miners prove that their stocks’ extreme early-2016 rally was indeed fundamentally-justified. Back in late 2015, this entire sector was left for dead and trading at apocalyptic fundamentally-absurd levels. The junior gold miners already enjoying big 24.6% operating margins on average in Q1 argues their mean reversion is righteous!

The already-wide gap between prevailing gold prices and all-in sustaining costs generally fueled strong cash generation from operations, as seen in the second-to-last column in these tables. The only gold juniors that didn’t see good operating cash flows were the ones ramping up new mines to commercial production and of course the explorers. Exploration-stage companies naturally have nothing to sell yet.

These strong Q1’16 operating cash flows from the junior golds boosted impressive treasuries across the top GDXJ components. Most were running large cash balances relative to their market capitalizations, at much higher percentages compared to the top GDX components. This not only protects these smaller gold miners from any normal healthy gold correction, but enables them to ramp capital spending to boost production.

So despite the serious skepticism remaining out there about the outlook for the junior gold miners, they really enjoyed an excellent first quarter operationally! Their fundamentals are strong, and the best of the smaller gold miners and explorers are well-positioned to greatly leverage gold’s mean-reversion bull-market gains in the coming years. Each quarter gold rallies on balance, their results will get better and better.

With both gold and silver in confirmed new bull markets for the first time since 2011, experienced investors who understand the risks inherent in junior gold mining and exploration should be looking into this high-potential sector. While owning GDXJ grants some exposure, it’s certainly not a pure junior-gold ETF thanks to the heavy weighting of larger gold miners and silver majors that its managers inexplicably include.

The greatest gains among the junior golds will come from the small miners and explorers with the best fundamentals. While GDXJ includes plenty of these, their collective weighting is relatively low. There are some GDXJ components that are amazing, and others I wouldn’t touch with a ten-foot pole. There’s no doubt an expertly-handpicked portfolio of the best gold juniors will trounce the future performance of GDXJ!

The bottom line is the junior gold miners’ fundamentals proved very strong in just-reported Q1’16. They were able to mine gold at all-in sustaining costs several-hundred dollars per ounce under the still-low prevailing gold prices. These low costs are already fueling excellent and surging operating margins, which will eventually be reflected in falling P/E ratios. The gold juniors are ready to greatly leverage gold’s bull.

Unfortunately most investors fail to take advantage of their enormous upside potential relative to gold early on. Junior golds are largely shunned early in new bulls when disbelief remains high. But that’s the best time to buy them low before they eventually grow popular again and their stock prices soar. As always, the smart contrarians who buy in ahead of the herd will enjoy the greatest gains in gold’s new bull.