- Consumer confidence (Nov): set to improve significantly but still at a depressed level

- ISM manufacturing index (Nov): somewhat higher expansion level

- Labour market report (Nov): payroll rise not large enough to lower unemployment rate

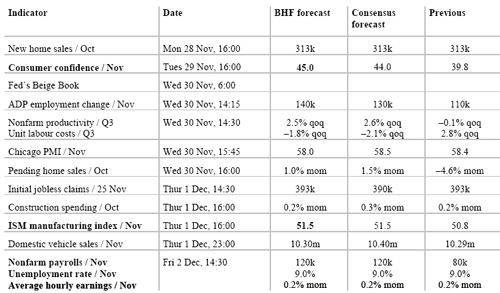

New home sales rose by 5.7% mom in September and were thus almost on the same level as in the previous year. The continuous decline in mortgage rates and the slight improvement in employment could be supporting the housing market. However, consumer confidence is still very low, and the stock market performance has deteriorated. We thus expect new home sales to have remained stable at best in October.

The graph shows that the consumer confidence indicators from the University of Michigan (UMI) and the Conference Board have diverged recently: while UMI’s consumer sentiment went up moderately in October, the Conference Board index plummeted by 6.6 points. We already know that UMI’s consumer sentiment rose markedly in November, and we expect the Conference Board’s indicator to havefollowed suit, recovering from 39.8 to about 45.0 in November. The indicator reacts sensitively to the labour market data, and initial jobless claims have been declining andpayroll growth has been better than expected in the last months.

The last Beige Book had reported slight improvements in consumer and business spending, but overall economic activity was described as modest. Moreover, the business outlook was weaker or more uncertain, due to the global economic slowdown and the sovereign debt crisis. Although several current indictors suggest some stabilisation and ongoing growth, we are expecting the Beige Book assesment of overall conditions to remain cautious.

Revised figures have shown that nonfarm business gross value added rose by 3.2% qoq annualised rather than 3.8% qoq as initially estimated. We thus expect nonfarm productivity to have risen less sharply by about 2.5% qoq annualised in Q3 rather than 3.1% qoq. Unit labour costs are likely to have dropped by 1.8% only as opposed to 2.4% qoq.

Pending home sales fell significantly by 4.6% mom in September, after having already declined some what in the two previous months. However, the big drop in the Northeast was connected with Hurricane Irene. Thus pending home sales could have recovered modestly by 1.0% mom in October.

After having jumped by 1.6% mom in August, construction spending increased again by 0.2% mom inSeptember. Given that the NAHB homebuilders’ index has risen by 6 points in the last two months, we expect construction spending to have increased moderately again by 0.2% mom in October.

The Chicago Purchasing Manager index fell by two pointbut was still at a high expansion level of 58.4 in October. The new orders component fell more markedly, but, at 61.3 was still signaling robust growth. The Chicago PMI could thus have remained elevated at about 58.0 in November.

The ISM manufacturing index declined unexpectedly from 51.6 to 50.8 in October. However, the new orders component jumped to 52.4, after having been below the expansion threshold for three consecutive months. The first indications for November from the regional PMIs were mixed: the NewYork Empire returned into positive territory, the RichmFed index rose to zero, but the Philadelphia Fed index dropped from 8.7 to 3.6. However, a closer look at the respective subcomponents leads us to conclude that the national ISM manufacturing could have increased slightly to 51.5 November.

At 393k, initial jobless claims were virtually unchanged in the week ending 18 November. The 4-week moving average declined to 394.3k, and we expect jobless claims to have remained at arround the same level in the week ending 25 November.

Total nonfarm payrolls went up by 80k in October, which was somewhat less than expected. However, the increases in the previous two months were revised up significantly, raising the 3-month moving average to 114k. We expect nonfarm payrolls to have risen by about 120k in November– still a moderate increase for an economic up-swing.

Given that jobless claim have fallen to under 400k. ADP private payrolls could have even risen by about 140k.

The unemployment rate, which fell by 0.1 percentage points to 9.0% in October due to a sizeable boost of 277k in household employment is likely to have remained unchanged. If average hourly earnings rose again by 0.2% mom as in september and october, the annual rate would exceed 2% for the first time since july.