Today's trifecta of economic reports showed some moderate signs of improvement - that's the good news. The bad news is that all of these are lagging indicators for the month of October. It will be important to continue to see gains in the coming months in order for the economy to avoid a recession in 2012 which we will discuss in our outlook below.

RETAIL SALES

Retail sales came in much stronger than expectations. In October, retail sales built on gains from September although at a much slower rate. Moving into the very anticipated shopping season it will be important that sales continue to hold ground. Overall retail sales in October advanced 0.5 percent, following a 1.1 percent jump in September. Excluding autos, retail sales increased 0.6 percent in October after increasing 0.5 percent in September (originally up 0.6 percent).

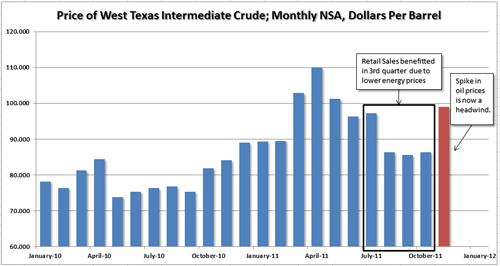

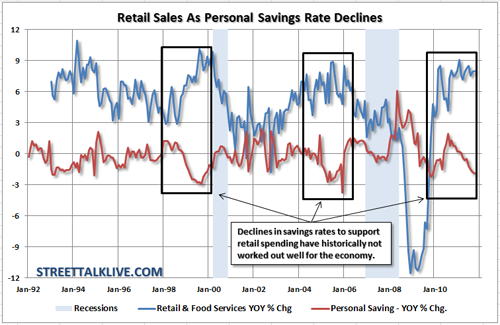

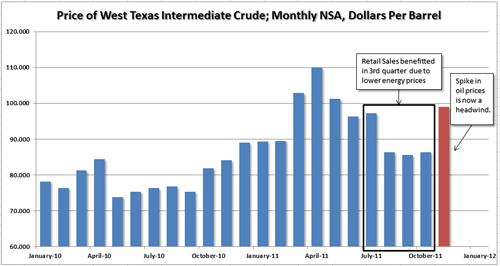

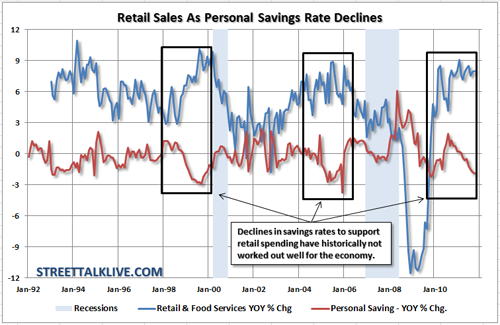

The issue that seems to be escaping the media at the moment is that these increases in retails sales came from the effects of two benefactors that do not bode well going forward. The first was falling energy prices and the second was a sharp decline in the personal savings rate.

With the jump in oil prices from the low to mid-80's this summer to near the century mark today; the drag on retail sales in the coming month will be apparent. Furthermore, the drag on the personal savings rate also does not portend to a stronger economy ahead. With wages remaining stagnant and an inability to obtain credit; the demand side of the equation for businesses remains in jeopardy as savings accounts are depleted to meet the costs of living. We have seen this exact same thing occur before the previous two recessions as, eventually, the consumer runs out of resources and cuts spending increasing the savings rate. My suspicion is that with the consumer already in a much weakened state we may see the effects of oil price increases much sooner than later.

PRODUCER PRICE INDEX

Those weaker energy costs this summer turned producer price inflation negative in October. Producer prices fell 0.3 percent in October and came in lower than the consensus forecast for a 0.2 percent dip. This drop in producer prices came from the 1.4% drop in Energy in October after the 2.3% rise in September. The rise and fall in energy also effects most other areas of PPI as the drop in energy prices also led to a decline in food prices.

For the overall PPI, the year-ago rate in October was 6.1 percent, compared to September's 7.0 percent (seasonally adjusted). The core rate in October firmed to 2.8 percent from 2.5 percent in September. On a not seasonally adjusted basis for October, the year-ago headline PPI was up 5.9 percent, compared to 6.9 percent the prior month. Meanwhile the core was up 2.8 percent on an NSA year-ago basis, compared to 2.5 percent in September.

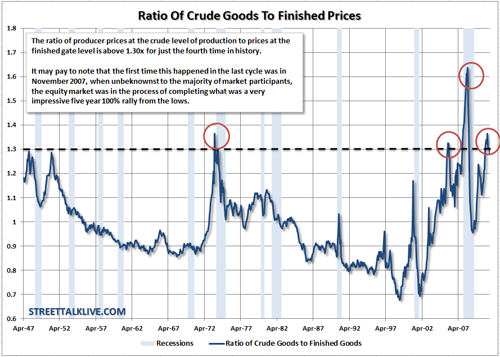

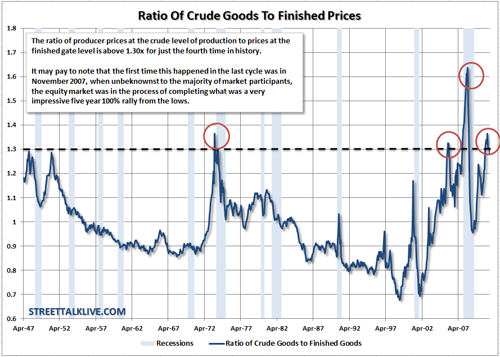

One of the key issues, however, remains the current ratio of crude goods to finished prices. This ratio peaked earlier this year above the 1.3 level which has only occurred three other times in history. Each of these peaks have been present prior to a recession. Furthermore, if you look at the chart you will also see that historically when there are sharp spikes in this ratio it has normally been prior to, or coincident, with recession. So, while the media trumpets the fall in the PPI as a detraction from short term inflation in October there are two critical points to take away: 1) PPI will increase sharply in November due the rise in energy prices and 2) the damage to the economy is most likely already done.

EMPIRE INDEX

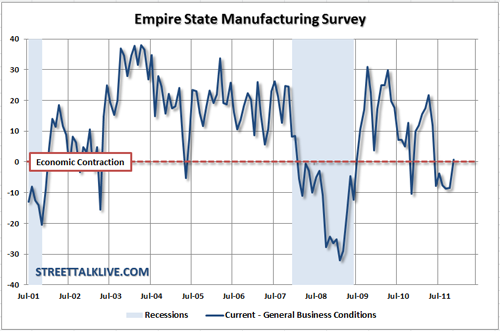

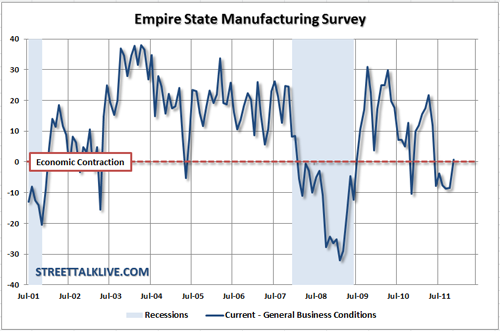

The New York Fed regional manufacturing survey (Empire Index) showed a mild bump back into positive territory today at plus 0.61 and is in positive ground for the first time since May. Coincident with the sharp spike in the market in October the outlook for general conditions improved to 39.02 from October's unusually low 6.74. This is a positive sign with business sentiment, like consumer sentiment, picking up after the debt limit debacle in August.

However, current conditions was another story with almost all areas declining especially in employment, unfilled orders and new orders. While the future outlooks are currently positive it will not take much to wipe away that positive glimmer given the potential political infighting that is coming in the next couple of weeks over spending cuts. Furthermore, the sharp rise in energy prices may also ding the outlook in the coming months if it crimps consumer demand.

OUTLOOK

While we will likely see similar improvements from the other regional indexes coming in the next couple of weeks, as well as other lagging reports of data from October, it is important to keep in context the environment for which we saw the recent upticks. First, we had a good bit of pent up demand from the lock up that we saw with consumers in the July and August periods as the media broadcasted the end of the world due to the debt ceiling debate and the global upheaval espoused by the Administration. Secondly, the fall in commodity prices, particularly energy, led to increased purchasing power which timed out perfectly for a replacement/purchase cycle after consumers had effectively bunkered for the summer.

Finally, the draw down in the personal savings rate is particularly disturbing. With incomes stagnant, or on the decline, it doesn't bode well for a continued cycle of consumptive spending. We are still maintaining our odds of a recession for 2012 at greater than 50% not only because of these issues but also due to the impending recession in Europe. The fragile state of the U.S. economy cannot withstand an internal shock from a renewed debate on deficit spending or increased turbulence from the European crisis. 2012 will likely prove to be a challenging year for investors and volatility will remain elevated. We continue to espouse safety over risk, income over growth and discipline over emotion in portfolio management strategies.

RETAIL SALES

Retail sales came in much stronger than expectations. In October, retail sales built on gains from September although at a much slower rate. Moving into the very anticipated shopping season it will be important that sales continue to hold ground. Overall retail sales in October advanced 0.5 percent, following a 1.1 percent jump in September. Excluding autos, retail sales increased 0.6 percent in October after increasing 0.5 percent in September (originally up 0.6 percent).

The issue that seems to be escaping the media at the moment is that these increases in retails sales came from the effects of two benefactors that do not bode well going forward. The first was falling energy prices and the second was a sharp decline in the personal savings rate.

With the jump in oil prices from the low to mid-80's this summer to near the century mark today; the drag on retail sales in the coming month will be apparent. Furthermore, the drag on the personal savings rate also does not portend to a stronger economy ahead. With wages remaining stagnant and an inability to obtain credit; the demand side of the equation for businesses remains in jeopardy as savings accounts are depleted to meet the costs of living. We have seen this exact same thing occur before the previous two recessions as, eventually, the consumer runs out of resources and cuts spending increasing the savings rate. My suspicion is that with the consumer already in a much weakened state we may see the effects of oil price increases much sooner than later.

PRODUCER PRICE INDEX

Those weaker energy costs this summer turned producer price inflation negative in October. Producer prices fell 0.3 percent in October and came in lower than the consensus forecast for a 0.2 percent dip. This drop in producer prices came from the 1.4% drop in Energy in October after the 2.3% rise in September. The rise and fall in energy also effects most other areas of PPI as the drop in energy prices also led to a decline in food prices.

For the overall PPI, the year-ago rate in October was 6.1 percent, compared to September's 7.0 percent (seasonally adjusted). The core rate in October firmed to 2.8 percent from 2.5 percent in September. On a not seasonally adjusted basis for October, the year-ago headline PPI was up 5.9 percent, compared to 6.9 percent the prior month. Meanwhile the core was up 2.8 percent on an NSA year-ago basis, compared to 2.5 percent in September.

One of the key issues, however, remains the current ratio of crude goods to finished prices. This ratio peaked earlier this year above the 1.3 level which has only occurred three other times in history. Each of these peaks have been present prior to a recession. Furthermore, if you look at the chart you will also see that historically when there are sharp spikes in this ratio it has normally been prior to, or coincident, with recession. So, while the media trumpets the fall in the PPI as a detraction from short term inflation in October there are two critical points to take away: 1) PPI will increase sharply in November due the rise in energy prices and 2) the damage to the economy is most likely already done.

EMPIRE INDEX

The New York Fed regional manufacturing survey (Empire Index) showed a mild bump back into positive territory today at plus 0.61 and is in positive ground for the first time since May. Coincident with the sharp spike in the market in October the outlook for general conditions improved to 39.02 from October's unusually low 6.74. This is a positive sign with business sentiment, like consumer sentiment, picking up after the debt limit debacle in August.

However, current conditions was another story with almost all areas declining especially in employment, unfilled orders and new orders. While the future outlooks are currently positive it will not take much to wipe away that positive glimmer given the potential political infighting that is coming in the next couple of weeks over spending cuts. Furthermore, the sharp rise in energy prices may also ding the outlook in the coming months if it crimps consumer demand.

OUTLOOK

While we will likely see similar improvements from the other regional indexes coming in the next couple of weeks, as well as other lagging reports of data from October, it is important to keep in context the environment for which we saw the recent upticks. First, we had a good bit of pent up demand from the lock up that we saw with consumers in the July and August periods as the media broadcasted the end of the world due to the debt ceiling debate and the global upheaval espoused by the Administration. Secondly, the fall in commodity prices, particularly energy, led to increased purchasing power which timed out perfectly for a replacement/purchase cycle after consumers had effectively bunkered for the summer.

Finally, the draw down in the personal savings rate is particularly disturbing. With incomes stagnant, or on the decline, it doesn't bode well for a continued cycle of consumptive spending. We are still maintaining our odds of a recession for 2012 at greater than 50% not only because of these issues but also due to the impending recession in Europe. The fragile state of the U.S. economy cannot withstand an internal shock from a renewed debate on deficit spending or increased turbulence from the European crisis. 2012 will likely prove to be a challenging year for investors and volatility will remain elevated. We continue to espouse safety over risk, income over growth and discipline over emotion in portfolio management strategies.