The US equity market finally suffered an ugly drop yesterday, only the second time it has seen an appreciable decline since the very beginning of February. This saw the usual associated developments in currency markets, with the JPY crosses pushing back down toward support and emerging market currencies on the defensive. If USDJPY can’t find support in the 102.50 area, we may be headed for a larger adjustment lower rather than a test of the top that was the default scenario after the recent rally above resistance. The disruptive moves in metals markets (copper and iron ore) and the situation in Ukraine are likely significant contributors here, though it is curious that these moves started in earnest two days ago already.

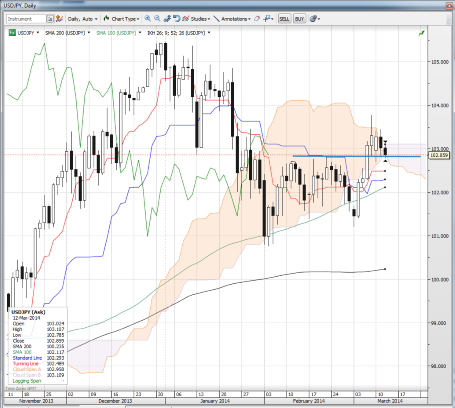

Chart: USDJPY

With risk assets nervous here, the JPY crosses are the main focus, and USDJPY is at an interesting crossroads here. Note the general confluence of flat-line support (the old range highs that were broken late last week) and the daily Ichimoku cloud support.

In other news

Another bad data point out of Australia overnight, as the Consumer Confidence measure dipped to a new ten-month low in February. This and the complete collapse in iron ore and copper prices are eroding Aussie fundamentals in a big way, though the rates market seems a bit complacent and the lack of volatility elsewhere is limiting the strength of the move.

Japan’s Domestic Goods Corporate Price Index dropped month-on-month and showed its slowest rate of inflation in eight months at under 2 percent, a disappointment for Kuroda and company. Another sign of “Kurodanomics” losing steam was the fall in February Japanese consumer confidence to the lowest since late 2011.

Even while clearly cracking down on the CNY carry trade and triggering an impressive fallout in the collateral like iron ore and copper that helped drive some of that trade, China’s central bank said it would ease policy if growth came under pressure. I’m suspecting that growth will come under pressure…

Looking ahead

We have the Reserve Bank of New Zealand (RBNZ) front and centre this evening (Thursday in NZ) with what will likely be the first rate hike of many — but how many, and how much is already priced into the currency. The hike couldn’t be coming at a more interesting time as we have signs of nervousness in risk appetite (generally a very strong deterrent to Kiwi buyers) and China clearly entering a significant set of challenges to its financial system with the latest moves in the currency market and commodities employed as financialised collateral, especially copper, that helped drive the Chinese credit market growth in recent year collapsing at fearsome rates. It still looks to me like the Kiwi is priced for perfection, and only a turnaround in risk appetite and persistent further rally in risky assets would be able to provide further wind in the Kiwi’s sails at this point. That being said, it looks like AUDNZD may have a go at those all-time lows below 1.0500 first if the Australian employment report is another weak one.

Besides the RBNZ up late today, the economic calendar today looks rather sparse, but there could be plenty of room for market volatility as risk sentiment is strongly in play here, and volatility tends to beget volatility in the short run. We’ll either see a strong snapback or a deeper sell-off from here. In the event of the former, a long USDCHF might be an interesting way to trade the situation ,while risk-off should continue to see pressure on AUD and the Scandies against the USD and the highest beta trades could be in USD/EM.

Watch out for the European Central Bank (ECB) officials out speaking. A rather dovish string of rhetoric from a number of ECB officials over the last couple of days have worn down the hawkish impression that central bank chief Draghi seemed to present at the ECB presser last week. Consider, for example, Vice President Constancio’s comments from yesterday in which he tried to re-route the market’s interpretation of the ECB press conference, and even emphasized that ECB retains all policy options, including quantitative easing.

Stay careful out there.

Economic Data Highlights

- Australia Mar. Westpac Consumer Confidence Index fell to 99.5 vs. 100.2 in Feb.

- Japan Feb. Domestic CGPI out at -0.2% MoM and +1.8% YoY vs. +0.2%/+2.1% expected, respectively and vs. +2.4% YoY in Jan.

- Japan Feb. Consumer Confidence Index out at 38.3 vs. 40.0 expected and 40.5 in Jan.

Upcoming Economic Calendar Highlights (all times GMT)

- Eurozone Jan. Industrial Production (1000)

- Eurozone ECB’s Coeure, Issing to Speak (1000)

- Canada Feb. Teranet/National Bank Home Price Index (1300)

- Eurozone ECB’s Mersch out speaking (1300)

- New Zealand RBNZ Official Cash Rate (2000)

- New Zealand RBNZ Governor Wheeler Press Conference (2005)

- Japan Jan. Machine Orders (2350)

- UK Feb. RICS House Price Balance (0001)

- Australia Feb. Employment Change and Unemployment Rate (0030)

- China Feb. Retail Sales (0530)

- China Feb. Industrial Production (0530)