If you’re like most Americans, your medicine cabinet is filled with drugs that treat high blood pressure, pain and high cholesterol. (Better watch those hot dogs and chips during today’s Fourth of July festivities...) You might feel like you’re paying an arm and a leg for these prescriptions. But, surprisingly, those types of medications aren’t what’s costing consumers the most money...

The bulk of out-of-pocket pharmaceutical spending goes toward specialty drugs. These drugs require special administration and monitoring and are used to treat complex conditions. As a result, they can be extremely costly.

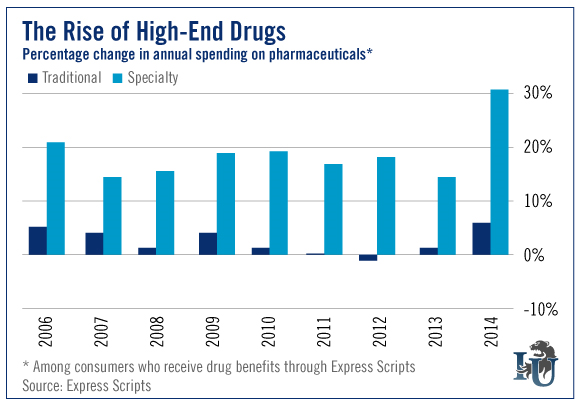

Today’s chart looks at the change in spending on traditional and specialty drugs over the past nine years. As you can see, consumers spent 30% more on specialty drugs last year than they did in 2013.

How is this possible? Easy. Just look at the price tags...

Gilead Sciences (NASDAQ:GILD)’ (Nasdaq: GILD) Hepatitis C treatment drug Harvoni costs $94,500 for a 12-week treatment. Genentech’s cancer treatment drug Avastin costs $5,560 for two vials. Biogen (NASDAQ:BIIB)’s (Nasdaq: BIIB) multiple sclerosis drug Avonex costs $1,363 for just one injection.

And this high-level pricing isn’t about to stop. Consumer spending on specialty drugs is expected to reach $400 billion by 2020.

Of course, while specialty drugs are costly for consumers, they can be extremely profitable for the companies that create them...

In 2014, Harvoni and its predecessor Sovaldi made more than $12.4 billion for Gilead. Shares of the company ended the year 25% higher than where they started.

So it’s easy to see why more and more companies are racing to develop specialty drugs... and why more and more investors are scrambling to get in on the action.