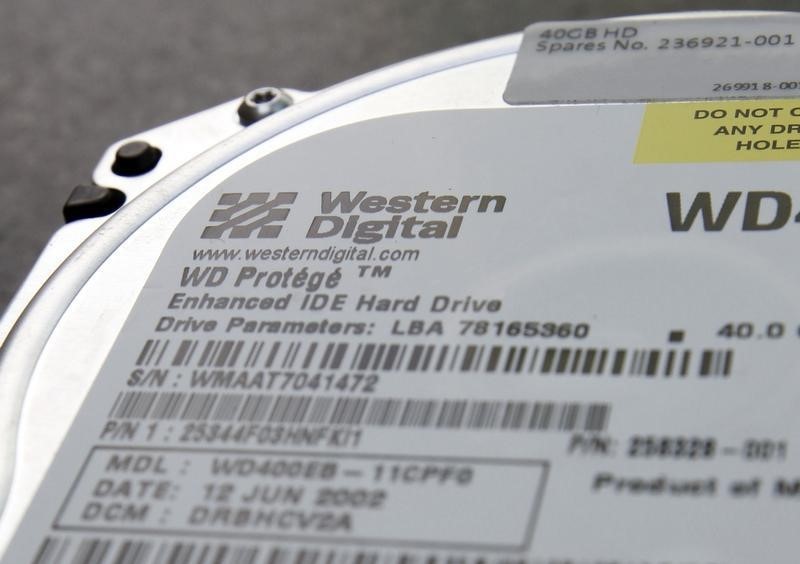

Citi Research has begun research coverage on both Western Digital (NASDAQ:WDC) and Seagate (STX) with Buy ratings, citing expectations of “a cyclical recovery in the storage market.”

“Following several quarters of storage digestion, capex cuts and workforce reductions, we expect the storage media industry dynamics to improve from here with the return of pent-up storage demand led by hyperscalers,” analysts said in a note.

WDC and STX shares rose 1.4% and 0.15% in premarket trading, respectively.

Citi projects total revenues for the storage media industry to grow at approximately 25% compound annual growth rate (CAGR) over the next three years, largely fueled by total petabyte (PB) growth of around 30% CAGR.

In addition, enterprise data is projected to grow at over 40% CAGR as AI continues to drive data creation, storage, and management, analysts noted.

Giving it a 12-month target price of $110, the analysts are bullish on STX prospects amid a sustained HDD cyclical recovery fueled by enterprise and hyperscalers, along with AI-driven storage demand growth, rational capacity additions, and HAMR-led cost improvements.

For WDC, with a $90 target price, Citi said its positive view is based on a broader recovery in the storage market, along with the company’s exposure to both HDD and SSD, improved margins in a constrained flash industry, and the potential spin-off of its flash business based on a sum-of-the-parts analysis “which we believe is likely to unlock value based on a SOTP analysis,” analysts wrote.

Potential risks to those views include macro factors, as demand pressures from hyperscalers (60+% of storage capacity) could lead to a supply glut, causing increased pricing volatility and margin erosion, concluded Citi.