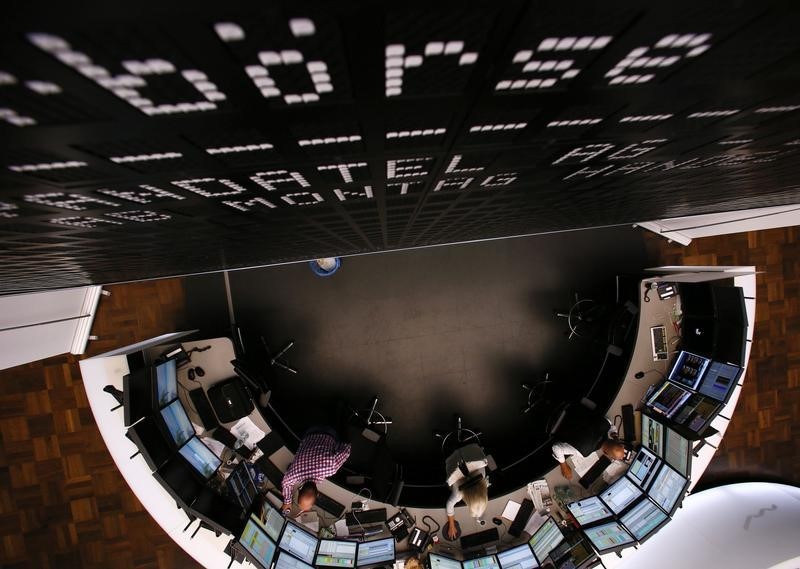

Investing.com - European stocks were steady to higher on Monday, as investors eyed upcoming comments by European Central Bank President Mario Drgahi due later in the day, after he reaffirmed last week that the bank was ready to implement fresh stimulus measures if necessary.

During European morning trade, the EURO STOXX 50 eased 0.05%, France’s CAC 40 inched 0.07% higher, while Germany’s DAX 30 dipped 0.01%.

European equities found support after ECB President Draghi said on Friday that the central bank will continue to act as warranted using all instruments available.

Speaking at the 26th European Banking Congress, in Frankfurt, Draghi added that the euro zone’s economic recovery still relies to a considerable degree on accommodative monetary policy.

Financial stocks were mostly lower. French lenders BNP Paribas (PA:BNPP) and Societe Generale (PA:SOGN) gained 0.57% and 0.22%, while Germany’s Deutsche Bank (DE:DBKGn) and Commerzbank (DE:CBKG) slid 0.37% and 0.68%.

Among peripheral lenders, Italy’s Intesa Sanpaolo (MI:ISP) and Unicredit (MI:CRDI) fell 0.20% and 0.15% respectively, while Spanish banks Banco Santander (MC:SAN) and BBVA (MC:BBVA) declined 0.84% and 0.79%.

Sanofi (PA:SASY) SA added to losses, with shares down 0.46% said it plans to stop Producing its bladder-cancer drug BCG, citing the company’s inability to restore full capacity of a Toronto manufacturing plant.

On the upside, Infineon Technologies AG NA O.N. (DE:IFXGn) jumped 1.04% as the German chipmaker was expected to report strong revenue growth on Wednesday.

In London, commodity-heavy FTSE 100 gained 0.25%, boosted by sharp gains in the mining sector.

Shares in Randgold Resources (LON:RRS) jumped 2.42% ans BHP Billiton (LON:BLT) advanced 2.45%, while Anglo American (LON:AAL) and Antofagasta (LON:ANTO) surged 2.75% and 2.78% respectively.

Meanwhile, financial stocks were mixed. The Royal Bank of Scotland (LON:RBS) edged up 0.10% and HSBC Holdings (LON:HSBA) rose 0.38%, while Barclays (LON:BARC) slid 0.28% and Lloyds Banking (LON:LLOY) tumbled 1.35%.

Capita Plc (LON:CPI) was one of the worst performers on the index, with shares down 1.90% as U.K. ,ilitary chiefs were reviewing how they run their £30 billion estate, which includes a key outsourcing contract with Capita, in the wake of a damning report from the audit office.

Capita signed a 10-year deal with the Ministry of Defense to run its UK estate in 2014.

In the U.S., equity markets pointed to a steady to higher open. The Dow Jones Industrial Average futures pointed to a 0.06% uptick, S&P 500 futures showed a 0.14% rise, while the Nasdaq 100 futures indicated a 0.14% gain.