Without question, 2016 was the year of the big surprise. Or to be more accurate, surprises.

The biggest surprises were the Brexit decision in late June, when—despite all expectations to the contrary—the UK electorate voted to leave the EU, sending markets into a tailspin for a few days while pushing sterling lower. Then, just when markets appeared to have regained their footing, the US electorate provided the next, possibly even bigger curveball—the unexpected election of Donald Trump as 45th President of the United States.

Perhaps not a bombshell by the time it occurred, but nevertheless surprising in light of how long it took to play out, the Fed finally raised interest rates at the end of 2016, only the second time it hiked since 2006, after indicating at the end of 2015 that four hikes would probably occur in 2016.

It was an eventful year for markets from the outset. On January 4, the sharp selloff of the Shanghai Composite continued the meltdown that began in mid-2015. It was driven by fears of a slowdown of China’s economy and additional yuan devaluation. Though government intervention stanched the bloodletting, it’s been a roller coaster ride for Chinese markets throughout 2016.

February brought an additional shocker: crude oil prices hit their lowest level since May 2003—$26.21bbl. Mid month the Dow was down 10% on the year.

Both the commodity and the benchmark index have recovered nicely. Currently crude is priced at around $53.00, while the Dow, having already reached a number of all-time highs over the course of the year, now sits just a hair below its next record—the hallmark 20,000 level.

Gold, which many assumed would be a major beneficiary of such risk events as Brexit, as investors and traders went in search of safe havens immediately after election results were announced, hit its 2016 high during July, $1,364. Many predicted a new bull market for the Precious Metals complex, but the baby bull faltered and as of this writing appears to have died….at least for now. Gold is currently trading at around $1,130, its lowest level in 11 months.

There were some serious surprises in FX markets as well. The U.S. dollar looked to be weakening as 2016 commenced, with the US Dollar Index hitting its 2016 low of 92.62 on May 2. But as events during the second half of the year played out, king dollar reasserted its strength; the DXY is currently hovering around 103.00, a level not seen since December 2002.

The GBP and EUR didn’t fare nearly as well. The pound is currently trading at 1.2277 vs the USD, not far from a 31-year low of 1.2020 touched in the immediate aftermath of the Brexit vote. The euro is hovering at a 13-year low of $1.0456 though analysts predict there’s USD parity in its near future, possibly followed by a fall below that benchmark.

As we await the inauguration of the US’s next president, and markets continue to benefit, albeit perhaps less and less forcefully, from the Trump Bump, we asked 10 of our most popular contributors to tell us how they see markets performing as 2017 begins.

In part 1, published on Monday, contributors discussed Commodities and Currencies. Part 2, below, features author calls on Stocks, Bonds, Interest Rates and Inflation.

Joseph L. Shaefer: Balance Asset Classes, Buy Leaders, Set Stops

“It will fluctuate.” That answer is not intended to be glib or flippant. It is, in fact, the same response J.P.Morgan gave when asked the dull-witted question as to what the stock market would do more than 100 years ago.

J.P. Morgan didn’t know what the market would do. Neither do I. Neither does anyone else. Yet there is an entire sub-industry of people paying to appear on TV “interviews” and bombarding you via e-mail and your mailbox, “So-and- So’s Startling Prediction for Tomorrow’s Market! Buy Our Service Today!!!”

Seriously now — if they really knew what the market was going to do or what stock would return 1000% or more, why wouldn’t they just buy it and retire rich rather than trying to sell you their predictions / guesses? Yet every day, otherwise-intelligent people line up and scramble to get to the front of the line to buy this hooey!

Forget the shrill and the charlatan. Instead, build a portfolio, balance your assets across asset classes, stock it with quality funds and firms from around the world, and be willing to sell when the time is right. Concern yourself with asset allocation and secular timing before you even move on to stock selection.

That’s how we invest. Still, I try to make as “informed” a decision as I can when advising our clients and managing our family accounts. So I approach 2017 with a calm borne of having many trailing stops in place.

Make an Informed Decision

On the one hand, I see that president-elect Trump and both houses of Congress agree that an overhaul of the US tax system for individuals and, especially, for businesses, is essential. This is hugely bullish!

I see that international trade treaties that have harmed American workers and American productivity are subject to review. Also bullish.

As is a renewed emphasis on infrastructure spending which will certainly help the materials sector. It just doesn’t make sense to import rock from another country. We have our own. Also, the decision to encourage domestic energy production from both renewables and Nature’s Batteries (fossil fuels) bodes well for an increase in both GDP and individual standards of living.

We always prefer the market leaders in each sector as long as we can buy them at a fair price:

- In materials that means Dow Chemical (NYSE:DOW.) But here's a smaller firm that is solidly beaten down as well: Cemex (NYSE:CX). It's only sin? It is headquartered in Mexico so many investors are avoiding it. But, pssst, it's also the biggest cement company in...the USA.

- In energy, you can't beat Exxon (NYSE:XOM) but I like their majority-owned Canadian subsidiary, Imperial Oil (NYSE:IMO)) every bit as much.

- In financials, I like the brokers, insurers and regional banks more than the money center banks. Rather than pick only one, let me suggest for your due diligence the ETFs First Trust NASDAQ ABA Community Bank Fund (NASDAQ:QABA) and SPDR S&P Insurance (NYSE:KIE). For a more speculative look, I am also buying the 2 year warrants on BofA: BAC/WS/A.

- Finally, in health care, I think the big pharma companies with great R&D and big moats are beaten down to a ridiculous level. I'm buying NovoNordisk (NYSE:NVO) and Teva Pharmaceuticals (NYSE:TEVA).

So what tempers my enthusiasm? Experience. I’ve been doing this a long time and just as it’s often darkest before the dawn, the bright beckoning light we see may well be an onrushing train.

Sooner or later bull markets die. So while I remain sanguine, and am long materials, energy, financials and certain parts of the healthcare sector, my clients and I sleep much better with those trailing stops!

Jeff Miller: Banks, Deep Cyclicals,Tech Stocks Are Fine; Homebuilders Too

The biggest downside for markets comes after a business cycle peak, the technical definition of a recession. There is no sign of a cycle peak. The best indicators see a recession as very unlikely in 2017. Corrections of 15-20% can always happen, and no one has a good record of predicting them.

On the plus side, the earnings recession has ended. Forward estimates are moving higher. A better economy will help. Many believe that stock values are elevated. Historically, at this part of the cycle and with the 10-year note below 4%, it is not unusual to see higher multiples. 18.5 is quite possible.

There has been a sharp move since the election. Bonds, overpriced utilities, and other bond substitutes are getting hammered. The bond guys are calling for this move to be reversed. It is actually a very small reaction to a thirty-year move in bonds. It could be just the beginning – especially when investors see the performance of the bond mutual funds on their year-end statements.

This means that banks are especially good along with other mid to late-cycle sectors. Deep cyclicals and tech stocks are fine. I continue to like homebuilders.

Worries? What to avoid?

Energy is in what I have called a sweet spot. The price is not low enough to be worrisome, but oil is probably not moving higher than $60/barrel in the near term. This is not a great place to invest, but the stability might help other sectors.

Dollar strength will probably continue, and that will weigh on the earnings of some companies. If some of the celebrated Trump policies look like they are backfiring – Chinese trade war, overdoing it on immigration, repatriation of funds derailed – then confidence might be reduced.

How much of his agenda can be implemented and in what form is a big question. I have favored large regional banks like KeyCorp (NYSE:KEY) and PNC Financial Services Group (NYSE:PNC), but the entire sector should do better.

Among the Homebuilders I like Lennar Corporation (NYSE:LEN) and PulteGroup (NYSE:PHM).

In tech, I sell calls for extra yield against some positions. Intel (NASDAQ:INTC) and Cisco (NASDAQ:CSCO) are examples. Apple (NASDAQ:AAPL) remains very attractive. The AAPL food chain is interesting, but riskier. Qorvo (NASDAQ:QRVO) is an example.

Cyclicals are a good area to shop, and I am reviewing some ideas. We have done well with Manpower (NYSE:MAN) and Penske Automotive (NYSE:PAG), and sold others that reached our price targets.

Biotech will rebound, but the jury is out on when.

Watch out for utility ETFs like Utilities Select Sector SPDR (NYSE:XLU). Yield from modest dividends and covered calls is both higher and safer. That is actually our most popular program.

Author's Note: We own everything I named here.

Michael Ashton: Higher Interest Rates, Higher Inflation

2016 was a year of substantial changes in global political leadership teams at both the national level and within multinational bodies. Election results in the US and Italy, to name two, and the vote in the UK that will change the composition of the EU in the future were important changes that surprisingly had no significant immediate effect.

However, I believe that the reverberations from these events will begin to be felt in 2017, along with changes in the stances of monetary policymakers globally. Most of these reverberations are likely to result in higher inflation not just in the US, but globally.

One particularly dangerous trend is the move towards borders that are less-porous for trade. I express no opinion about the movement of refugees and that trend’s effect on political comity.

But the ‘globalization dividend’ of the last quarter-century created a better combination of growth and inflation than would have been possible otherwise, and any reversal in globalization will similarly create a worse combination of growth and inflation. On the monetary policy side, higher interest rates in the context of large balances of inert reserves create the probability of higher inflation as monetary velocity rises with interest rates.

The combination of these two factors is an unhappy one for the inflation picture globally. I expect higher core inflation readings in the US – with the likelihood that it will exceed 3% for the first time in more than two decades – as well as increases in Europe, the UK, and possibly even Japan. Headline inflation, on the other hand, could decline if major economies slip into recession but this should not stop core inflation measures from trending higher.

Painful for Equities and Bonds

This is going to be painful for equity markets and bond markets; I would reduce equity exposures to the lowest comfortable level and avoid fixed-rate bonds in favor of intermediate-duration inflation-indexed bonds (possibly through ETFs such as FlexShares iBoxx 5-Year Target Duration TIPS (NYSE:TDTF) or SPDR Barclays 1-10 Year TIPS (NYSE:TIPX)). Broad commodity indices will be good investments, especially ones that avoid energy and precious metals. United States Commodity Fund (NYSE:USCI) is a good staple of such an allocation.

More speculative investors might consider the base metals ETF PowerShares DB Base Metals (NYSE:DBB) or the livestock ETF iPath Bloomberg Livestock Subindex Total Return Exp 22 Oct 2037 (NYSE:COW) if you’re feeling particularly chippy.

** Disclosure: Some of our clients own USCI as part of their allocation. We have no other positions, or intent to enter any positions in the next 30 days, in any of the other securities mentioned. **

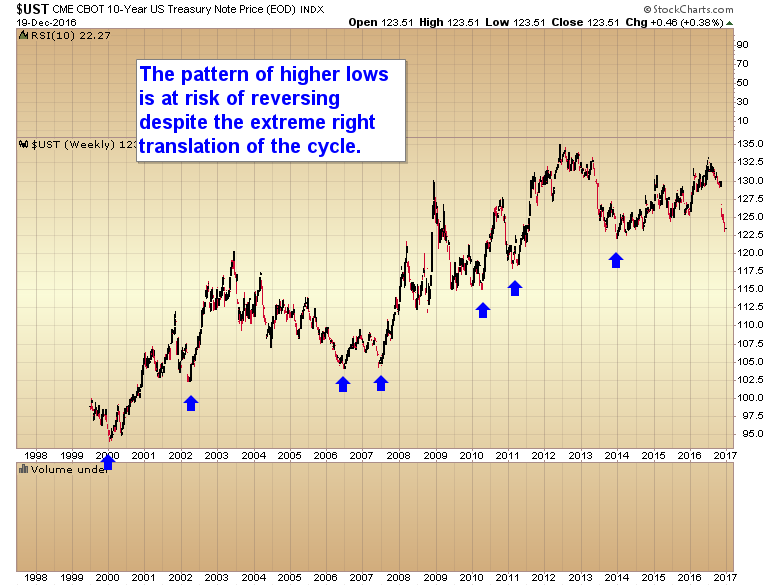

Gary Savage: Will The Bond Bubble Pop?

I suspect the biggest story of 2017 will be whether or not the bond bubble has popped. If the 10-year can slice through the 2013 low, that might be enough to ring the bell that something is terribly wrong.

I’ve never seen a bubble that popped gracefully, or one that didn’t cause major ripples across the financial markets when it did. If this is starting, then I would expect major turmoil in almost all markets. So I think the markets to watch this year are the sovereign bond markets.

Candy Matheson: SPX At 2400 By End Of 2017

At the end of November, I posted an article which outlined a hypothetical scenario of the S&P 500 Index reaching 2700 by the next U.S. Presidential election, in November 2020.

I realize that this is only one of many possibilities that lie ahead for the SPX. However, given the aggressive economic, tax and fiscal agenda that President-elect Trump is currently promoting, it could, very well, materialize without too much resistance.

In keeping with the trajectory and velocity associated with that premise, I anticipate that the SPX could reach 2400 by the end of 2017, as shown on the Monthly chart below.

In last year's market outlook for 2016, I anticipated a rise of around 5-6% in equities, in general, in a run-up to this past November's Presidential election.

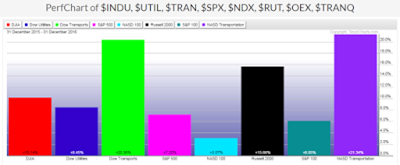

As of this writing (December 1st) you will see that the S&P 500 Index has gained 7.2% Year-to-Date, as shown on the first graph below, while the Dow and NASDAQ Transportation Indices and Russell 2000 Index have gained the most. The NASDAQ 100 Index has been the weakest.

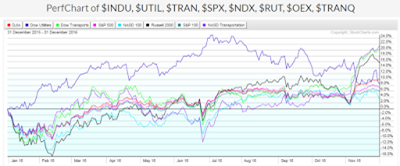

The second graph, below, shows the steep rise of the Dow and NASDAQ Transport Indices and Russell 2000 Index from the day after the election.

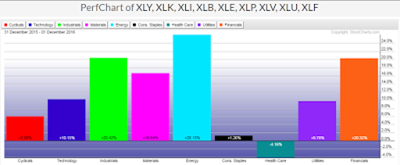

The third Year-to-Date graph, below, shows the percentages gained/lost for the 9 Major Sectors. Energy, Industrials, Financials and Materials have gained the most, while Consumer Staples has gained the least, and Healthcare has lost 4.16%, so far, this year.

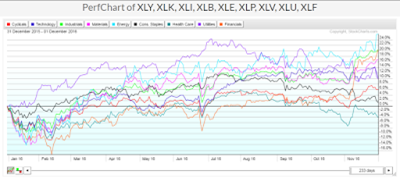

The last graph shows the steep rise of the Energy, Industrials, Financials and Materials sectors, and the decline of the Healthcare and Consumer Staples sectors, since the election.

CONCLUSIONS

Assuming that volatility will be kept low (which can be monitored in a manner as described in my post of November 26th), I'd project that equity markets, in general, will gain around 11% in 2017. That would place the S&P 500 Index at just above the 2400 level by the end of the year.

In that regard, I think it will be important that Financials, Large-Caps and Small-Caps stay strong and that market participants continue to favour the riskier sectors over their more defensive counterparts. As well, I'd like to see Technology firm up and gain strength to support such a bullish outlook.

Read Part 1: Outlook 2017: What To Expect From Oil, Gold, USD And FX