The biggest market stories over the course of 2014 were Oil, the US dollar and surging U.S. equities. The Russian ruble tumbled to record lows in December and as of this writing continues to weaken, but the U.S market's meteoric rise appears to be unstoppable.

As 2014 comes to a close we asked 10 of the most popular contributors to Investing.com for their strategies for the coming year. We received a provocative mix of views and have divided the responses into two articles. Part I, below, covers macro and instrument specific convictions. Part II offers insight into what contrarians are considering.

Steven Hansen: Overvalued Markets Relative to Business Cycle

Life as an investor has been very different since the Great Recession. I know you cannot accurately anticipate long term market moves - and I did not anticipate the large drop in oil prices this year. Oil price decline will have so many knock-on effects (good and bad) that one cannot understand the timing or intensity of the effects. Many pundits are pointing to increased consumer holiday buying on the back of reduced oil prices. I believe reduced oil prices will have the opposite effect on many non-retail business which will end up offsetting (how much is the question) the positive retail growth.

There is always uncertainty about the future - and the weighting of the uncertainty is problematic in making forecasts. Most uncertainty is over-weighted, and ends up having little effect on the economy. But we are NOT talking about the economy here, but the markets and business cycles (which are related but not joined at the hips).

In any event, my belief is the market is over-valued relative to the business cycle - and that the markets will have a ho-hum year as the markets adjust to the business cycle. Market movements anticipate the change in the business cycle. This will be the primary dynamic on the markets in the first half of 2015. However, the second half of the year is a little cloudy as global growth and currency valuations may be the primary dynamics.

- As long as global economies do not contract (and at this point I only anticipate a slowing) - the USA business cycle should strengthen;

- It seems a currency war has been triggered by Japan. If the dollar continues to strengthen, it will have a mixture of positive and negative dynamics on the USA business cycle. A strengthening dollar reduces business profits. The question is how much will the dollar strengthen?

Kathy Lien: Greenback to Strengthen, Interest Rates Could Rise Slightly

When it comes to the outlook for currencies, there’s nothing more important than the direction of monetary policy. In the last few months we got a taste of what to expect for the coming year. In the second half of 2014, the dollar appreciated 13% against the Japanese yen and 8% against the euro.

In 2015, we expect the greenback to strengthen by least another 3 to 5 percent against both of these currencies as monetary policies between these countries drift further apart. This past year, the Federal Reserve ended its Quantitative Easing a month after the European Central Bank cut interest rates and days before the Bank of Japan stunned the market with a gigantic increase in QE.

In 2015, the Fed will raise interest rates as the ECB launches its own Quantitative Easing program and the Bank of Japan considers more loosening measures. With the U.S. unemployment rate dropping below 6% and wages beginning to rise, the central bank has no choice but to begin the process of normalizing monetary policy. While we don’t expect U.S. interest rates to exceed 3%, a 200 to 250bp increase in rates is still very significant especially in an environment where rates will remain near record lows in the Eurozone and Japan. Uncontrollable debt levels in Italy have left Italian bonds a hair above junk status at a time when France will be tested by President Hollande’s austerity measures. If the situation exacerbates, the ECB will have to step in more with a series of easing measures that will include Quantitative Easing. Japan on the other hand will continue to face sluggish growth, leaving the BoJ in easing mode.

With stocks expected to provide less return, the dollar will become more attractive to yield hungry investors and their demand for the greenback should drive EUR/USD below 1.20 and USD/JPY to 125.

Gary Savage: Equity Market Bubble Begins, Oil Bottoms, Commodity Decline Completes, Dollar Drops

I think we are at the very beginning stage of the next bubble in the stock market. This is where the public starts to pile in as they view an investment as a “sure thing”. By sending not-so-subtle signals that they will protect the stock market at any cost, the Fed has again created the conditions for another bubble. The meteoric rise out of the October bottom once Bullard and Williams warned that further QE would be applied if necessary, is signaling the beginning of the bubble phase. I have to think the NASDAQ will at least marginally rise above the 2000 high at 5100 before we have to worry about a top, and this could even go much higher as the final bubble phase in any asset can often last up to a year as retail pours into the asset.

I also think that at some point soon oil will find a final bottom and the three year cycle decline in the CRB will be complete. Once that bottom is achieved inflation will start to slowly leak out of the stock market as it progress closer and closer to NASDAQ 5100 and flow into the undervalued commodity markets. So I think next year is likely to be much better for commodities than the last 3 years were.

Finally I suspect that the stimulus policies in Europe and Japan will turn their economies around (at least for a while) and that will cause the euro and yen to strengthen next year causing the dollar to drop. A strong dollar is the one trade where everyone seems to be on the same side of the boat, so it’s probably time for a major trend change.

David Tablish: 3 Major Trends Will Continue

As 2014 draws to a volatile close I expect three major trends to continue well into 2015 with the US dollar being the most important area to keep a close eye on. In September of this year, the US dollar finally broke out from a massive fourteen year base which is a fractal to a base that was built back in the 1980s and 1990s that propelled the US dollar up to the 120 area before it topped out. When the US dollar topped out in 2001 the precious metals complex was ready to start its spectacular bull market.

The precious metals complex is another area I'm keeping a close eye on as it had a beautiful 10-year bull market that ended in September of 2011. From that top Gold has been in a bear market, making lower lows and lower highs. There is a potential massive H&S top forming, and if it plays out will send gold to much lower price levels. It's at a critical backtest to the neckline right now at 1240 which needs to hold resistance if this H&S top has a chance to play out.

The third area I'm keep a close eye on is the US stock market which has been in a bull market since 2009 and is still running strong. The INDU has formed a very large fourteen year expanding triangle that many are calling the Jaws of Death. My take is just the opposite as I see a big breakout through the top rail of the expanding triangle that was just recently backtested from the topside during the October correction. As long as the top rail holds support, which is currently at 16,000, the bull market remains intact. The semiconductor, health care and biotech sectors are areas to watch for leadership as the bull market charges forward which should make 2015 another great year for investors.

Strawberry Blonde: Shift Into 'Offensive' Sectors

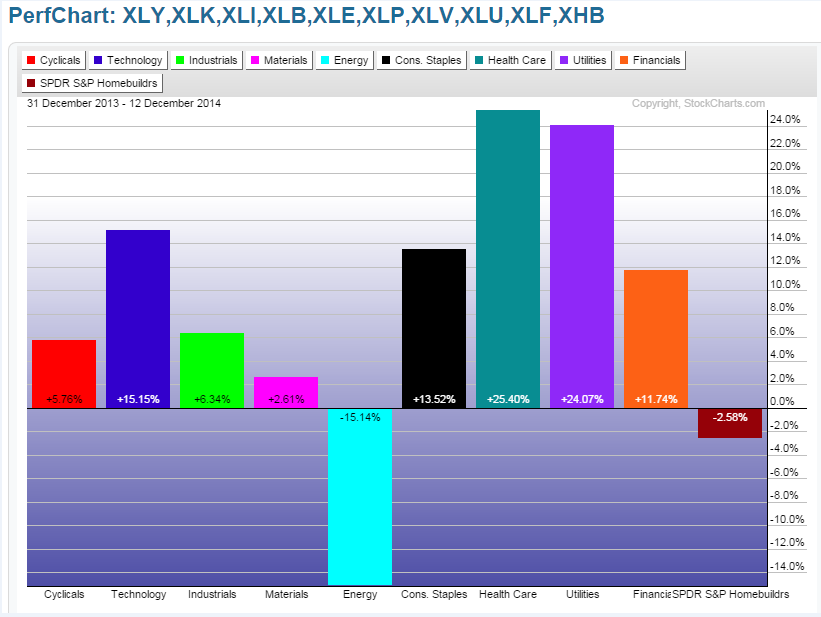

As we approach the end of 2014, we can see from the below Year-to-date percentage gained/lost graph of the Major Sectors that markets have favoured the "defensive" sectors (Consumer Staples, Healthcare, Utilities) plus Financials and Technology, while Housing has taken a back seat this year. It's my opinion that we may see a slight shift from, say, February until May of 2015, and a rotation into a more "offensive" approach (into Cyclicals, Industrials, Materials, Consumer Staples, and Housing) if (and only if) market participants are willing to assume more risk, and if Oil doesn't continue to slide down to or below $50.00. If we start to see more major selling in Oil for any sustained period of time, then I believe we'll likely see a major pullback occur in the equity markets...particularly, if the Fed hints at raising interest rates in mid-2015 or thereabouts.

Otherwise, if Oil stabilizes around 60.00-75.00, we may see a short rebound in the accumulation of the riskier sectors, until, say, May or June. This may involve some profit-taking in the above-noted "defensive" sectors, although, these may continue to outperform again, as they have this year. It really depends on the bottom-line forecasts and targets for overall percentage gains from equity markets to meet the needs of the major institutions and their clients for 2015.

However, I also believe that any further advance in U.S. equities beyond their current levels is dependent on further sustained strengthening of Japan's Nikkei Index, Europe, Brazil, China, Lumber, Copper, Housing, and the Russell 2000 Small-Cap Index. Likely, the US dollar will continue to strengthen if those markets (and those countries' economies) continue to show weakness. Links to my previous posts on these markets can be seen in my latest post here for further explanation.

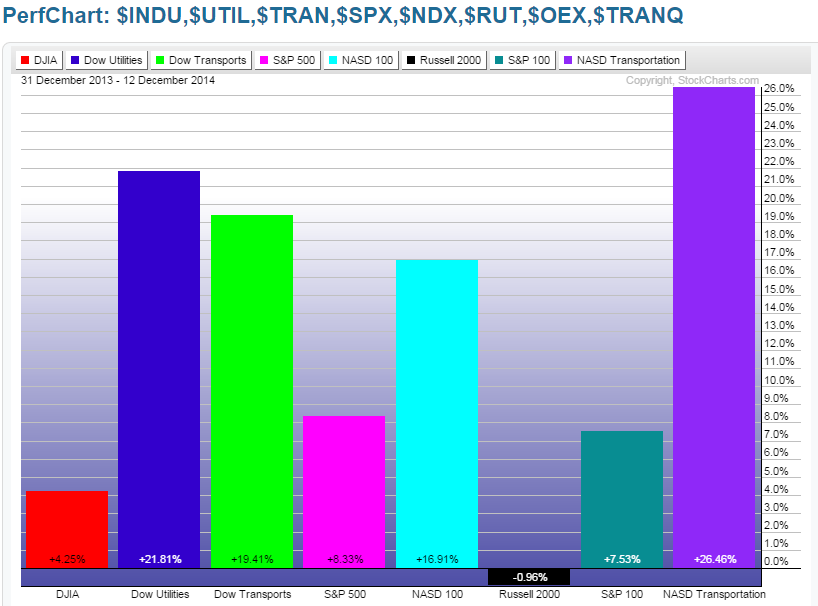

Year-to-date, the SPX has gained 8.33%, as shown on the percentage gained/lost graph of the Major Indices, below. I think we'll be lucky to see half that increase in 2015 (say, a total of 4% for 2015), as I believe market volatility will increase and markets will consolidate in large trading ranges for longer periods of time in between moves, especially if we see a softening in the U.S. labour markets and wages.

To read Part II of Investing.com's '2015 Outlook, Part II: Contrarian Perspectives, click here