Market Brief

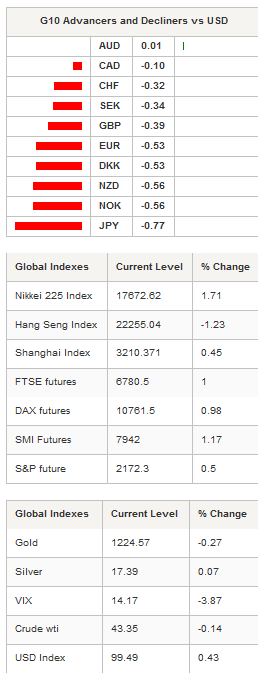

The US dollar started the week on a firm footing as investors interpret Trump’s victory as positive for the US economy. Within the G10 complex, the greenback rose the most against the Japanese yen which fell 0.80%. USD/JPY is currently testing the resistance that lies at 107.49 (high from July 21st).

The BoJ has been desperately looking for a solution to weaken the yen and it now seems as though the “Trump effect” is doing the job just fine. However, we expect such weakening to be short-lived as the president-elect will not take over the White House until mid-January.

The single currency fell further on Monday and reached 1.0773, its lowest level since January 7th, as market participants anticipate an acceleration of the Fed’s tightening path as Trump’s infrastructure spending plan is expected to boost inflation and growth. EUR/USD slid 4.65% after hitting 1.13 in the immediate aftermath of the US election results.

The entire US yield curve has shifted to the upside with the monetary sensitive 2-year sovereign yields reaching 0.98%, the highest level since March this year. The long-end of the curve accelerated faster than the short-end with 10-year yields climbing to 2.23%, while 30-year yields rose to 3.02% from 2.55%, bolstered by firmer inflation expectations.

On the equities side, Asian regional markets were broadly mixed on Monday as the prospect of a Trump presidency does not have the same consequences for all Asian countries. The Japanese Nikkei was up 1.71%. In mainland China, the Shanghai Composite and Shenzhen Composite were up 0.45% and 0.30% respectively.

Further South, the mood was a little morose as the prospect of a tougher trade relationship with the world’s largest economy weighted on investors’ risk appetite. South Korean shares were down 0.51% as the political crisis intensifies. In Thailand, the SET was down 1.12%, while in Indonesia the JCI fell 1.86%.

In Europe, investors lifted equity futures higher, suggesting a higher open. The German DAX was up 0.98%, the French CAC rose 0.94%, while the SMI was up 1.13%. EUR/CHF continued to move lower on a broader EUR weakness. The currency pair is now testing the ley 1.07 level, raising the likelihood of an SNB intervention. Indeed, the 1.07 level is widely seen as the implicit floor that the SNB is defending.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.0784

S 1: 1.0711

S 2: 1.0524

GBP/USD

R 2: 1.2771

R 1: 1.2674

CURRENT: 1.2495

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 114.87

R 1: 111.91

CURRENT: 107.65

S 1: 102.55

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9920

S 1: 0.9632

S 2: 0.9537