- The U.S. stock market is on track for its worst year since 2008, with the S&P 500 down 19.6% year-to-date.

- The market’s trajectory in 2023 will continue to be dictated by rising interest rates, persistently high inflation, and recession fears.

- As such, I highlight 15 stocks well placed to ride out further turmoil in the year ahead.

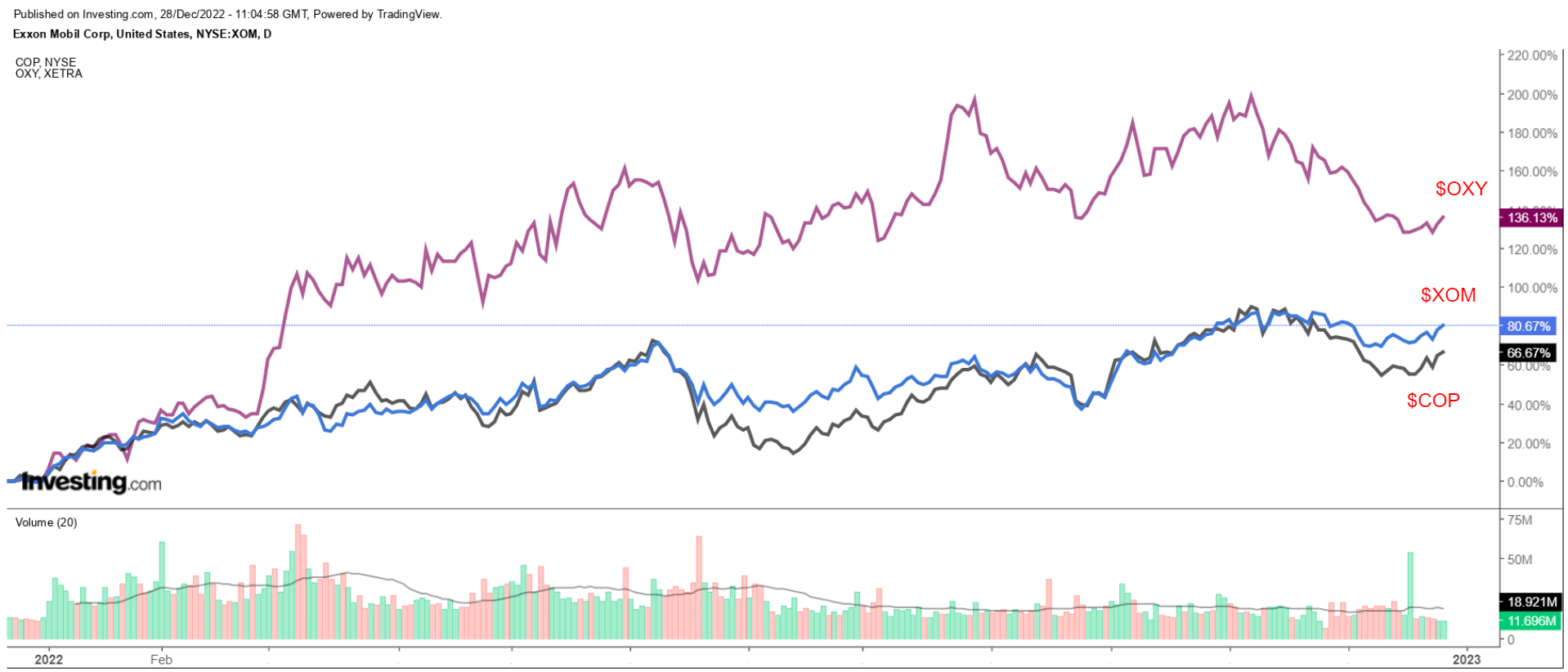

- ExxonMobil Corporation (NYSE:XOM)

- ConocoPhillips (NYSE:COP)

- Occidental Petroleum Corporation (NYSE:OXY)

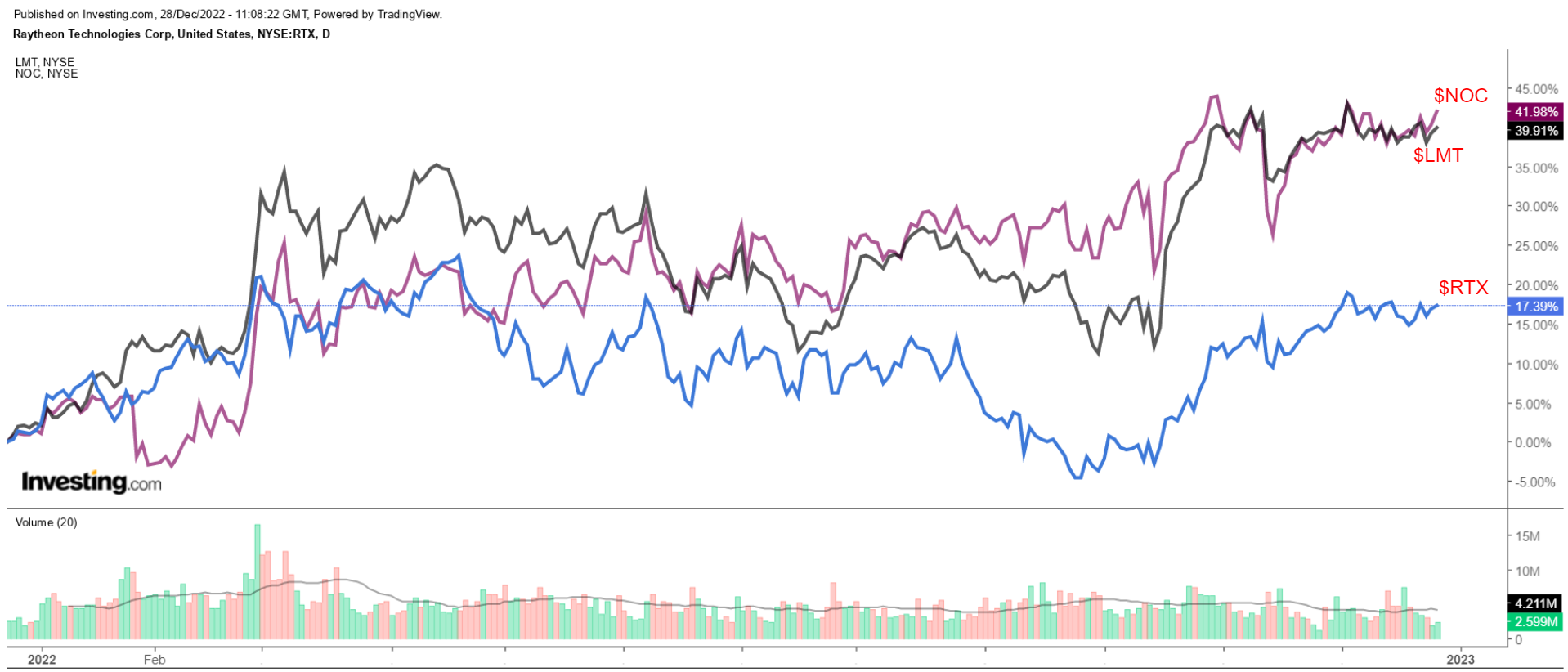

- Raytheon Technologies Corporation (NYSE:RTX)

- Lockheed Martin Corporation (NYSE:LMT)

- Northrop Grumman Corporation (NYSE:NOC)

As it’s shaping up to be the worst year for the U.S. stock market in more than a decade, it’s safe to say that 2022 has been tough for investors on Wall Street.

The S&P 500 is down 19.6% with just a few trading days left to go, which would mark its biggest annual drop since the 2008 financial crisis, amid worries the Federal Reserve’s aggressive monetary tightening to combat inflation will plunge the economy into recession. The benchmark index is roughly 21% below its record high reached on Jan. 4, 2022, meeting the technical definition of a bear market.

The Nasdaq Composite, which has struggled in bear market territory for much of the year, is off by a whopping 33.8% year-to-date and 36.1% below its Nov. 19, 2021, record peak, weighed down by hefty declines in shares of mega cap tech companies that had led markets higher in previous years, such as Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Netflix (NASDAQ:NFLX), and Meta Platforms (NASDAQ:META).

Meanwhile, the Dow Jones Industrial Average is down ‘just’ 8.5% YTD and 10% below its all-time high reached at the start of the year. The Dow is on pace to score its best year since 1933 relative to the S&P, thanks to its reliance on blue-chip companies.

But is the worst over for the U.S. stock market? While anything can happen, of course, I believe that the same risks that dominated sentiment in 2022 will be the leading drivers affecting trading conditions in 2023.

Contrary to popular opinion, I don’t think the Fed will backtrack on higher rates and pivot to a dovish policy stance in 2023, despite mounting recession worries. Fed Chair Jerome Powell recently indicated that the central bank remains stubbornly committed to achieving its 2% inflation goal, and projected rate hikes to a level not seen since 2007, peaking above 5%.

So, in that climate of fears over the path of interest rates, slowing economic growth, persistently high inflation, declining corporate earnings, and volatile foreign exchange moves, investors are in for another wild ride.

Given all that, I highlight my top 15 stock picks for 2023 in no particular order. Unsurprisingly, most of my preferred names for the year ahead hail from defensive areas of the market.

Stock Picks For 2023:

Energy:

With further turmoil expected in 2023, I recommend buying XOM, COP, and OXY, given their solid fundamentals, reasonable valuations, healthy balance sheets, and enormous cash piles.

In my opinion, shares of these three energy companies remain some of the best stocks to own heading into the new year, thanks to their ongoing efforts to return capital to shareholders in the form of higher dividend payouts and share buybacks.

Consumer Staples:

As investors worry about rising interest rates, elevated inflation, and weakening economic growth, GIS, HSY, and CPB have potential to deliver strong returns in the coming year as investors pile into defensive areas of the consumer staples sector.

While non-profitable high-growth technology companies are set for continued declines, defensive-minded value stocks will likely see impressive gains amid ongoing market turmoil due to their strong balance sheets and high free cash flow levels.

Healthcare:

I expect shares of Eli Lilly, Merck, and Bristol Myers Squibb to continue to outperform the broader market in 2023. All three names offer relatively high dividend yields and are still reasonably valued, making them attractive defensive plays amid the current market backdrop.

In general, stocks of defensive companies whose products and services are essential to people’s everyday lives, such as drug manufacturers, tend to perform well in environments of slowing economic growth and market turbulence.

Defense Contractors:

RTX, LMT, and NOC will continue their march higher in 2023 as the three defense giants remain well-positioned to benefit from growing government and military defense budgets due to the current global geopolitical environment.

Considering their status as three of the world’s biggest manufacturers of various military goods and advanced technologies - such as fighter jets, combat ships, hypersonic missiles, and missile defense systems - Raytheon, Lockheed, and Northrop are set to gain from increased tensions between the U.S., its NATO partners, and Russia due to the ongoing Ukraine war.

China Internet Companies:

I anticipate shares of Alibaba, Pinduoduo, and Baidu will rebound in 2023 following their brutal selloff as the worst of Chinese President Xi Jinping’s anti-tech regulatory clampdown appears to be over for the time being and the country’s economy reopens following strict COVID-related lockdowns.

In another positive sign, Chinese and U.S. regulators have recently stepped up their efforts to reach an agreement and solve their years-long audit dispute so that Chinese firms can remain listed on the U.S. stock market.

Disclosure: At the time of writing, I am short the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ).

I am long the Energy Select Sector SPDR ETF (XLE) and the Health Care Select Sector SPDR ETF (XLV).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.