Free Cash Flow (FCF) is more than just a financial term — it’s the lifeblood of any successful business. It offers a clear snapshot of a company’s financial well-being, serving as an essential tool for investors, business leaders, and financial analysts.

From evaluating a company’s ability to cover its expenses and invest in growth, to gauging its attractiveness as an investment, Free Cash Flow provides a comprehensive view of financial health and strategic potential.

What is Free Cash Flow?

Free cash flow is the definitive measure of a company’s financial health, representing the cash left after meeting both operational expenses and capital investments. This metric stands as a financial reality check, focusing strictly on cash, which is the ultimate indicator of financial solidity.

The allocation of FCF reveals a company’s strategic objectives. For instance, using FCF for dividends suggests a shareholder-centric approach, while reinvestment indicates growth ambitions. In either case, how a company uses its free cash flow can provide crucial insights into its long-term vision and financial stability.

For investors, a consistent generation of strong FCF makes a company an attractive investment option, signaling its capability to self-finance growth and deliver shareholder value.

What is the Free Cash Flow Formula?

The formula to calculate free cash flow is relatively straightforward:

Free Cash Flow (FCF) = Operating Cash Flow − Capital Expenditures

Here, Operating Cash Flow refers to the cash generated from regular business activities, while Capital Expenditures encompass the costs incurred for long-term investments, such as machinery or real estate.

How to Calculate Free Cash Flow?

The process of calculating Free Cash Flow (FCF) involves a detailed examination of a company’s financial statements. It is a straightforward process but requires attention to detail.

Let’s break it down step by step:

Step 1: Identify Operating Cash Flow

The first step is to locate the Operating Cash Flow on the company’s Cash Flow Statement. This figure represents the cash generated from the company’s regular business operations. You can get this information directly from a company’s quarterly or annual reports. These reports are publicly available online, or you can request a mailed copy.

Step 2: Spot Capital Expenditures

The next step is to identify the Capital Expenditures, which can also be found on the Cash Flow Statement, usually listed under the section titled ‘Investing Activities’. Capital Expenditures refer to the funds spent by the company on acquiring or maintaining fixed assets, such as property, buildings, or equipment.

Step 3: Calculate Free Cash Flow

Finally, subtract the Capital Expenditures from the Operating Cash Flow. The result is the Free Cash Flow, which represents the cash available to the company after paying for its operational expenses and long-term investments.

Example Calculation of Free Cash Flow

Let’s consider a company with the following data:

- Operating Cash Flow: $500,000

- Capital Expenditures: $150,000

Using the formula:

FCF = 500,000 − 150,000

FCF = 350,000

This company has $350,000 in Free Cash Flow, indicating surplus cash available for strategic initiatives like debt repayment, acquisitions, or shareholder rewards.

Why is Free Cash Flow Important?

Free Cash Flow (FCF) is a critical financial indicator that provides a comprehensive view of a company’s financial health.

- Measures Financial Health: FCF provides a direct insight into a company’s liquidity, showcasing its ability to generate cash while covering operational and capital expenses.

- Supports Dividend Payments: Companies with healthy FCF are better positioned to pay consistent dividends to shareholders, signaling financial stability.

- Facilitates Debt Management: High FCF enables firms to reduce debt levels, lower interest expenses, and strengthen their balance sheets.

- Drives Growth Opportunities: Positive FCF allows companies to reinvest in their business, whether through research and development, acquisitions, or new market expansion.

- Enhances Valuation: FCF is a critical component of valuation models, such as discounted cash flow (DCF) analysis, helping investors assess a company’s intrinsic value.

How to Interpret Free Cash Flow?

Interpreting Free Cash Flow (FCF) effectively requires a deep dive into the context in which the cash is generated and how it aligns with the company’s operations, strategy, and industry norms. Below is an expanded discussion of the key points for interpreting FCF:

Positive FCF

Positive FCF shows financial health and operational efficiency. Companies can reinvest in growth, pay dividends, or reduce debt. It indicates surplus cash generation and the ability to sustain operations without relying on external funding.

Negative FCF

Negative FCF often signals strategic investments in growth initiatives or expansion. While it may seem concerning, it can reflect long-term planning rather than financial distress, especially for companies focusing on future profitability and competitive positioning.

Consistent Growth

Steady FCF growth highlights efficient operations and strong financial management. It attracts investors by increasing intrinsic value, showcasing sustainable performance, and supporting potential dividend increases, signaling long-term stability and robust business operations.

Sector-Specific Context

Industries like utilities or manufacturing may show lower FCF due to capital intensity, while tech firms often exhibit higher FCF. Analyzing sector norms provides clarity, ensuring fair comparisons and understanding within unique operational environments.

Comparative Analysis

Comparing FCF with competitors reveals operational efficiency and market positioning. It helps identify strengths or weaknesses, supports valuation analysis, and offers insights into financial performance across industry benchmarks and historical trends.

What is a Good Free Cash Flow?

A “good” Free Cash Flow varies depending on industry, company size, and growth stage. Here’s what to consider:

- Positive and Growing: Positive FCF that grows consistently over time is generally considered favorable.

- Industry Norms: Compare FCF against industry peers; for example, tech companies often exhibit higher FCF margins than capital-intensive sectors.

- Proportional to Revenue: A good FCF should constitute a healthy percentage of the company’s revenue, signaling efficient cash management.

- Aligned with Strategy: For growth companies, temporary negative FCF may be acceptable if aligned with long-term strategic goals.

Limitations of Free Cash Flow

Despite its importance, Free Cash Flow has certain limitations. Here are five key points to consider:

- Excludes Non-Cash Items: FCF focuses solely on cash-based transactions, ignoring non-cash expenses like depreciation, which can affect a company’s overall profitability.

- Subject to Volatility: FCF can be highly volatile due to irregular capital expenditures, making it less reliable for short-term assessments.

- Misleading During Growth Phases: Companies investing heavily in expansion may show negative FCF, despite being fundamentally sound and poised for long-term growth.

- Lacks Standardization: Different companies calculate FCF differently, leading to inconsistencies in comparisons across industries and geographies.

- Overemphasis on Cash: Excessive focus on FCF may overlook other vital aspects of financial health, such as earnings quality and revenue growth.

How to Find Free Cash Flow?

InvestingPro offers detailed insights into companies’ Levered Free Cash Flow and Unlevered Free Cash Flow including sector benchmarks and competitor analysis.

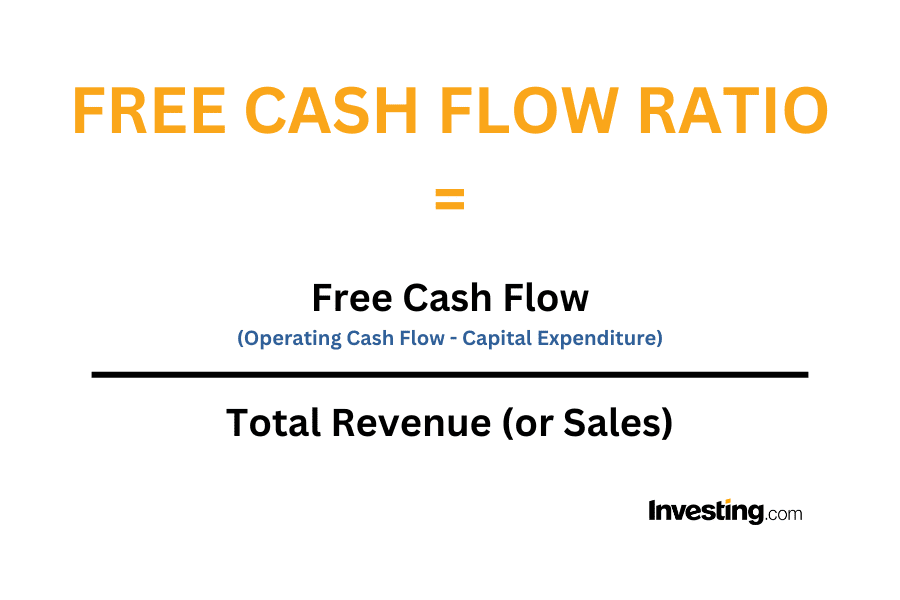

How To Calculate Free Cash Flow Ratio?

Once you have calculated a company’s free cash flow, the next step is to find the free cash flow ratio. This is a simple process, as outlined in the step by step below:

Step 1: Find the Free Cash Flow (FCF)

Start by locating a company’s free cash flow figure in its financial reports. This information is what we worked out earlier in this article.

Step 2: Identify the Total Revenue or Sales

Look for the company’s total revenue or sales for the same period as the free cash flow figure. You can usually find this information in the company’s income statement.

Step 3: Perform the Calculation

Take the Free Cash Flow (from Step 1) and divide it by the Total Revenue or Sales (from Step 2).

Step 4: Interpret the Result

The number you get from Step 3 is the Free Cash Flow Ratio. A higher FCF Ratio indicates that the company is generating more cash relative to its revenue. This can be a positive sign for investors as it suggests the company is efficiently converting sales into actual cash profits.

Step 5: Consider Implications

Analyze the FCF Ratio in the context of the company’s industry and financial goals. A high or improving FCF Ratio may suggest strong financial health, while a declining ratio might warrant further investigation.

What is a Good Free Cash Flow Ratio?

Defining a “good” FCF ratio isn’t as simple as pointing to a single number. While a ratio above 1 is generally a positive indicator across industries, the benchmark for what constitutes a ‘good’ ratio can differ significantly depending on the sector.

As a starting point, a Free Cash Flow ratio above 1 is considered favorable for any company. This implies that the business is generating enough cash to more than cover its operating expenses and investments, a key indicator of financial health. It’s like earning more money than you spend on bills and groceries; it leaves you with options and a sense of financial security.

Sector-Specific Differences

Different industries have their own ‘good’ FCF ratio due to the unique challenges and costs they face:

Retail Sector: Here, a ratio above 1.2 is a strong sign. It means the company is financially healthy and could potentially open new stores or enhance existing ones.

Software Industry: A ratio above 1.5 is especially favorable in this sector. Software companies often spend a lot on research and development, so a higher ratio suggests they can afford these expenses while still being profitable.

Energy Sector: Companies here often have high costs for things like drilling and equipment, so a slightly lower ratio above 0.8 is still considered good.

Investor and Stakeholder Implications

So what does it all mean for investors and stakeholders? A strong Free Cash Flow ratio is generally seen as a favorable financial indicator, signaling a company’s ability to grow, reduce debt, or provide returns to shareholders. It often suggests competent management and makes the company an attractive investment opportunity.

On the other hand, a low Free Cash Flow ratio calls for caution. It could indicate operational inefficiencies or high capital expenditures, leading to potential liquidity risks. In such instances, comprehensive due diligence is advisable for investors and stakeholders.

It’s essential to view the Free Cash Flow ratio in the broader context of other financial metrics and market conditions. This nuanced approach allows for more informed decision-making regarding investment and risk assessment.

InvestingPro+: Access Free Cash Flow Data Instantly

Unlock Premium Data With InvestingPro 📈💸

Gain instant access to free cash flow data within the InvestingPro platform. Plus:

✓ Access to 1200+ additional fundamental metrics

✓ Competitor comparison tools

✓ Evaluate stocks with 14+ proven financial models

Free Cash Flow FAQs

Free Cash Flow is often considered a more reliable metric than EPS because it is harder to manipulate. It provides a transparent view of a company’s cash position, which is crucial for any investor.

How does seasonality impact Free Cash Flow?

Seasonal businesses may experience fluctuations in Free Cash Flow depending on the time of year. This is important to consider when analyzing FCF as these fluctuations could be mistaken for volatility or instability.

What are some red flags in Free Cash Flow?

Consistently declining or negative Free Cash Flow can be a red flag. It could indicate underlying issues such as decreasing revenues, increasing costs, or inefficient operations.

Is Free Cash Flow the same as Net Income?

No, Free Cash Flow and Net Income are not the same. Net Income includes various non-cash items and accounting adjustments, whereas Free Cash Flow focuses strictly on actual cash generated.

How does debt repayment factor into Free Cash Flow?

Debt repayment doesn’t directly affect the calculation of Free Cash Flow, but a company’s ability to service its debt is often evaluated in the context of its Free Cash Flow.

Can Free Cash Flow be negative for a successful company?

Yes, a successful company can have negative Free Cash Flow temporarily, especially if it’s making significant long-term investments. However, this isn’t sustainable in the long term.