For investors, having access to up-to-date company earnings information is crucial for making informed investment decisions and anticipating market moves. This is where earnings calendars come in handy. This article will deep dive into what earnings calendars are, why they’re essential, and how to use them to your best advantage as a smart investor.

Earnings Calendar Definition

An earnings calendar is the timetable (usually in the form of a quarterly schedule) that lists the dates when publicly traded companies are scheduled to announce their quarterly or annual earnings. These calendars offer at-a-glance information on expected earnings releases, making it easier for investors, both seasoned and rookies, to plan their investment strategies accordingly.

These releases occur in the months just after the end of each fiscal quarter. Not all companies release their data on the same date, which means an earnings calendar is often needed for investors to keep track of releases that are relevant to their portfolios.

Lags after the end of a quarter are due to accounting periods that allow the companies time to prepare the data collected. Many important documents are updated at this time, including a company’s income statement, its balance sheet, and cash flow statement. Other important information is also released, including net income, net sales, and earnings per share – which is often the headliner of the released data as it’s a quick measurement of company performance and often a precursor to market movements.

How an Earnings Calendar Works

Typically, companies disclose their earnings dates weeks or even months in advance. They need to share these data with all market participants, including individual investors and financial analysts. Having access to this information levels the playing field somewhat between small investors and large institutions.

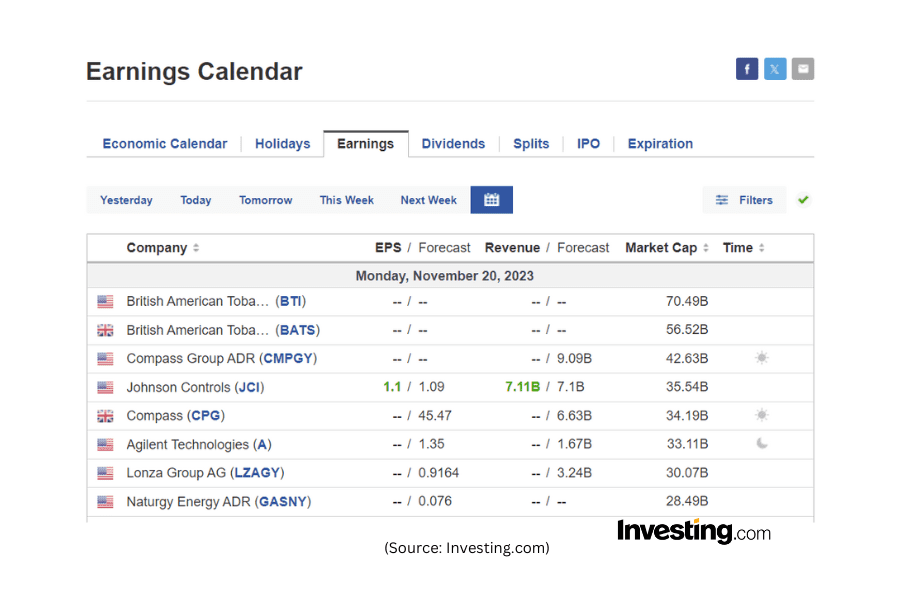

For example, a look at Investing.com’s earnings calendar shows companies’ names (with links to their specific instrument pages), along with the exact date and time of day that they’re expected to release their earnings.

The mechanics behind earnings calendars are relatively straightforward. Companies convey their future earnings release dates weeks, if not months, in advance to exchange authorities. The dates are then compiled, cleaned and aggregated before being pulled through and compiled in the calendar, offering market participants, including individual investors and financial analysts, an equal chance to prepare for the occasion.

While the visible information appears basic, each entry in an easily navigable earnings calendar like Investing.com’s possesses a wealth of underlying information. Delving into the details reveals the company’s reported EPS, EPS forecast, the potential market reaction, and much more, providing invaluable insights into the company’s overall financial trajectory.

In essence, an earnings calendar turns a slew of scattered data into an organized, digestible format. It empowers investors to create an informed investment strategy that takes into account potential market volatility surrounding earnings announcements. This insight offered by an earnings calendar grants the investor a distinct advantage—a big step toward making intelligent and prosperous investing decisions.

Why Use An Earnings Calendar?

A robust earnings calendar is an indispensable tool for time-poor investors looking to gain an edge in the market. Using an earnings calendar can help investors to stay informed, recognize potential opportunities, manage risk, and plan investment strategy more effectively. It grants investors a deeper understanding of market trends and allows them to make more strategic and confident investment decisions.

Here’s why:

- Stay Informed: Knowing when different companies will release their financial results keeps you ahead of the curve in terms of investment decisions.

- Strategic Planning: It helps in planning buying or selling strategies around earnings announcements.

- Strategic Planning: It helps in planning buying or selling strategies around earnings announcements.

- Anticipating Market Reaction: Accurately predicting a company’s performance before its earnings are announced can lead to profitable trades, especially if the market hasn’t already priced in the results.

- Risk Management: Knowing a company’s earnings date can help you avoid unexpected price swings.

How to Use an Earnings Calendar

Using an earnings calendar effectively is much like reading a map. Here’s a step-by-step guide to getting the most out of an earnings calendar:

- Decide on the company you want to track and take note of its specific earnings release date.

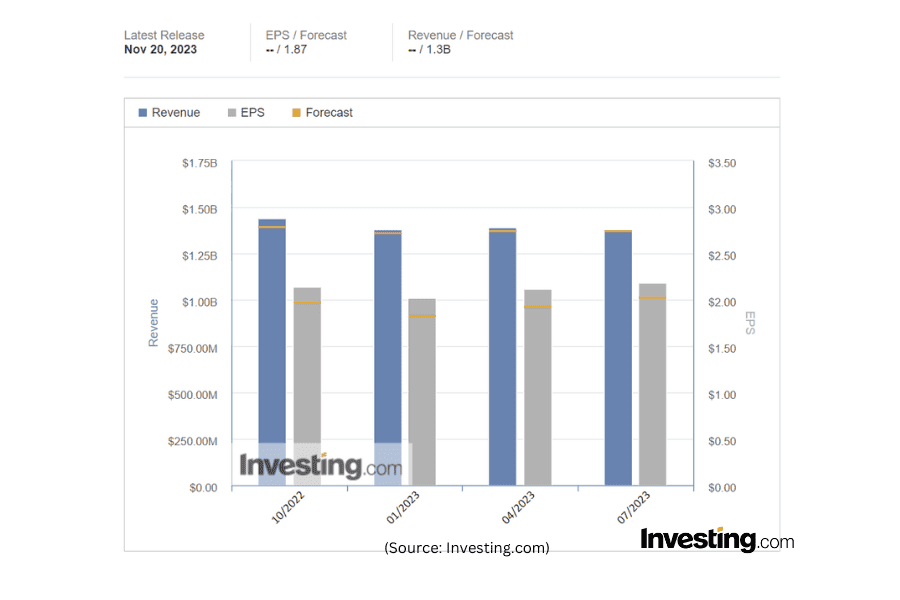

- Click on the name of the company and get taken through to its individual earnings page. Have a look at the preceding trends in the EPS data. Are they improving, declining, or static?

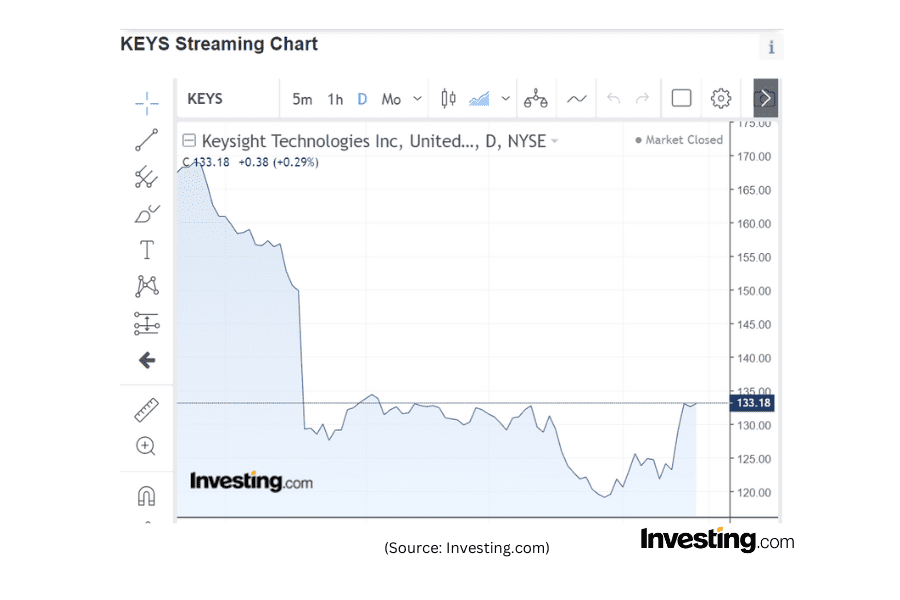

- Reference these dates and positive/negative fluctuations against the company’s streaming chart. Evaluate how each earning release impacts the market. Is there a rapid price movement?

- Back on the Earnings Calendar main page, pay attention to the consensus EPS forecast, as future share prices are largely influenced by the company’s possible deviation from this value.

- Finally, use this data to inform your investment strategy.

Remember 📌

One of the best benefits of the investing.com earnings calendar in particular is its integration with the powerful Investing.com App. Simply set an alert to receive push notifications at whatever intervals before the earnings report that you set, which means you don’t have to manually remember to check back on these dates.

Finding The Chosen Company On The Earnings Calendar

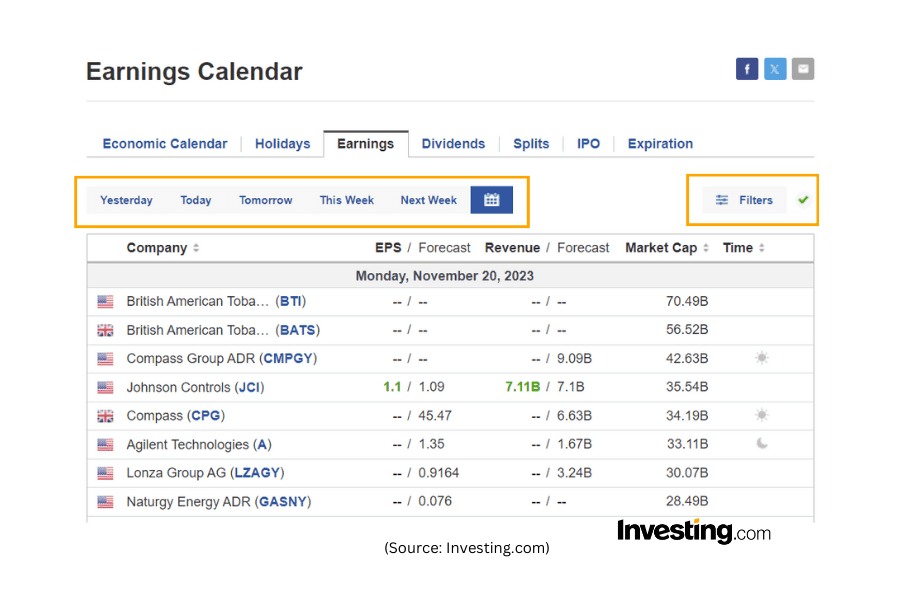

The Earnings Calendar is laid out by date in a table with sortable columns. The buttons at the top of the table allow the user to look back at the releases that occurred both ‘yesterday,’ and ‘today,’ but also upcoming releases grouped by tomorrow, this week, and next week.

The filter button at the top right of the table lets users filter by country, sector, and importance of the report to markets. Note that using the Clear link in the upper left of the filter window removes all the preselected data for starting a narrowed search. The Select All link should be used if a broad search is preferred.

How Financial Analysts Use Earnings Calendars

Financial analysts play a crucial role in interpreting earnings calendar information. These professionals use their deep knowledge of finance and sector-specific expertise to analyze the listed companies’ historical earnings data, make accurate forecasts, and dissect the potential impact of the forthcoming earnings reports.

Here are some of the ways in which analysts interpret earnings calendar information:

1. Making Earnings Forecasts

Analysts make earnings forecasts prior to the actual release of earnings reports. They estimate the earnings per share (EPS) based on their understanding of the company’s operations, the market environment, and broader economic indicators. These predictions form the basis of consensus estimates, which are widely used by investors to anticipate the company’s performance.

2. Assessing Market Volatility

Analysts gauge the likely market volatility by comparing the consensus estimates with the company’s past announcements. If a company has a history of beating or missing forecasts, these patterns might cause price swings following the new earnings announcement.

3. Evaluating Overall Company Health

Analysts also use historical earnings data to assess company health and profitability. Once the new earnings are announced, they compare forecasted earnings with actual results. Discrepancies can hint at deeper issues within the company, which investors must consider.

4. Creating Investment Recommendations

Based on their interpretation of the earnings calendar and a company’s released earnings data, analysts can advise on a stock being a ‘buy’, ‘hold’, or ‘sell’. For investors, following these recommendations can be an effective way to make informed decisions.

Though analysts play a significant role in interpreting and predicting earnings data, investors should also understand that analysts’ estimates or advice are not guarantees. A well-informed investor would also conduct their own research, thoroughly examining the earnings calendar to make wise and independent investment decisions.

Wrapping Up

Incorporating real-time event insights and current financial data into an investment approach equips you with the tools needed to make informed choices, seize opportunities, and manage risks effectively.

Earnings Calendars and other such tools serve as invaluable guides on investment journeys, transforming raw information into actionable intelligence that drives confident and authoritative decisions.

Remember, any effort spent learning about business financial health and trajectory is a core step in the success of any investment journey.

InvestingPro: Supporting Investors of All Levels

Empower Yourself with InvestingPro 📈💸

Gain instant access to over 1,200 fundamental metrics for thousands of listed companies.

Plus:

✓ Competitor comparison tools

✓ Evaluate stocks with 14+ proven financial models

✓ Copy stock picks and weightings from top investors (including Warren Buffett)

✓ Use filters to find stocks that perfectly match your strategy

Earnings Calendar Frequently Asked Questions

Q. How often are earnings reports released?

Earnings reports are typically released quarterly in the U.S., with additional updates provided in annual reports and special announcements when necessary.

Q. What information is included in an earnings report?

Reports around earnings include details about a company’s financial performance, such as revenue, profit, expenses, and guidance for future performance.

Q. How can I interpret an earnings report?

To interpret an earnings report, focus on key metrics like revenue growth, earnings per share (EPS), and any commentary from the company regarding its financial health and future outlook.

Q. What is an earnings call?

An earnings call is a conference call or webcast where a company’s management discusses the results in detail, answers questions from analysts, and provides insights into the company’s strategy.

Q. How can I listen to an earnings call?

Earnings calls are often accessible on the company’s website or through financial news platforms. They are typically held shortly after the earnings report is released.

Q. What is a consensus estimate in an earnings report?

A consensus estimate is the average forecast of financial analysts for a company’s earnings and revenue. It serves as a benchmark against which the actual results are compared.

Q. Why do stock prices often move after an earnings release?

Stock prices can be influenced by whether a company’s actual results beat or fall short of the consensus estimates, as well as by the guidance and commentary provided during the earnings call.

Q. What are pre-announcements or profit warnings?

Pre-announcements, or profit warnings, are early notifications by companies when they expect their earnings to significantly differ from market expectations, either positively or negatively.

Q. How can I use earnings calendars for long-term investing?

Long-term investors can use earnings calendars to plan the timing of their investments, identify trends, and make informed decisions about portfolio adjustments.

Q. What are the potential risks of relying on earnings reports for investment decisions?

Relying solely on earnings reports can be risky because they provide a historical snapshot, and future performance may not align with past results. It’s important to consider other factors too.