For investors, having access to up-to-date economic information is crucial for making informed investment decisions and anticipating market moves. This is where economic calendars come in handy.

Using Economic Calendars for Successful Investing

By using an economic calendar wisely, investors can gain an edge and strategically position their portfolios by forecasting potential market reactions and identifying trading opportunities around impactful events. Whether you are a long-term investor looking to diversify your portfolio or a short-term trader aiming to capitalize on volatility, economic calendars can provide valuable insights.

In this article, we will explore how economic calendars work and why they are an indispensable tool for investors. You will learn how to access key economic calendars, interpret major economic indicators, and leverage the data to time your trades and investments.

When you finish reading, you will have a solid understanding of how to utilize economic calendars to make smarter investment decisions. You will be equipped with the knowledge to monitor critical economic events, analyze the data, and base your investment choices on informed assessments of market responses. Using these calendars effectively can significantly improve your ability to grow your wealth through savvy investing.

The initial effort to set up alerts following important economic developments is time well spent towards achieving investment success.

What Is an Economic Calendar?

Economic calendars provide a schedule of upcoming economic events, data releases, and announcements that can impact financial markets. They often provide an filterable ‘overview’ so that investors can decide which events are most important to then delve deeper into.

What Do Economic Calendars Include?

Economic calendars provide schedules and details on various influential events and announcements. Some of the major data categories found on these calendars include:

- Economic Indicators – These include critical reports on GDP, unemployment, inflation, consumer spending, manufacturing activity, housing, and more. Economic indicators offer insights into the health and trajectory of the economy as a whole. They can cause significant market reactions.

- Central Bank Policy Decisions – Announcements from central banks like the Federal Reserve, ECB, and Bank of England on interest rate changes, monetary policy shifts, and economic outlooks can shake up markets even on a global scale.

- Speeches by Central Bankers – Remarks by Fed Chairs, Treasury Secretaries, and other central bank leaders hint at future decisions. Their tone on the economy is closely watched.

- Geopolitical Events – Elections, global summits, regulatory changes, and political instability can all impact investor sentiment and asset flows.

- Confidence Indices – Sentiment surveys like consumer confidence reports provide leading indicators on where the economy may be headed as they capture public perceptions.

Monitoring these types of impactful events on economic calendars allows you to gain actionable insights and prepare for volatility around these potential market movers. Mitigating risk ensures that an your portfolio remains in the best position to take advantage of sudden market upswings without having to ‘make up the downside’ first.

When it comes to Economic Calendars, intuitive interfaces make all the difference to reduce information overload and increase visual efficiency. Investors need to have powerful, robust information at their fingertips in order to develop the best personal strategy – a difficult-to-navigate economic calendar will only undo their hard work!

Here’s a screenshot of the Economic Calendar on investing.com.

Let’s break down each highlighted column:

- Time: Denotes when the event is going to happen (based on the day and timezone selected).

- Currency: The currency which will be most directly affected by the event.

- Importance: How volatile the resulting effect is likely to be. 1 star denotes minimal volatility, 2 stars medium and 3 stars suggests high volatility linked to the event.

- Event: A brief description of the event, often including which quarter (e.g. Q1, Q2), whether it’s being measured against month-on-month (MoM) or Year-on-Year (YoY).

- Actual Value: The actual outcome of the event in numerical terms. Red denotes a lower number than what was forecasted, and green indicates a higher number than forecasted expectations.

- Forecast Value: Prior to the event happening, analysts often come to a consensus about what the forecasted outcome of the event will be. As investors will see in the ‘actual’ column, these forecasts are often not exact, but rather show an outcome indication.

- Previous Value: The actual value of the previous same event. If the event is MoM, for example, the previous value will show the actual value of the previous month.

How To Use Economic Calendar Filters

Let’s see what happens when an investor clicks the calendar/date icon (1):

From here, investors can select a date range to see information around economic events both upcoming and also in the past.

This is an excellent opportunity for a memory refresh if an investor needs to sense-check what happened last time a particular event occurred, or what happened in the market near or on a particular time period.

Now, here are the available filters (2):

The first two available filters on the investing economic calendar are ‘Search: Event Name’ and ‘Country’.

Search: Event Name: Investors who know the event name they’re looking for can type this in straight away.

A great additional feature of this search is that it will suggest as an investor is typing:

Country: For the Country selection, investors can either look through the (alphabetical) list of countries, or simply ‘Select All’ using the blue text on the left. To remove any selected countries, the ‘Clear’ text can be pressed to start again.

Scrolling down past the list of countries, there are three further filters to get to the right information as quickly as possible:

Time: Investors can see at a glance how many hours and minutes remain until the event happens. Alternatively, it can simply show the time of the event in relation to the ‘Current Time’ shown (highlighted in the screenshot above).

Category: Select one or more of eight category types to see all upcoming matching events. For example, high inflation might prompt central banks to raise interest rates, affecting borrowing costs and potentially impacting the profitability of certain industries in which an investor has a specific interest. So a check of upcoming ‘inflation’ or ‘central banks’ events would give a good overview of when to expect potential volatility.

Importance: Use this filter to view events of only the relevant importance level. Leave blank to see all impact types.

Apply: This button (highlighted in the screenshot above) isn’t a filter, but it’s important to note that the filters aren’t automatically applied – Investing visitors need to click the button in order to get the results.

Do Economic Calendar Filter Results Stack?

Yes! This means that if you choose events from ‘Today’, in ‘United States’ from the ‘Inflation’ category, only events which align with all current filters will be shown.

Finding Additional Event Details

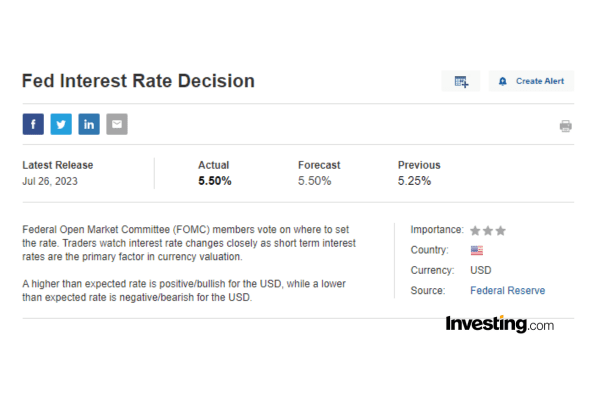

To see more in-depth information about a particular event (either historical data or general info), it’s possible to click on the event name and be taken to a separate, dedicated page. Here’s an example of a page after selecting and clicking an event (Federal Interest Rate Decision) in the economic calendar:

Scrolling down, there’s also a more visual interactive chart, along with a brief but useful table of outcomes over time.

Benefits Of Using An Economic Calendar

There are many benefits of using a robust economic calendar as part of a due diligence process.

- Efficient Information Gathering: The ability to customize with filters enables an economic calendar to provide a concise overview of upcoming economic events, helping investors quickly identify and focus on the events that matter most to their investments.

- Timely Decision-Making: Investors can plan ahead and make timely decisions based on the release of important economic data. For example, knowing when a central bank will announce its interest rate decision allows you to adjust your strategies accordingly.

- Risk Management: By tracking events such as GDP releases, employment reports, and inflation data, investors can anticipate potential market movements and adjust their positions to manage risk.

- Sector-Specific Insights: Investors can narrow down their focus to economic categories relevant to their investment interests. For instance, a tech-focused investor might closely monitor technology spending data.

- Avoiding Jargon: Economic calendars present information in a clear and understandable manner, catering to investors who don’t have time for technical jargon.

- Volatility Awareness: Events like interest rate decisions or political announcements can lead to market volatility. Being aware of these events through an economic calendar helps you to prepare for sudden price fluctuations.

- Strategy Adjustment: You can use an economic calendar to proactively adjust your investment strategies based on anticipated economic events. By staying informed about upcoming data releases, policy announcements, and market-moving events, you can fine-tune your positions to align with changing market conditions.

Remember! 📌💸

One of the best benefits of the investing.com economic calendar in particular is its integration with the powerful Investing.com App. Simply set alerts for whatever filters are most useful to your investing journey, and get notifications on the go without needing to keep checking back!

Strategies for Incorporating Economic Calendar Data

Staying ahead of investment and economic data requires more than just an understanding of market trends; it demands a keen awareness of the economic landscape. Incorporating economic calendar data into decision-making processes can provide the edge investors need to navigate dynamic markets with confidence.

Below are some effective strategies for making the most of economic calendar data.

- Identify Potential Market-Moving Events and Plan Ahead

The key to successful investment lies in proactive planning. Economic calendar data empowers investors to identify events that could trigger significant market movements. Focus on high-impact indicators like interest rate decisions, employment reports, GDP releases, and inflation data. These events often have far-reaching effects on various asset classes. By recognizing their timing, investors can adjust their investment positions in advance, optimizing their portfolios for potential opportunities or risks.

Example: A central bank’s interest rate decision can swiftly influence exchange rates. With this information from the economic calendar, investors have the advantage of preparing for possible currency fluctuations and taking forex positions accordingly.

- Balance Short-Term and Long-Term Insights

Successful investment strategies consider both short-term volatility and long-term trends. Economic calendar data provides a balance of these insights. While short-term events can lead to immediate market shifts, long-term indicators offer a broader perspective on an economy’s health.

Example: Suppose you’re invested in stocks. By tracking both quarterly earnings releases and annual GDP growth figures, you gain a comprehensive understanding of how individual companies are performing within the context of the broader economic landscape.

- Stay Adaptable and Research-Driven

Economic calendar data is a powerful tool, but its true potential is realized through continuous learning and adaptability. Take the time to research how specific events historically influenced markets. Regularly review your watchlist and evaluate the outcomes of events you’ve tracked. This iterative process enhances your ability to anticipate and respond to future events more effectively.

Example: After observing how certain economic indicators affected bond yields, you might adjust your fixed-income portfolio in anticipation of similar future events.

Incorporating economic calendar data into your investment approach transforms raw information into actionable insights. By identifying market-moving events, tailoring your watchlist, balancing short-term and long-term perspectives, and remaining research-driven, you can navigate the markets with the confidence and authority your investment endeavors demand.

- Create a Personalized Watchlist of Events

Tackling the financial markets efficiently requires organization. Create a personalized watchlist based on investment interests and risk tolerance. Filter the economic calendar to display only portfolio-relevant events. This focused approach saves time and ensures that investors don’t get overwhelmed by excessive information.

Example: A real estate investor might customize their watchlist to include housing market data, construction spending, and mortgage rate announcements. This tailored view allows them to monitor events directly impacting their sector, enabling more informed decisions.

How To Add Economic Events To Watchlist / Alerts

Open the investing.com app and log in. Then follow the steps below:

- Click through to the economic calendar by tapping ‘view all’ next to ‘trending events’.

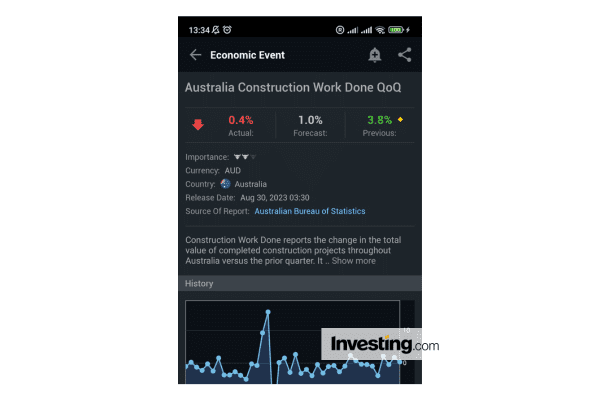

- Find the event to add to the alert list and tap.

- Check the event is the correct one, then tap the bell symbol at the top-right corner.

- Select the reminder timing (60, 30, 15 minutes before). And whether to alert on a recurring basis (whenever the same event is about to happen in the future).

Remember 📌

Push Notifications from the app should be approved on the device.

- Checking the ‘Economic Events’ section of the Alerts page will show the new alert. To switch off, simply tap the orange toggle button.

Other Economic Event Resources

The Economic Calendar isn’t the only event resource; here are seven more.

Holiday Calendar

Financial markets can be adversely affected during stock market holiday breaks, so this holiday calendar acts as a key tool for long-term traders and investors to manage risk expectations. Explore the calendar to find information on the NYSE, NASDAQ, LSE, Euronext, Tokyo Stock Exchange and many other world exchanges.

Earnings Reports

Quarterly earnings from major public companies are released on scheduled dates. Earnings Reports showing better than expected earnings can boost stock prices for a company, while misses can cause declines.

Dividends Calendar

This Dividends Calendar features upcoming dividend payment dates and ex-dividends dates, posted as they are announced. No more hunting through endless data – investors can filter the dividend data by country, payment date, ex-dividend date, yield and more. Select an individual share to see robust information about the individual company stock prices over time.

IPO Calendar

Filter upcoming IPOs by country (UK IPOs, US IPOs, etc), listing date, company, stock exchange, value or price. Set IPO alerts when signed into the free mobile app. Find the best new companies to invest in, or keep an eye on what’s coming up on multiple stock exchanges.

Futures Calendar

Get live data on options and futures expiry dates for each contract by market category. Filter information on: settlement, last trading and roll over dates. Use the search bar to check sector types and global location as well as specific instruments. Set alerts using the investing app to never miss important upcoming futures expirations.

The Investing App

Download today to add these events to a watchlist with real-time notifications.

Unlock Premium Data With InvestingPro 📈💸

Unlock the power of precision in your investment journey with InvestingPro’s cutting-edge stock screener. Seamlessly tailored to your needs, this tool empowers investors to confidently navigate the markets, uncover hidden opportunities, and make informed real-time decisions.

Wrapping Up

Incorporating real-time event insights into an investment approach equips you with the tools needed to make informed choices, seize opportunities, and manage risks effectively.

Economic calendar tools serve as invaluable guides on investment journeys, transforming raw information into actionable intelligence that drives confident and authoritative decisions.

Remember, any effort spent learning about and understanding economic developments is a core step in the success of any investment journey.

Economic Calendar FAQs

Q. Should I adjust my portfolio based on Economic Calendar events?

It depends on your investment strategy and risk tolerance. Some investors choose to reduce exposure to the market before high-impact events, while others may see such events as opportunities.

Q. Can Economic Calendars help me become a more confident investor?

Absolutely. By staying informed about upcoming economic events and their potential impact, you can make more informed decisions, resulting in increased confidence in your investment choices.

Q. What key economic indicators should I track?

Important economic indicators to follow include GDP, unemployment rates, manufacturing PMI, interest rates, inflation rates, retail sales, and consumer confidence indexes. These metrics influence market and asset prices.

Q. How often should I check economic calendars?

It’s a good idea to check economic calendars at least once a week. Around big announcements, daily checks may be warranted to anticipate impacts.

Q. How far in advance should I look at economic calendars?

1-2 weeks is optimal. This gives enough time to analyze upcoming events and adjust positions accordingly.

Q. What’s the difference between preliminary and final data releases?

Preliminary releases provide the first estimate which can change. Final releases give the complete data after revisions. Both can impact markets.

Q. How do I distinguish high, medium and low impact events?

The calendar uses either 1-3 stars (on the website) or 1-3 bull icons (on the app) to indicate expected magnitude of market impact for each release.

Q. How can economic calendars help with technical analysis?

Calendar data provides context for price movements. This improves the effectiveness of technical indicators and chart pattern analysis.

Q. Should long-term investors care about economic calendars?

Yes. Economic data can indicate shifting macro conditions that could impact long-term positions. Key trends are revealed.

Q. Where can I find historical economic data for backtesting?

Try sites like Investing.com, FRED (Federal Reserve), Bureau of Labor Statistics, or Macrotrends for economic data archives.

Q. Are economic calendars a requirement for fundamental analysis?

Fundamental analysis depends heavily on economic factors. Calendars streamline tracking this key data.