Recent years have shown just how much Artificial Intelligence is reshaping the investment sector for both individual and institutional participants. No longer are gut instincts or anecdotal evidence enough; today’s investing triumphs are built on robust data analytics and predictive modeling. With AI at the helm, investors can uncover actionable insights without information overload.

Picture the advantage of sifting through countless data points in mere seconds, spotting trends before they become common knowledge, and tailoring investment strategies that align precisely with your risk appetite, portfolio makeup, and time horizon. This is not a vision for tomorrow—it’s the reality of today’s AI-enhanced investing.

Yet, while many available AI tools may seem perfect on the surface, they often end up falling short. They might struggle with real-time updates (critical for detailed stock analysis), lack seamless integration into personal portfolios, or produce erratic visualizations that don’t accurately reflect the market’s volatility.

Enter WarrenAI.

This article discusses the features, advantages, and limitations of this cutting-edge AI platform. We’ll uncover why WarrenAI stands out for investors aiming to navigate complex market landscapes and meet their financial aspirations.

Brace yourself for a glimpse into the future of investing—a future that’s not only smarter and quicker, but also empowered by the innovative capabilities of WarrenAI.

Understanding AI in Investing

Investors now have access to a spectrum of AI technologies—from machine learning and natural language processing to predictive analytics. These tools sift through massive datasets, detect hidden patterns, and forecast market trends, enabling you to streamline your portfolio without drowning in endless information.

Why AI Matters for Investors

Investors can gain invaluable insights from market trends, economic indicators, and even sentiment analysis from news and social media.

By automating labor-intensive tasks, AI lightens the cognitive burden, so investors can zero-in on high-level, strategic decision-making to boost performance, manage risks, and stay ahead.

Key advantages of using AI include:

- Efficiency and Speed: AI processes enormous datasets significantly faster than any human, offering real-time insights that streamline decision-making.

- Predictive Capability: While no tool can perfectly forecast the market due to its inherent complexity, AI identifies patterns and trends, helping investors anticipate shifts and adjust their portfolios proactively.

- Precision in Data Processing: With its ability to analyze both structured and unstructured data—from financial reports to news articles and social media streams—AI uncovers actionable insights across diverse sources.

- Risk Management: By pinpointing potential risks and evaluating their impacts, AI helps to reduce losses and optimize returns.

Embracing AI not only empowers investors with data-driven insights but also refines the entire investment process, making it a crucial asset for those aiming to excel in increasingly short-arbitrage markets.

WarrenAI vs Gemini: At a Glance

| WarrenAI | Gemini | |

|---|---|---|

| Real-Time Training Data | Yes | 3-6 Month Lag |

| Asset Coverage | 195,0000 globally across all asset types (stocks, bonds, ETFs, crypto, Forex, etc.) | Limited |

| Investment Ideas | Yes | No (Only sector-specific ideas) |

| Financial Data | Enterprise-grade data (up to 1,200+ premium metrics) | Limited |

| Tools Integration | Screener, Watchlist, Portfolio & more | No |

| Technical Analysis | Yes | No |

| Charts | Yes | No |

| Premade Investment Prompts | Yes | No |

| Pricing | From $8.99 p/m | From $20 p/m |

AI Investment Tool Key Criteria

Our mission is to deliver unbiased insights that help investors navigate the complex landscape of stock market tech. For this reason, both tools are assessed using the same consistent criteria with a focus on clarity and fairness, ensuring you receive reliable information to make well-informed decisions.

Data Accuracy, Timeliness and Robustness

Investors depend on accurate, up-to-date information to fine-tune their strategies to match current market conditions and steer clear of costly mistakes. Relying on yesterday’s data for today’s decisions is like playing tupperware roulette with something at the back of your fridge. You might get lucky once in a while, but more often than not you’re going to regret that decision. Like leftovers, fresh data is best.

Ease of Use and Accessibility

Tools that are easy to navigate and feature user-friendly, intuitive designs let investors concentrate on analysis instead of wrestling with a steep learning curve. Plus, mobile-friendly interfaces and dedicated apps deliver immediate access to essential data, empowering informed decisions anytime, anywhere.

Analysis and Customization Features

Since every investor has unique needs, tools that offer the best robust analysis and customization allow users to tailor research to their specific goals and strategies. A clear, comprehensive analytical approach enhances decision-making—whether you’re starting fresh or refining priorities from an existing stock list. As markets and strategies evolve, a versatile tool stays relevant by adapting to new trends and investor preferences.

Cost and Value for Money

Beyond immediate affordability, it’s important to evaluate a tool’s lasting value. An effective tool should offer a reasonable cost, consistent accuracy, and valuable features, making it a wise long-term investment. The opportunity cost of a free option, in many cases, far (negatively) outweighs the monetary cost of a paid equivalent.

WarrenAI vs Gemini

Is using Gemini good for investors? What are the benefits of WarrenAI? This is where we’ll compare and contrast the background, history, features and benefits of these two tools alongside their respective pricing and plans.

Real Use-Cases

For investors wondering how to get started with using a chatbot AT for financial analysis, here’s an example of the same prompt used for WarrenAI and Gemini. I’m the user in both instances, so you can see how each tool seeks to find the relevant information before returning its information.

In both cases, I used the same, following prompt:

Analyze my dividend watchlist and suggest stocks to keep an eye on that might underperform over the next year, with a short summary of the logic used to make each suggestion. In a table format, create a list of the top 10 undervalued stocks by country and exchange. Add a column to the list that displays the sector/industry. Add a column of the potential upside as a percentage in relation to the current share price. Provide 3 bullet points with underlying data as to why each stock is valued as undervalued.

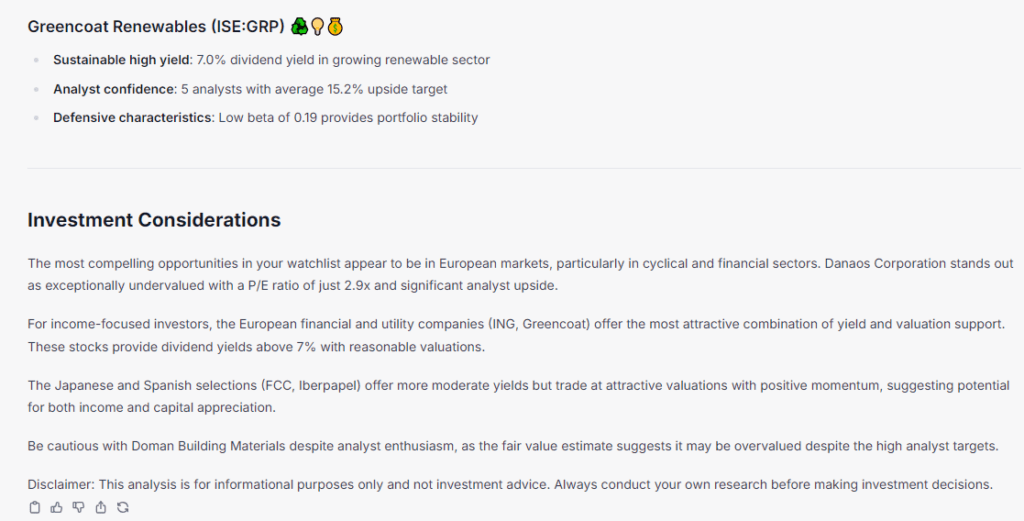

WarrenAI created the full table of ten stocks in my portfolio, then went on to explain why the stocks are undervalued (in a visual way that made the responses straightforward to read through), and even finished with a summary:

And here’s the full response to show how WarrenAI’s impressively robust and immediate understanding of the multi-step question.

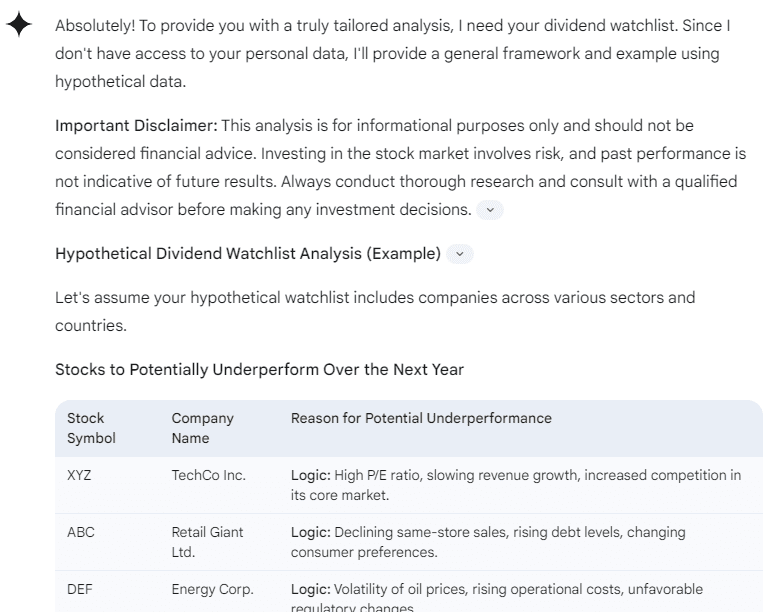

Gemini Stock Analysis Example Response

Gemini doesn’t have access to my watchlist as WarrenAI does (through InvestingPro), so there was an additional step to go through prior to receiving the information. Unlike Claude, Gemini acknowledged that it didn’t know about my list, but instead of asking for it, it instead decided to ‘fill in an example’.

Once it had the relevant information, the first section that Gemini returned was about potentially underperforming stocks:

The reasoning on the table focused on macro trends, which all seemed sensible (and in line with one another, as it basically picked out all construction-based stocks). It would have been nice to see some fundamentals in there, but at least it didn’t have any contradictory information as I’ve found with other chatbots. Next, it offered some undervalued stocks, with a disclaimer attached.

Unfortunately, it only offered an explanation of the points for Aperam, and none of the other stocks listed. This was again a shame, because the explanations were well-presented and understandable without any jargon.

Rather than an abrupt signoff, Gemini did offer a ‘next steps’ section, although its offer to help further was relegated to a ‘let me know’, rather than something more pro-active.

Background Information & History

WarrenAI

Company History: WarrenAI is part of Investing.com, a well-established financial platform founded in 2007. Over the years, Investing.com has grown to become one of the top financial websites globally, providing comprehensive market data, news, and analysis. WarrenAI is part of the platform’s premium extension, InvestingPro, which offers advanced, data-driven tools and cutting-edge AI insights for a wide range of investors.

Target Audience: The WarrenAI financial assistant platform combines live market data with algorithmic analysis, making it suitable for both self-directed traders who want to execute their own strategies and investors who prefer guided investment opportunities backed by quantitative research. Its comprehensive toolset accommodates various investment styles, from technical traders analyzing chart patterns to fundamental investors evaluating business metrics and valuation models. WarrenAI is designed for users requiring professional-grade tools to inform their investment decisions and trading strategies. This service particularly appeals to those who value data-driven investment recommendations without needing to perform extensive research themselves.

Gemini

Company History: Gemini AI is developed by Google DeepMind, a leading research division with a strong legacy in artificial intelligence innovation. Building on years of research and development, Gemini AI leverages the latest advancements in machine learning and large language model (LLM) technology. Launched as a next-generation platform that refines and expands upon earlier AI innovations, Gemini AI reflects Google’s commitment to integrating user feedback and real-world applications to deliver an even more powerful consumer experience.T

Target Audience: Gemini AI caters to a diverse spectrum of users, from everyday technology enthusiasts to corporate professionals seeking advanced AI capabilities. Its context-aware responses, natural language understanding, and cross-domain functionality make it an appealing tool for knowledge workers, content creators, educators, and businesses aiming to boost productivity through intelligent digital assistance.

Features Comparison

Let’s take a closer look at how the features of these two tools compare. We’ve organized them into three sections, making it easier for you to pinpoint the aspects that are most relevant to your daily needs.

WarrenAI

Data (Accuracy, Timeliness and Robustness)

- Exclusive, Live Market Information: WarrenAI taps into Investing.com’s premium, rigorously vetted financial data, spanning over 195,000 assets—from stocks and bonds to ETFs, crypto, Forex, and more. With its ongoing real-time updates, investors get immediate insights into market shifts as they happen.

- Expert Investment Insight: Crafted specifically for the investor community, WarrenAI mirrors the analytical depth of a seasoned Wall Street professional. It breaks down key factors like valuation, earnings, and macroeconomic trends, enabling users to make decisions with confidence.

- Instantaneous Financial Analysis: WarrenAI offers swift access to essential metrics, including P/E ratios, dividend yields, and earnings growth. Additionally, it provides comprehensive stock screening, concise summaries of financial news, and forward-looking analyst opinions, slashing research time from hours to minutes.

- A Decade of Historical Data: Not just focused on the present, WarrenAI integrates ten years of historical market data. This extensive backdrop aids in tracking long-term trends, evaluating company performance, and spotting patterns that may influence future investments.

- Automated, Insightful Charting: To prevent data overload, WarrenAI intelligently curates the most relevant financial charts based on user queries. Investors can also generate tailored line, area, or bar charts for a clearer visualization of market trends.

Usability & Interface

- Conversational, Intuitive AI: WarrenAI offers an intuitive chat interface that understands everyday language, so users of any experience level can ask financial questions without needing to learn technical jargon or complex commands.

- Investor-Focused Design: Built for both in-depth analysis and rapid market insights, the platform features a user-friendly desktop setup with customizable dashboards and streamlined navigation—prioritized to make financial research straightforward and efficient.

- Versatile Data Export for Smarter Workflows: Whether you need a brief snapshot of stock fundamentals or a detailed financial report, WarrenAI delivers tailored responses in multiple formats. Easily export essential data for offline analysis or to integrate into your own financial models.

Customization and Analysis

- Tailored Investment Guidance: WarrenAI monitors your portfolios, watchlists, and preferences to offer recommendations that are specifically relevant to you. By learning from previous interactions, it continuously refines its responses, ensuring a more personalized experience over time.

- Multilingual Support for Global Investors: Supporting over 26 languages, WarrenAI enables investors from around the world to access insights in their native language, enhancing confidence and ease when navigating international markets.

- In-Depth Analytical Insights: Rather than offering one-size-fits-all answers, WarrenAI delivers detailed, question-specific analyses—whether you’re assessing risk, comparing sectors, or pinpointing undervalued stocks, investors receive information that’s both precise and actionable.

- Access to Pro+ Premium Data: With more than 1,200 premium metrics available, investors gain a competitive edge by analyzing companies globally through robust, verified financial intelligence, leading to well-informed, data-driven decisions.

Gemini

Data (Accuracy, Timeliness, and Robustness)

- Web Search for Up-to-Date Information: Gemini has the ability to pull certain (but not all) data from the web in real time, ensuring investors get the most recent financial news, stock movements, and market insights. However, the training data set often sees lags of up to six months, meaning that investors should double-check anything particularly time-sensitive.

- Multi-Source Contextual Analysis: The tool uses information from various sources, summarizing financial news, earnings call transcripts, and expert analyses to provide a well-rounded view of market conditions.

- Historical and Predictive Insights: If data is delivered by the user, Gemini can process and analyze historical financial data to identify trends, compare past and present market conditions, and generate basic risk assessments based on historical performance.

Usability & Interface

- Natural Language Understanding: Investors can ask questions in plain English (or multiple languages) without needing to know specific financial jargon. The tool can interpret the intent and deliver responses based on its interpretation.

- Cross-Platform Integration: Gemini is accessible across desktop, mobile, and API integrations, allowing investors to use it within their preferred trading platforms or research tools.

- Customizable Outputs for Efficiency: Responses can be requested in different formats, such as bullet points, full reports, or exportable data.

Customization and Analysis

- Multi-Layered Analysis on Demand: Gemini can break down financial data into various analytical perspectives, from fundamental and technical analysis to sentiment analysis of news coverage.

- Industry and Asset-Specific Insights: Analysis can be refined to cater to specific industries, geographies, or asset classes.

Pricing & Plans

| InvestingPro (WarrenAI) | Gemini | |

|---|---|---|

| Free | Limited (10 lifetime messages) | Varies based on demand |

| Tier 1 | $13.99/month – 50 messages | $19.99/month – Limits change based on demand, query length and amount |

| Tier 2 | $31.49/month – 500 messages | Pay-As-You-Go – Limits change based on demand, query length and amount |

WarrenAI or Gemini? The Final Verdict

While Gemini excels as a general-purpose AI with natural language understanding and well-explained results reasoning, it lacks the real-time financial data, integrated market tools, and specialized investment intelligence that serious investors need. Gemini can assist with broad financial concepts, historical trends, and many stock evaluation frameworks, but its lack of live market data and dedicated investment screening tools makes it less effective for active decision-making. It does, however, create a good ‘starting point’ for investors who want to narrow down the scope and prioritize their own research.

WarrenAI, on the other hand, is purpose-built for investors, combining real-time financial metrics, expert-level analysis, and powerful screening tools into a single platform. With access to 72,000+ stocks and more than 195,000 total assets, 10 years of historical data, and automated fundamental charting, it provides the depth and timeliness that professional investors need. Whether it’s stock screening, technical analysis, or tracking global markets, WarrenAI offers a specialised edge that general AIs simply can’t match. For those serious about making data-driven investment decisions, WarrenAI is the clear choice.

How to Get Started with InvestingPro and WarrenAI

Learn More 📜

For the full (but simple) process on how to begin using InvestingPro and WarrenAI, take a look at our step-by-step guide on getting started with InvestingPro.

WarrenAI Finance Researcher FAQs

Q. How does WarrenAI work?

WarrenAI harnesses advanced AI, including similarity search and LLMs, to dissect complex market data and unearth vital insights. It equips investors with dependable real-time data, comprehensive metrics, the latest financial news, and analytics. The streamlined, ad-free experience, all underpinned by a solid infrastructure of investing APIs and up-to-date databases.

Q. How many companies can I ask about?

We support over 72,000+ companies, FX, Cryptos, ETFs, mutual funds, closed-end funds, REITs, and indices.

Q. What can I ask WarrenAI?

WarrenAI serves as your comprehensive investment companion, offering advanced capabilities including fundamental analysis, technical indicators, custom screening, AI watchlist monitoring, earnings call summaries, multi-asset comparisons, and Wall Street analyst insights – all powered by Investing.com’s premium data.

Q. When is data updated?

Data is continuously updated in real-time from the investing.com database.

Q. What is the source of WarrenAI’s stock market data?

WarrenAI’s stock market data is meticulously sourced from the InvestingPro premium database.

Q. Does WarrenAI offer technical analysis for stocks?

Yes, WarrenAI offers technical analysis to help users make informed decisions regarding stock investments.

Q. Can I try WarrenAI for free before subscribing?

Yes. Once registered for a free account, users get 10 messages to show the power and speed of WarrenAI.

Q. How much does WarrenAI cost?

WarrenAI is part of an InvestingPro subscription. Learn more about our pricing information on the InvestingPro Pricing page.

Q. Are there usage limits?

Free users get 10 messages to try the tool. InvestingPro users can send chat messages according to their plan’s set limits.