The investment world is continuously transforming, and recent years have witnessed an even more dramatic shift thanks to the rise of Artificial Intelligence. Gone are the days when investor instinct and recency bias ruled investment decisions; today, data-backed insights and predictive analytics pave the way for smarter decisions, and AI is at the forefront of this revolution.

Picture a tool that sifts through millions of data points in moments, unlocks early trends before they become widespread, and tailors investment approaches according to your unique risk profile, current holdings, and wishlists. This isn’t sci-fi – it’s the reality of AI-enhanced investing.

But many current AI solutions fall short. They often do not provide real-time data crucial for in-depth stock analysis, fail to seamlessly integrate with personalized portfolios, and frequently display unstable charting outputs (which can be as unpredictable as the market itself).

But the game is changing.

Enter WarrenAI.

This article will explain what makes WarrenAI a standout in the world of okay-ish AI-driven investment tools. We’ll examine its strengths, explore its limitations, and explain why it could be the ultimate partner for investors aiming to stay ahead in the market and reach their financial targets.

Prepare to experience an evolved era of investing – one that’s quicker, more intuitive, and revolutionized by WarrenAI.

How Does AI Help Investors?

In investing, there’s a broad spectrum of AI technologies, including machine learning, natural language processing, and predictive analytics. These AI applications are designed to process enormous datasets, uncover hidden patterns, and forecast trends – all with the aim of enhancing investment strategies while reducing the information overload that many investors face.

Why AI Is A Game-Changer for Investors

Investors stand to benefit immensely from the insights provided by AI—from spotting market trends and gauging economic indicators to analyzing sentiment derived from news and social media.

By automating labor-intensive tasks, AI lightens the load, allowing investors to concentrate on high-level strategy, enhancing performance, managing risks, and staying one step ahead.

Some of the primary advantages of using AI in the investment arena include:

- Speed and Efficiency: AI can digest and evaluate massive datasets at lightning speeds, delivering real-time insights that cut down the time required to make smart decisions.

- Enhanced Predictive Power: While it’s impossible to know exactly what will happen to the stock market in the future, AI can detect patterns and trends that allow investors to foresee market shifts and adjust their portfolios proactively.

- Accurate Data Processing: AI excels at filtering through both structured and unstructured data, drawing actionable insights from various sources like financial statements, news releases, and social media chatter.

- Improved Risk Management: These systems are adept at spotting potential risks and evaluating their impact, aiding investors to minimize losses and optimize returns.

Using AI strategically not only results in more informed, data-driven decisions but also streamlines the overall investment process. As the market evolves, a robust AI tool can be a key asset in achieving long-term investment success.

WarrenAI Vs. Claude: At a Glance

| WarrenAI | Claude | |

|---|---|---|

| Real-Time Training Data | Yes | 1-3 Month Lag |

| Asset Coverage | 195,0000 globally across all asset types (stocks, bonds, ETFs, crypto, Forex, etc.) | Limited |

| Investment Ideas | Yes | No (Only sector-specific ideas) |

| Financial Data | Enterprise-grade data (up to 1,200+ premium metrics) | Limited |

| Tools Integration | Screener, Watchlist, Portfolio & more | No |

| Technical Analysis | Yes | No |

| Charts | Yes | No |

| Premade Investment Prompts | Yes | No |

| Pricing | From $8.99 p/m | From $18 p/m |

AI Investment Tool Evaluation Criteria

Our method for assessing these AI tools for investors is designed to be transparent and objective. We aim to deliver impartial, practical information that helps investors navigate the vast array of available stock market solutions. Both AI tools featured here have been analyzed based on a uniform set of standards, ensuring consistency and clarity across both evaluations.

Accuracy / Timeliness and Robustness of Data

Reliable information helps investors align their strategies with the latest market conditions, minimizing the risk of mistakes. Relying on old data to make important investment decisions is like betting on a horse based on how it ran a year ago. Maybe you’ll get lucky, but more often than not the poor animal has started to run out of steam and gets pipped to the post by a younger, faster competitor. That’s why real-time information will always be king when it comes to investing.

Ease of Use and Accessibility

The most effective tools are designed to be intuitive and user-friendly, so investors can concentrate on analyzing the market rather than struggling with a steep learning curve. With mobile-optimized interfaces and dedicated applications, you can access critical information on the go, empowering you to make informed decisions whenever and wherever you need them.

Analysis and Customization Features

Every investor has unique requirements, so it’s essential that a tool offers in-depth analysis and customization to align with individual goals and strategies. A clear, thorough approach not only supports decision-making for investors building their portfolios from the ground up, but also for those refining a pre-existing list of stocks. Moreover, as market conditions and investment strategies shift, having a flexible tool that evolves with new trends and investor needs is crucial to stay relevant.

Cost and Value for Money

Beyond just the upfront costs, it’s crucial to assess a tool’s potential long-term value. A well-designed tool should strike the right balance—combining affordability with consistent accuracy and a suite of useful features—to serve as a sound long-term investment. In many cases, the hidden opportunity costs of choosing a free option can significantly surpass the modest expense of a paid alternative.

WarrenAI vs Claude

Is Claude AI good for investors? What are the benefits of WarrenAI? This is where we’ll compare and contrast the background, history, features and benefits of these two tools alongside their respective pricing and plans.

Real-Use Cases

For those curious about getting started, here’s an example of the same prompt I used with both WarrenAI and Claude. As the user in both cases, you’ll see how each tool searches for the relevant information before delivering its response.

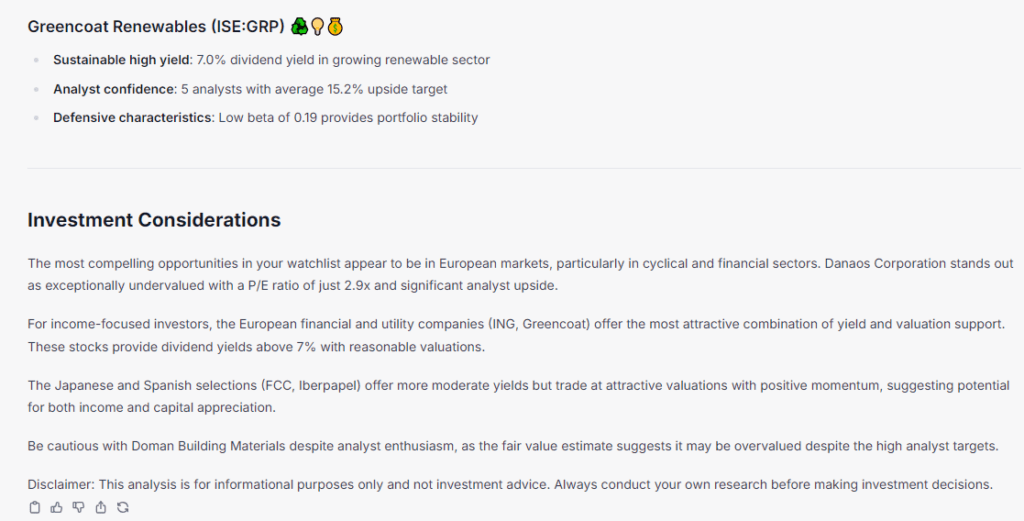

WarrenAI created the full table of ten stocks in my portfolio, then went on to explain why the stocks are undervalued (in a visual way that made the responses straightforward to read through), and even finished with a summary:

And here’s the full response to show how WarrenAI’s impressively robust and immediate understanding of the multi-step question.

Claude Stock Analysis Example

Claude doesn’t have access to my watchlist as WarrenAI does (through InvestingPro), so there was an additional step to go through prior to receiving the information – although at first it ‘forgot’ that it didn’t have the relevant information and began to create a list of random dividend stocks:

The first section that Claude returned was about potentially underperforming stocks, and it was nice to see the option to export direct into a Google Sheet:

Interestingly, the table of undervalued stocks also included Doman, which was one of the ‘potential underperformers’. While the table did include some reasoning, it didn’t have the actual numbers to back up what it was saying (and as a minor point, trying to view the whole table was frustrating, even on a laptop).

I was pleased to see that Claude didn’t end the conversation abruptly. Instead it offered some insight into how it decided on the table, and then asked a relevant follow-up query.

Background Information & History

WarrenAI

Company History: WarrenAI is part of Investing.com, a well-established financial platform founded in 2007. Over the years, Investing.com has grown to become one of the top financial websites globally, providing comprehensive market data, news, and analysis. WarrenAI is part of the platform’s premium extension, InvestingPro, which offers advanced, data-driven tools and cutting-edge AI insights for a wide range of investors.

Target Audience: The WarrenAI platform seamlessly integrates real-time market data with sophisticated algorithmic analysis. This approach makes it an excellent choice not only for self-directed traders executing independent strategies but also for investors who prefer investment opportunities guided by quantitative research. Its wide-ranging toolset supports various investment approaches—from technical traders who rely on chart pattern insights to fundamental investors who focus on business metrics and valuation models. Designed with professional-grade capabilities, WarrenAI caters to users looking for robust tools to support their investment decisions and trading strategies. It is particularly appealing to those who appreciate data-driven recommendations without the need for manual exhaustive research.

Claude

Company History: Claude is the flagship conversational AI from Anthropic, an organization founded in 2020 by experts dedicated to advancing safe and reliable AI technologies. Born from a commitment to ethical AI development, Claude builds on years of research into large language models and robust safety protocols, emerging as one of Anthropic’s most notable consumer-facing innovations.

Target Audience: Claude caters to a diverse user base, ranging from casual users seeking intelligent conversational support to enterprise professionals in need of dependable AI-enhanced productivity tools. With its nuanced context understanding and articulate, multifaceted responses, Claude is especially attractive to content creators, educators, researchers, and businesses looking to harness AI for streamlined decision-making and creative problem-solving.

Features Comparison

Let’s focus more on the differences (or similarities) in features for these two tools. We’ve organized the highlights into three sections, making it easier for you to identify the functionalities that best meet your everyday needs.

WarrenAI

Data (Accuracy, Timeliness and Robustness)

- Exclusive, Real-Time Market Data: WarrenAI taps into Investing.com’s premium, rigorously vetted financial data that spans more than 195,000 assets—including stocks, bonds, ETFs, cryptocurrencies, Forex, and more. This continuous stream of real-time updates ensures investors are always in sync with the latest market movements.

- Investment Intelligence with Expert-Level Analysis: Tailored specifically for investors, WarrenAI isn’t a one-size-fits-all tool. It mirrors the insights of a seasoned Wall Street analyst by delivering structured assessments on valuations, earnings, and macroeconomic trends, empowering users to make well-informed decisions.

- Comprehensive Financial Analysis in Seconds: With WarrenAI, investors gain immediate access to crucial financial indicators like P/E ratios, dividend yields, and earnings growth. Moreover, it streamlines research through features like stock screening, concise financial news summaries, and analyst outlooks, dramatically reducing research time.

- A Decade of Historical Market Data: WarrenAI goes beyond current market insights by incorporating a decade of historical data, allowing users to track long-term trends, evaluate company performance, and uncover patterns that may influence future investments.

- Automated Fundamental Charting: To help cut through the complexity of raw data, WarrenAI intelligently selects the most relevant financial charts in response to your queries. Additionally, you can request specific visualizations—whether line, area, or bar charts—to effectively analyze market trends.

Usability & Interface

- Conversational, Intuitive AI: WarrenAI offers a natural-language chat interface that makes it easy for users of every background to ask financial questions in plain English—no need to worry about technical jargon or complicated commands.

- Optimised for Investors: Designed to cater to both detailed analysis and swift market insights, the platform features an intuitive desktop layout with customizable dashboards, smooth navigation, and an easy-to-use interface that streamlines financial research.

- Flexible Data Export for Smarter Workflows: Whether users need a brief overview of stock fundamentals or a detailed financial report, WarrenAI delivers tailored responses in multiple formats. This flexibility allows investors to export essential data for offline analysis or seamlessly integrate it into their own financial models.

Customization and Analysis

- Personalised Investment Insights: WarrenAI monitors user preferences, portfolios, and watchlists to deliver highly targeted recommendations. By taking past interactions into account, it continuously refines its insights, ensuring a progressively tailored user experience.

- Multilingual AI Assistance for Global Investors: Supporting over 26 languages, WarrenAI offers insights in your native tongue, empowering international investors to navigate global markets with ease and enhanced confidence.

- Advanced Analytical Insights: Instead of providing one-size-fits-all answers, WarrenAI delivers deep, question-specific analysis. Whether you’re evaluating risk, comparing performance across sectors, or identifying undervalued stocks, WarrenAI’s insights will be strategic and thorough.

- Access to Pro+ for Premium Market Data: WarrenAI gives investors an edge with over 1,200 premium metrics, offering comprehensive insights into companies across global markets. This robust (real-time!) data ensures that your investment decisions are firmly rooted in reliable financial intelligence.

Claude

Data (Accuracy, Timeliness, and Robustness)

- Web Search for Up-to-Date Information: Claude is equipped to pull certain data from the web in real time, ensuring investors receive recent financial news, stock movements, and market insights. However, the training data set often lags between 1-3 months, meaning that investors should double-check anything particularly time-sensitive.

- Multi-Source Contextual Analysis: By aggregating information from diverse outlets—such as financial news reports, earnings call transcripts, and expert analyses—Claude can deliver a comprehensive view of market dynamics.

- Historical and Predictive Insights: When users provide historical financial data, Claude can analyze it to identify trends, compare past performance with current conditions, and generate informed risk assessments.

Usability & Interface

- Natural Language Understanding: Investors can ask questions in plain English (or multiple languages) without needing to know specific financial jargon. The tool can interpret the intent and deliver responses based on its interpretation.

- Cross-Platform Integration: Claude is designed for accessibility across desktop, mobile, and API integrations, letting investors incorporate its capabilities within their preferred trading platforms and research tools.

- Customizable Outputs for Efficiency: Responses can be returned in different formats, such as bullet points, full reports, or exportable data.

Customization and Analysis

- Multi-Layered Analysis on Demand – Claude can break down financial data into various analytical perspectives, from fundamental and technical analysis to sentiment analysis of news coverage.

- Industry and Asset-Specific Insights: Analysis can be refined to cater to specific industries, geographies, or asset classes.

Pricing & Plans

| InvestingPro (WarrenAI) | Claude | |

|---|---|---|

| Free | Limited (10 lifetime messages) | 45 /5 hours (Varies based on demand, query length and amount) |

| Tier 1 | $13.99/month – 50 messages | $18/month – 5x (may change based on demand, query length and amount) |

| Tier 2 | $31.49/month – 500 messages | $25/month – Unlimited messages (may change based on demand, query length and amount) |

WarrenAI or Claude? The Final Verdict

While Claude excels at natural language understanding and the ability to ask relevant follow-up questions, enhancing the dialogue and helping users drill down into specific topics, this feature comes with caveats. Users need to be cautious of veering off track into rabbit holes, which might quickly use up message limits. Moreover, Claude’s handling of documents can be frustrating—its desktop interface makes viewing them challenging without having first downloaded them. As a result, Claude can provide broad financial insights and engaging conversation, but is unable to offer integrated financial tools and specialised investment intelligence that active traders demand.

WarrenAI, on the other hand, is purpose-built for investors. It combines real-time financial metrics, expert-level analysis, and powerful screening tools into a single platform. With access to over 72,000 stocks, more than 195,000 total assets, 10 years of historical data, and automated fundamental charting, WarrenAI delivers the depth and precision professional investors need. Whether it’s stock screening, technical analysis, or tracking global market movements, WarrenAI offers a specialized edge that general conversational AIs simply can’t match—making it the clear choice for data-driven investment decisions.

How to Get Started with InvestingPro and WarrenAI

Learn More 📜

For the full (but simple) process on how to begin using InvestingPro and WarrenAI, take a look at our step-by-step guide on getting started with InvestingPro.

WarrenAI Finance Researcher FAQs

Q. How does WarrenAI work?

WarrenAI harnesses advanced AI, including similarity search and LLMs, to dissect complex market data and unearth vital insights. It equips investors with dependable real-time data, comprehensive metrics, the latest financial news, and analytics. The streamlined, ad-free experience, all underpinned by a solid infrastructure of investing APIs and up-to-date databases.

Q. How many companies can I ask about?

We support over 72,000+ companies, FX, Cryptos, ETFs, mutual funds, closed-end funds, REITs, and indices.

Q. What can I ask WarrenAI?

WarrenAI serves as your comprehensive investment companion, offering advanced capabilities including fundamental analysis, technical indicators, custom screening, AI watchlist monitoring, earnings call summaries, multi-asset comparisons, and Wall Street analyst insights – all powered by Investing.com’s premium data.

Q. When is data updated?

Data is continuously updated in real-time from the investing.com database.

Q. What is the source of WarrenAI’s stock market data?

WarrenAI’s stock market data is meticulously sourced from the InvestingPro premium database.

Q. Does WarrenAI offer technical analysis for stocks?

Yes, WarrenAI offers technical analysis to help users make informed decisions regarding stock investments.

Q. Can I try WarrenAI for free before subscribing?

Yes. Once registered for a free account, users get 10 messages to show the power and speed of WarrenAI.

Q. How much does WarrenAI cost?

WarrenAI is part of an InvestingPro subscription. Learn more about our pricing information on the InvestingPro Pricing page.

Q. Are there usage limits?

Free users get 10 messages to try the tool. InvestingPro users can send chat messages according to their plan’s set limits.