The investment landscape is constantly evolving, and the past few years have seen a seismic shift driven by the increasing power of Artificial Intelligence. Forget gut feelings and anecdotal evidence; the future of successful investing hinges on data-driven insights and predictive analytics without getting overwhelmed, and AI is leading the charge.

Imagine having the ability to analyze millions of data points in seconds, identify emerging trends before they hit the mainstream, and personalize investment strategies based on your individual risk tolerance and even your current portfolio and wishlist. This isn’t science fiction; it’s the promise of AI-powered investing.

But despite the excitement, many AI tools aren’t up to the task. They lack real-time data (essential for robust stock analysis), can’t be integrated into personal portfolios, and their chart representation is often wobbly at best (and not just because of price volatility!).

But that’s all changing.

Thanks to WarrenAI.

This article will explore the capabilities, strengths, and weaknesses of this new leading AI platform, identifying why WarrenAI is poised to be the best AI companion for investors looking to navigate the market and achieve their financial goals.

Get ready to discover the future of investing – it’s smarter, faster, and powered by WarrenAI.

Understanding AI in Investing

In investing, the AI technologies used can vary widely and include machine learning, natural language processing, and predictive analytics. AI is leveraged to analyze vast amounts of data, identify patterns, and make predictions that help investors optimize their portfolios without getting so overwhelmed by the constant barrage of information.

Why AI Matters for Investors

Investors can gain invaluable insights from market trends, economic indicators, and even sentiment analysis from news and social media.

By automating the more labor-intensive processes, AI reduces the cognitive load on investors, allowing them to focus on strategic decision-making to enhance performance, manage risks and stay ahead of the game.

Here are some of the key benefits of using AI for investors:

- Efficiency and Speed: AI can process and analyze large datasets much faster than any human, enabling real-time insights and reducing the time needed to make informed decisions.

- Predictive Capability: Although predicting the market is impossible thanks to the many variables, by identifying patterns and trends, AI systems help investors to anticipate market shifts and make proactive adjustments to their portfolios.

- Precision in Data Processing: The ability to sift through unstructured and structured data means AI can extract actionable insights from diverse sources, including financial reports, news articles, and social media feeds.

- Risk Management: AI tools can aid in identifying potential risks and assessing their implications, helping investors to mitigate losses and optimize returns.

The strategic use of AI allows investors to not only make data-driven decisions but also to streamline their investment processes. As the market continues to evolve, having a robust AI tool can be a significant differentiator in achieving investment success.

WarrenAI vs ChatGPT: At a Glance

| WarrenAI | ChatGPT | |

|---|---|---|

| Real-Time Training Data | Yes | 3-6 Month Lag |

| Asset Coverage | 195,0000 globally across all asset types (stocks, bonds, ETFs, crypto, Forex, etc.) | Limited |

| Investment Ideas | Yes | No (Only sector-specific ideas) |

| Financial Data | Enterprise-grade data (up to 1,200+ premium metrics) | Limited |

| Tools Integration | Screener, Watchlist, Portfolio & more | No |

| Technical Analysis | Yes | No |

| Charts | Yes | No |

| Premade Investment Prompts | Yes | No |

| Pricing | From $8.99 p/m | From $20 p/m |

AI Investment Tool Key Criteria

Our approach to ranking these AI tools for investors is all about keeping things clear and fair. Our goal is to provide unbiased and useful information that investors can rely on to make sense of the overwhelming array of stock market tools. Every AI tool featured below has been evaluated using the same consistent criteria.

Accuracy / Timeliness and Robustness of Data

Reliable information helps investors align their strategies with the latest market conditions, minimizing the risk of missteps. Relying on old data to make important investment decisions is like dressing for whatever the weather was a month ago. Maybe you’ll get lucky but, more often than not, the clouds have sailed and you’re left wearing your winter boots in the middle of a heat-wave. That’s why current information will always be king when it comes to investing.

Ease of Use and Accessibility

Tools that are easy to navigate and have intuitive, user-friendly designs mean investors can focus on analysis without getting frustrated by the learning curve of understanding a new tool. In addition, mobile-friendly interfaces and dedicated apps allow for making informed decisions anytime, anywhere, thanks to immediate access to vital information.

Analysis and Customization Features

Since every investor’s needs are different, tools that offer robust analysis and customization allow users to tailor their research to fit their specific goals and strategies. A logical and comprehensive analysis method also facilitates better decision-making – both when starting from scratch or understanding priorities from a pre-selected stock list. As markets and strategies evolve, a versatile tool remains relevant and adapts to new trends and investor preferences.

Cost and Value for Money

Beyond immediate affordability, it’s important to evaluate a tool’s lasting value. An effective tool should offer a reasonable cost, consistent accuracy, and valuable features, making it a wise long-term investment. The opportunity cost of a free option, in many cases, far (negatively) outweighs the monetary cost of a paid equivalent.

WarrenAI vs ChatGPT Pro

Is ChatGPT good for investors? What are the benefits of WarrenAI? This is where we’ll compare and contrast the background, history, features and benefits of these two tools alongside their respective pricing and plans.

Real Use-Cases

For readers wondering how to get started, below is an example of the same prompt used for the WarrenAI and ChatGPT. I’m the user in both instances, so you can see how each tool seeks to find the relevant information before returning its suggestions.

In both cases, I used the same, following prompt:

Analyze my dividend watchlist and suggest stocks to keep an eye on that might underperform over the next year, with a short summary of the logic used to make each suggestion. In a table format, create a list of the top 10 undervalued stocks by country and exchange. Add a column to the list that displays the sector/industry. Add a column of the potential upside as a percentage in relation to the current share price. Provide 3 bullet points with underlying data as to why each stock is valued as undervalued.

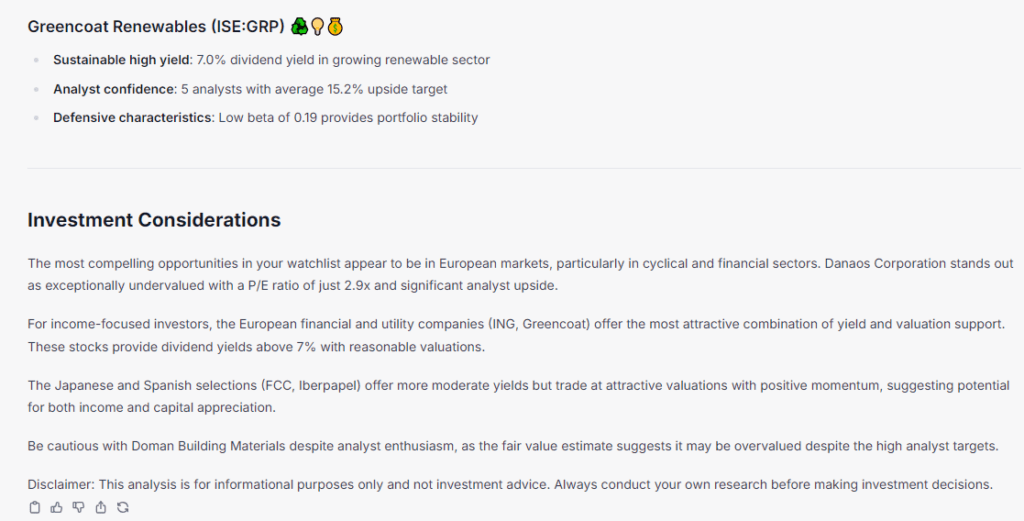

WarrenAI created the full table of ten stocks in my portfolio, then went on to explain why the stocks are undervalued (in a visual way that made the responses straightforward to read through), and even finished with a summary:

And here’s the full response to show how WarrenAI’s impressively robust and immediate understanding of the multi-step question.

ChatGPT Stock Analysis Example Response

ChatGPT doesn’t have access to my watchlist as WarrenAI does (through InvestingPro), so there was an additional step to go through prior to receiving the information:

The first section that ChatGPT returned was about potentially underperforming stocks:

Interestingly, the table of undervalued stocks also included Mapfre, which was one of the ‘potential underperformers’. As you can see, this is where the conversation ends. While the table did include some reasoning, it didn’t have the actual numbers to back up what it was saying.

Clicking the ‘sources’ button did show a list of external sites, but no direct-from-source (e.g. all 3rd party). This isn’t inherently an issue, but it does show that investors need to perform their own due dilligence with each analysis to ensure they’re correct (making them a good starting point, but not trustworthy enough to stand on their own).

Background Information & History

WarrenAI

Company History: WarrenAI is part of Investing.com, a well-established financial platform founded in 2007. Over the years, Investing.com has grown to become one of the top financial websites globally, providing comprehensive market data, news, and analysis. WarrenAI is part of the platform’s premium extension, InvestingPro, which offers advanced, data-driven tools and cutting-edge AI insights for a wide range of investors.

Target Audience: The WarrenAI financial assistant platform combines real-time market data with algorithmic analysis, making it suitable for both self-directed traders who want to execute their own strategies and investors who prefer guided investment opportunities backed by quantitative research. Its comprehensive toolset accommodates various investment styles, from technical traders analyzing chart patterns to fundamental investors evaluating business metrics and valuation models. WarrenAI is designed for users requiring professional-grade tools to inform their investment decisions and trading strategies. This service particularly appeals to those who value data-driven investment recommendations without needing to perform extensive research themselves.

ChatGPT

Company History: ChatGPT is developed by OpenAI, a research laboratory founded in December 2015. Initially established as a non-profit organization with a $1 billion pledge, OpenAI later restructured in 2019 to include a for-profit entity. ChatGPT, launched in November 2022, represents one of OpenAI’s most successful consumer-facing applications of its large language model technology, building upon earlier iterations like GPT-3 and incorporating user feedback to refine its capabilities.

Target Audience: ChatGPT serves a diverse user base ranging from casual consumers to enterprise professionals seeking AI-powered conversational assistance. With its ability to understand context, generate human-like responses, and perform tasks across multiple domains, ChatGPT appeals particularly to knowledge workers, content creators, educators, and businesses looking to enhance productivity through AI assistance.

Features Comparison

WarrenAI

Data (Accuracy, Timeliness and Robustness)

- Exclusive, Real-Time Market Data: WarrenAI leverages Investing.com’s premium, vetted financial data, covering over 195,0000 assets (across stocks, bonds, ETFs, crypto, Forex, etc.)—including global stocks, ETFs, and cryptocurrencies. By continuously pulling real-time information, it ensures investors receive the latest market movements without delays.

- Investment Intelligence with Expert-Level Analysis: Unlike general-purpose AI models, WarrenAI is built specifically for investors, mirroring the expertise of a Wall Street analyst. It provides structured insights into valuation, earnings, and macroeconomic trends, helping users make well-informed decisions.

- Comprehensive Financial Analysis in Seconds: Investors can instantly access key metrics such as P/E ratios, dividend yields, and earnings growth. WarrenAI also provides stock screening, summarises financial news, and delivers analyst outlooks—cutting down research time from hours to minutes.

- 10 Years of Historical Market Data: WarrenAI doesn’t just focus on the present—it incorporates a decade’s worth of historical data to track long-term trends, assess company performance, and identify patterns that might impact future investments.

- Automated Fundamental Charting: To reduce raw data overwhelm, WarrenAI intelligently selects the most relevant financial charts based on user queries. Users can also request specific line, area, or bar charts to visualise trends more effectively.

Usability & Interface

- Conversational, Intuitive AI: WarrenAI provides a seamless, natural-language chat experience, allowing users of all experience levels to ask financial questions in plain English—no technical jargon or complex commands required.

- Optimised for Investors: The platform is designed for both deep analysis and quick market insights. An intuitive desktop setup includes custom dashboards, streamlined navigation, and an easy-to-use interface that makes financial research more efficient.

- Flexible Data Export for Smarter Workflows: Whether users need a quick snapshot of stock fundamentals or a full financial report, WarrenAI allows for tailored responses in multiple formats. Investors can export key data for offline analysis or integration into their own financial models.

Customization and Analysis

- Personalised Investment Insights: WarrenAI tracks user preferences, portfolios, and watchlists to deliver highly relevant recommendations. It also considers past interactions, refining responses for a more tailored experience over time.

- Multilingual AI Assistance for Global Investors: With support for 26+ languages, WarrenAI enables international investors to receive insights in their native language, making it easier to navigate global markets with confidence.

- Advanced Analytical Insights: Instead of generic responses, WarrenAI provides in-depth, question-specific analysis—whether it’s evaluating risk, comparing sector performance, or identifying undervalued stocks.

- Access to Pro+ for Premium Market Data: Investors gain deeper insights with over 1,200 premium metrics, offering a competitive edge when analysing companies across global markets. This ensures robust, data-driven investment decisions with verified financial intelligence.

ChatGPT

Data (Accuracy, Timeliness, and Robustness)

- Web Search for Up-to-Date Information: ChatGPT has the ability to pull certain (but not all) data from the web in real time, ensuring investors get the most recent financial news, stock movements, and market insights.

- Multi-Source Contextual Analysis: Uses information from various sources, summarizing financial news, earnings call transcripts, and expert analyses to provide a well-rounded view of market conditions.

- Historical and Predictive Insights: If data is delivered by the user, ChatGPT can process and analyze historical financial data to identify trends, compare past and present market conditions, and generate risk assessments based on historical performance.

Usability & Interface

- Natural Language Understanding: Investors can ask questions in plain English (or multiple languages) without needing to know specific financial jargon. The tool can interpret the intent and deliver responses based on its interpretation.

- Cross-Platform Integration: ChatGPT is accessible across desktop, mobile, and API integrations, allowing investors to use it within their preferred trading platforms or research tools.

- Customizable Outputs for Efficiency: Responses can be returned in different formats, such as bullet points, full reports, or exportable data.

Customization and Analysis

- Multi-Layered Analysis on Demand – ChatGPT can break down financial data into various analytical perspectives, from fundamental and technical analysis to sentiment analysis of news coverage.

- Industry and Asset-Specific Insights: Analysis can be refined to cater to specific industries, geographies, or asset classes.

Pricing & Plans

| InvestingPro (WarrenAI) | ChatGPT | |

|---|---|---|

| Free | Limited (10 lifetime messages) | Varies based on demand |

| Tier 1 | $13.99/month – 50 messages | $20/month – 80 messages /3 hours (may change based on demand) |

| Tier 2 | $31.49/month – 500 messages | $200/month – Unlimited messages (may change based on demand) |

WarrenAI or ChatGPT? The Final Verdict

While ChatGPT excels as a general-purpose AI with strong analytical capabilities and natural language understanding, it lacks the real-time financial data, integrated market tools, and specialised investment intelligence that serious investors require. ChatGPT can assist with broad financial concepts, historical trends, and many stock evaluation frameworks, but its lack of live market data and dedicated investment screening tools makes it less effective for active decision-making.

WarrenAI, on the other hand, is purpose-built for investors, combining real-time financial metrics, expert-level analysis, and powerful screening tools into a single platform. With access to 72,000+ stocks and more than 195,000 total assets, 10 years of historical data, and automated fundamental charting, it provides the depth and timeliness that professional investors need. Whether it’s stock screening, technical analysis, or tracking global markets, WarrenAI offers a specialised edge that general AIs simply can’t match. For those serious about making data-driven investment decisions, WarrenAI is the clear choice.

How to Get Started with InvestingPro and WarrenAI

Learn More 📜

For the full (but simple) process on how to begin using InvestingPro and WarrenAI, take a look at our step-by-step guide on getting started with InvestingPro.

WarrenAI Finance Researcher FAQs

Q. How does WarrenAI work?

WarrenAI harnesses advanced AI, including similarity search and LLMs, to dissect complex market data and unearth vital insights. It equips investors with dependable real-time data, comprehensive metrics, the latest financial news, and analytics. The streamlined, ad-free experience, all underpinned by a solid infrastructure of investing APIs and up-to-date databases.

Q. How many companies can I ask about?

We support over 72,000+ companies, FX, Cryptos, ETFs, mutual funds, closed-end funds, REITs, and indices.

Q. What can I ask WarrenAI?

WarrenAI serves as your comprehensive investment companion, offering advanced capabilities including fundamental analysis, technical indicators, custom screening, AI watchlist monitoring, earnings call summaries, multi-asset comparisons, and Wall Street analyst insights – all powered by Investing.com’s premium data.

Q. When is data updated?

Data is continuously updated in real-time from the investing.com database.

Q. What is the source of WarrenAI’s stock market data?

WarrenAI’s stock market data is meticulously sourced from the InvestingPro premium database.

Q. Does WarrenAI offer technical analysis for stocks?

Yes, WarrenAI offers technical analysis to help users make informed decisions regarding stock investments.

Q. Can I try WarrenAI for free before subscribing?

Yes. Once registered for a free account, users get 10 messages to show the power and speed of WarrenAI.

Q. How much does WarrenAI cost?

WarrenAI is part of an InvestingPro subscription. Learn more about our pricing information on the InvestingPro Pricing page.

Q. Are there usage limits?

Free users get 10 messages to try the tool. InvestingPro users can send chat messages according to their plan’s set limits.