Investing in stocks involves looking at many different numbers and ratios to understand a company’s value and future potential. One of the most useful tools for this is the PEG ratio. Unlike simpler metrics, which only show a company’s current value, the PEG ratio also takes into account how much a company is expected to grow in the future.

This article is designed to be your go-to guide for understanding everything about the PEG ratio—how to calculate it, what it tells you, and its pros and cons. Whether you’re an experienced investor or just getting started, this guide aims to help you make smarter investment choices by fully understanding the PEG ratio.

What is the PEG Ratio?

The Price/Earnings-to-Growth (PEG) ratio is an advanced financial metric that enhances the traditional Price-to-Earnings (P/E) ratio by incorporating a company’s expected earnings growth rate.

While the P/E ratio provides a snapshot of a stock’s current valuation, the PEG ratio adds a forward-looking dimension. This allows investors to evaluate a stock’s value not just in terms of current earnings but also in the context of future growth prospects.

What is the PEG Ratio formula?

Understanding the PEG ratio begins with its formula, which is elegantly simple yet profoundly informative.

Here, the P/E Ratio represents how much investors are willing to pay for each dollar of earnings. The Earnings Growth Rate, typically expressed as a percentage, predicts how fast the company’s earnings are expected to grow.

How to Calculate PEG Ratio?

Calculating the PEG ratio may seem like a simple equation, but the accuracy of the data you use is extremely important. Let’s break it down:

Step 1: Determine the P/E Ratio

The Price-to-Earnings (P/E) ratio serves as the first essential component of the PEG ratio. This metric is widely available on financial news websites, investment platforms, and even within the ticker details on stock trading apps. If you prefer a hands-on approach, you can calculate the P/E ratio manually using the formula:

Stock Price: The current trading price of the stock, available from Investing.com or directly from the stock exchange.

Earnings Per Share (EPS): This data point is usually reported in a company’s quarterly or annual financial statements and represents the earnings allocated to each outstanding share of common stock.

Step 2: Obtain the Earnings Growth Rate

The second component is the Earnings Growth Rate, which adds a forward-looking dimension to the PEG ratio. This rate is generally expressed as an annual percentage and can be found in a company’s financial statements, analyst reports, or investor relations websites.

Importantly, ensure that the Earnings Growth Rate corresponds to the same time period as the EPS used in the P/E ratio calculation for consistency.

Step 3: Calculate PEG Ratio

The final step involves combining the P/E ratio and the Earnings Growth Rate using the PEG ratio formula we looked at previously:

Simply divide the P/E ratio by the Earnings Growth Rate to arrive at the PEG ratio.

Example Calculation of PEG Ratio

Let us consider a scenario, where company A has the following information:

- Stock Price: $100

- Earnings Per Share (EPS): $5

- Projected Annual Earnings Growth Rate: 25%

Step 1: Calculate the P/E Ratio

The Price-to-Earnings (P/E) ratio is calculated using the formula:

P/E = Stock Price / Earnings Per Share (EPS)

P/E = 100 / 5 = 20

Step 2: Apply the PEG Ratio Formula

The PEG ratio formula is:

PEG = P/E Ratio / Earnings Growth Rate (%)

PEG = 20 / 25 = 0.8

Interpretation:

- A PEG ratio of 0.8 indicates that the stock may be undervalued relative to its growth potential.

- Since a PEG ratio below 1 is generally considered favorable, this stock could be an attractive investment opportunity for growth-oriented investors.

This example shows how the PEG ratio offers a more nuanced perspective than the P/E ratio alone, as it factors in future growth projections to assess a stock’s true value.

Why is PEG Ratio Important?

The PEG ratio is a versatile tool that extends its utility beyond numerical evaluation. It offers investors vital clues about the intrinsic value of companies, the comparative attractiveness of different investments, and the prevailing trends in the stock market.

Firstly, the PEG ratio is a powerful resource for identifying companies that may be undervalued or overvalued. This is particularly beneficial for investors seeking growth opportunities while mitigating risks. For example, a company with a low PEG ratio could represent an undervalued investment opportunity with strong future growth potential.

Secondly, the metric is a common yardstick for comparing stocks within the same sector or industry. This uniformity in measurement enables investors to make well-informed choices by focusing on companies that offer the most promising future profitability.

Finally, the PEG ratio can provide valuable insights into broader market sentiment. A high average PEG ratio across a particular sector or the market as a whole may indicate either widespread investor optimism or a cautionary signal of an overheated market.

How to Interpret PEG Ratio?

Interpreting the PEG ratio involves understanding how the stock price compares to its earnings growth potential. It offers a more balanced view than the P/E ratio alone, as it incorporates the future growth rate into the valuation. Here’s a deeper dive into interpreting the PEG ratio:

PEG < 1: Undervalued Stock

A PEG ratio below 1 suggests that the stock is trading at a lower price than what its growth potential justifies. Essentially, the stock is underpriced in relation to its earnings growth. This scenario may represent a buying opportunity for investors looking for growth stocks at an attractive price.

For example, if a company is growing its earnings by 20% annually and has a P/E ratio of 10, its PEG ratio will be 0.5 (P/E of 10 ÷ 20% growth). This low PEG ratio indicates that the stock is undervalued relative to its strong growth prospects.

PEG = 1: Fairly Valued Stock

A PEG ratio of 1 indicates that the stock’s price is aligned with its earnings growth rate. In other words, investors are paying a price that accurately reflects the expected future growth of the company. This suggests that the stock is fairly valued.

If a company’s P/E ratio is equal to its projected earnings growth rate, the PEG ratio will equal 1. For instance, if the P/E ratio is 15 and the company is expected to grow earnings at 15% annually, the PEG ratio will be 1, signaling a balanced valuation.

PEG > 1: Overvalued Stock

A PEG ratio above 1 suggests that the stock is trading at a higher price relative to its growth potential, potentially indicating overvaluation. This could mean that the stock is too expensive for the growth rate it is expected to achieve. Investors should exercise caution and assess whether the premium price is justified by the company’s future performance.

For example, a company with a P/E ratio of 25 and an earnings growth rate of 10% will have a PEG ratio of 2.5. This implies that the stock may be overpriced relative to its earnings growth, and investors might consider other opportunities with a better value proposition.

What is a Good PEG Ratio?

Determining a ‘good’ PEG ratio involves considering factors such as industry norms, prevailing market conditions, and investment goals.

While a PEG ratio of 1 is often considered ideal, what qualifies as a “good” PEG ratio can vary by industry and market conditions. For example, fast-growing sectors like technology may justify a higher PEG ratio due to higher expected growth rates, while industries with lower growth potential, like utilities, may have lower PEG ratios.

Investors should also consider other factors, such as the company’s debt levels, competitive position, and overall economic conditions, in addition to the PEG ratio, before making an investment decision.

PEG Ratio Limitations

While the PEG ratio offers valuable insights into a stock’s worth relative to its growth, it has its limitations.

- Growth Rate Assumptions: The PEG ratio depends on future growth projections, which are uncertain and subject to change. If actual growth falls short of expectations, the ratio may misrepresent a stock’s value, leading to potentially flawed investment decisions.

- Ignores Qualitative Factors: The PEG ratio is based purely on numbers and doesn’t account for qualitative factors such as company leadership, brand strength, or industry dynamics. These elements can greatly influence long-term success but are not reflected in the ratio.

- Limited for Mature Companies: For mature companies with stable earnings but low growth rates, the PEG ratio can be misleading. It may incorrectly suggest overvaluation, while the company’s consistent profitability and dividend history may make it a valuable investment.

- Short-Term Focus: The PEG ratio often relies on short-term earnings growth projections, which can fluctuate significantly. This short-term focus may overlook a company’s long-term prospects, leading to an incomplete picture of its true value.

- Industry Variability: The PEG ratio can vary widely across industries, making cross-industry comparisons problematic. A high PEG in one sector may be justified, while the same ratio in another sector may indicate overvaluation, complicating direct comparisons.

How to Find PEG Ratio?

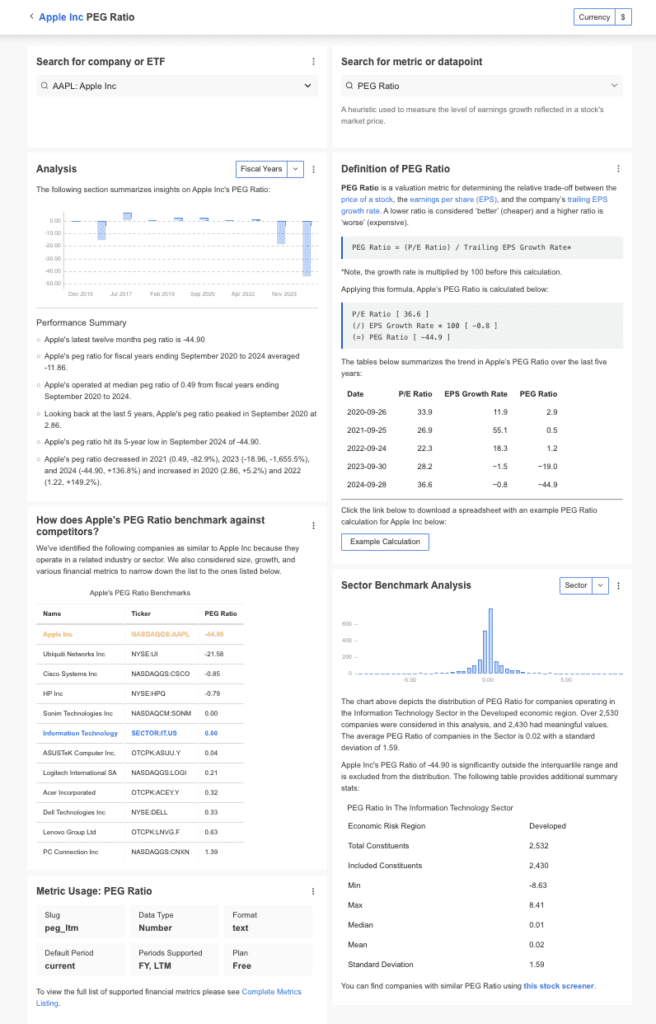

InvestingPro offers detailed insights into companies’ PEG Ratio including sector benchmarks and competitor analysis.

InvestingPro+: Access PEG Ratio Data Instantly

Unlock Premium Data With InvestingPro 📈💸

Gain instant access to PEG ratio data within the InvestingPro platform. Plus:

✓ Access to 1200+ additional fundamental metrics

✓ Competitor comparison tools

✓ Evaluate stocks with 14+ proven financial models

Wrapping Up

Navigating the investment landscape often involves sifting through a multitude of metrics to find those that truly offer valuable insights. The PEG ratio emerges as a particularly useful tool in this context, enhancing traditional valuation metrics like the P/E ratio by incorporating future growth prospects. While it provides invaluable perspectives on a stock’s intrinsic value and the broader market trends, it’s not without limitations, particularly its dependency on future earnings projections.

Therefore, while the PEG ratio can guide you in the right direction on your investment journey, it should be used in harmony with a range of other financial metrics and qualitative analyses for a comprehensive investment strategy. This balanced approach is essential for making well-informed and, ideally, more profitable investment decisions in a complex market teeming with data.

PEG Ratio FAQs

Is the PEG Ratio applicable to all types of stocks?

The PEG ratio is generally more useful for evaluating growth stocks. It may not be as effective for value or cyclical stocks, which might have lower or even negative growth rates.

How frequently should I update my PEG ratio calculations?

Given that the PEG ratio relies on future earnings projections, it’s advisable to update your calculations whenever there is a significant change in those projections or when new quarterly or annual reports are released.

How does the PEG ratio compare to other valuation metrics like the Price-to-Book (P/B) ratio?

Unlike the P/B ratio, which focuses on a company’s book value, the PEG ratio offers a more dynamic view by factoring in future earnings growth. Both metrics have their uses, but the PEG ratio can provide a more forward-looking assessment.

Can the PEG ratio help in portfolio diversification?

While this ratio primarily helps evaluate individual stocks, its insights can also guide you in diversifying your portfolio. For example, a mix of stocks with low and fairly-valued PEG ratios could add balance to your investments.

What limitations should I be aware of?

The PEG ratio is highly dependent on accurate future earnings growth projections, which can be uncertain. Also, it may not be suitable for companies with negative earnings or industries with cyclical growth patterns.

Is a PEG ratio of less than 1 always a ‘Buy’ signal?

Not necessarily. A PEG ratio below 1 indicates the stock might be undervalued, but it should not be the sole determinant for buying a stock. Always consider other metrics and market conditions.