What is Ending Cash?

Ending Cash represents the amount of cash a company has on hand at the conclusion of a specific accounting period, such as a month, quarter, or fiscal year. It reflects the company’s liquidity, indicating whether it has enough cash reserves to meet short-term obligations, fund operations, or invest in future opportunities. It is a key component of the cash flow statement, summarizing how cash inflows and outflows impact a company’s financial position.

How to Calculate Ending Cash?

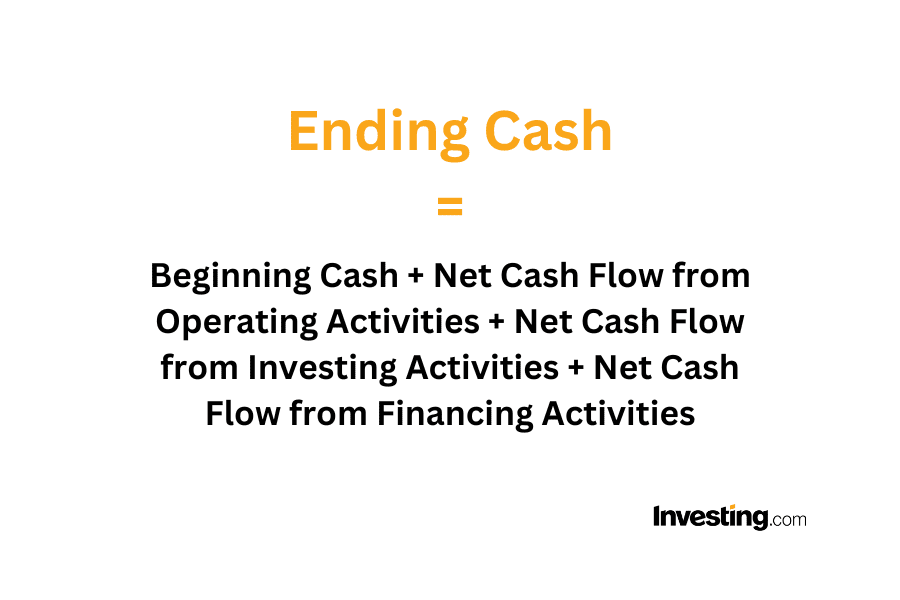

Calculating Ending Cash is straightforward if you have a clear understanding of a company’s cash flow components. Here’s the formula:

Ending Cash = Beginning Cash + Net Cash Flow from Operating Activities + Net Cash Flow from Investing Activities + Net Cash Flow from Financing Activities

Components Explained:

- Beginning Cash: The cash balance at the start of the accounting period. This serves as the baseline for calculating Ending Cash.

- Net Cash Flow from Operating Activities: Cash generated or used in the company’s primary business activities, such as sales revenue and operational expenses.

- Net Cash Flow from Investing Activities: Cash spent or earned from investments, including the purchase or sale of assets.

- Net Cash Flow from Financing Activities: Cash received or paid from financing operations, such as issuing shares, taking loans, or repaying debt.

This formula is typically presented in the cash flow statement, providing a detailed reconciliation of a company’s cash movements over the period.

Example Calculation of Ending Cash

Consider a company ABC Corporation is a mid-sized business with the following cash flow details for the quarter:

- Beginning Cash: $25,000

- Net Cash Flow from Operating Activities: $45,000

- Net Cash Flow from Investing Activities: -$20,000 (a negative value indicates cash outflow for investments such as purchasing equipment)

- Net Cash Flow from Financing Activities: -$10,000 (a negative value indicates cash outflows for repaying loans or issuing dividends)

Ending Cash = Beginning Cash + Net Cash Flow from Operating Activities + Net Cash Flow from Investing Activities + Net Cash Flow from Financing Activities

Ending Cash = 25,000 + 45,000 − 20,000 − 10,000 = 40,000

ABC Corporation’s Ending Cash for the quarter is $40,000.

The Ending Cash figure of $40,000 indicates that after all operational, investing, and financing activities, ABC Corporation has sufficient liquidity to manage its obligations or fund future operations.

Key Observations:

- A positive Ending Cash suggests strong liquidity, despite cash outflows from investments and financing.

- ABC Corporation appears to prioritize operational efficiency, as seen in the substantial cash inflow from operating activities.

- The company should assess whether the investment activities and debt repayment align with its long-term financial goals.

Why is Ending Cash Important?

Ending Cash is a vital indicator that serves as a snapshot of a company’s financial stability. It not only shows how well a company manages its cash but also provides valuable insights into its operational efficiency, financing decisions, and investment strategies. Here are the key reasons why it matters:

- Liquidity Assessment: It determines whether a company can meet its short-term obligations, such as payroll, supplier payments, or interest expenses.

- Operational Stability: A healthy Ending Cash balance ensures smooth day-to-day operations without the need for urgent borrowing.

- Investment Capacity: Companies with robust cash reserves can seize growth opportunities, such as acquisitions, product development, or market expansion.

- Financial Flexibility: Adequate cash reserves provide a cushion during economic downturns or unexpected expenses, enhancing resilience.

- Investor Confidence: A strong cash position reassures investors about a company’s ability to sustain growth and weather challenges.

How to Interpret Ending Cash?

Interpreting Ending Cash requires analyzing it in the context of the company’s operations, industry, and financial strategy:

- High Ending Cash: Indicates strong liquidity and financial stability. However, excessively high cash reserves may suggest underutilized resources that could be invested for growth.

- Low Ending Cash: Reflects potential liquidity challenges, but it could also signify strategic reinvestment in growth-oriented activities.

- Negative Ending Cash: A red flag signaling poor cash management, operational inefficiencies, or excessive reliance on credit.

Key Considerations

- Compare Ending Cash to short-term liabilities to assess liquidity.

- Analyze trends over time to identify improvements or deteriorations in cash management.

- Benchmark against industry peers to evaluate competitive standing.

What is a Good Ending Cash?

A “good” Ending Cash balance depends on the company’s size, industry, and operational requirements:

- Small Businesses: Should maintain cash reserves covering at least 3-6 months of operating expenses.

- Large Corporations: Often aim for higher reserves to manage complex operations and investment needs.

- Industry-Specific Norms: For example, capital-intensive industries like manufacturing may require larger cash buffers than service-based sectors.

Ultimately, a good Ending Cash balance strikes a balance between liquidity, operational efficiency, and investment capability.

What are the Limitations of Ending Cash?

While Ending Cash is an essential metric, it has its limitations:

- Snapshot in Time: It reflects the cash position only at a specific moment, not the fluctuations throughout the period.

- Doesn’t Reflect Profitability: A company can have high Ending Cash but still be unprofitable if it relies heavily on debt or asset sales.

- Ignores Non-Cash Assets: It doesn’t account for other liquid assets, such as receivables or inventory, which also contribute to liquidity.

- Subject to Seasonal Variations: Seasonal businesses may show significant cash swings that don’t reflect overall performance.

- Dependent on Context: Ending Cash must be analyzed alongside other metrics, such as net income, cash flow ratios, and operational data, to form a complete financial picture.

How to Find Ending Cash?

InvestingPro offers detailed insights into companies’ Ending Cash including sector benchmarks and competitor analysis.

InvestingPro+: Access Ending Cash Data Instantly

Unlock Premium Data With InvestingPro 📈💸

Gain instant access to Ending Cash data within the InvestingPro platform

🛠 Access to 1200+ additional fundamental metrics

🔍 Competitor comparison tools

📊 Evaluate stocks with 14+ proven financial models

Ending Cash FAQ

How is Ending Cash different from net income?

Ending Cash reflects liquidity, while net income measures profitability. A company can have high net income but low Ending Cash due to poor cash flow management.

Can Ending Cash be negative?

Yes, negative Ending Cash indicates cash deficits, often due to excessive expenses or insufficient inflows during the period.

How can a company improve its Ending Cash?

Strategies include optimizing receivables, controlling expenses, renegotiating supplier terms, and managing debt effectively.

Is Ending Cash the same as cash flow?

No, Ending Cash is a cumulative figure at the end of a period, while cash flow represents the movement of cash during that period.

Why do investors care about Ending Cash?

Ending Cash signals a company’s ability to sustain operations, invest in growth, and weather financial challenges, making it a critical factor for investment decisions.