What is Asset Turnover

Asset turnover is a crucial financial metric used to assess a company’s efficiency in generating revenue from its assets. It measures how effectively a company utilizes its assets to generate sales. In simpler terms, it shows how many dollars of revenue a company generates for each dollar invested in its assets.

How to Calculate Asset Turnover

The formula for calculating asset turnover is straightforward:

Asset Turnover = Net Sales ÷ Average Total Assets

Where:

- Net Sales refers to the total revenue generated by the company after deducting sales returns, allowances, and discounts.

- Average Total Assets represents the average value of a company’s assets over a specific period, typically the beginning and ending balances of the period divided by 2.

Example Calculation of Asset Turnover

Let’s consider a fictional company, ABC Corp, with net sales of $1,000,000 and average total assets of $500,000.

Asset Turnover = $1,000,000 ÷ $500,000 = $2

This means that for every dollar invested in assets, ABC Corp generates $2 in sales.

Why is Asset Turnover Important?

Asset turnover is vital for several reasons:

- Efficiency Analysis: It indicates how efficiently a company utilizes its assets to generate sales. Higher asset turnover ratios generally indicate better efficiency.

- Comparison: It allows for comparisons between companies in the same industry or a company’s performance over time. A higher asset turnover ratio may indicate a more competitive business model.

- Identifying Operational Issues: A declining asset turnover ratio may signal operational inefficiencies or underutilized assets, prompting management to investigate and make improvements.

Limitations of Asset Turnover

While asset turnover is a valuable metric, it does have limitations:

- Industry Differences: Industries with different business models may have naturally different asset turnover ratios, making comparisons across industries less meaningful.

- Quality of Assets: Asset turnover does not consider the quality of assets. A company might have high turnover due to low-quality, inexpensive assets, which may not necessarily be a positive indicator.

- Inflation Effects: Changes in the value of assets due to inflation can affect the accuracy of asset turnover calculations over time.

How to Find Asset Turnover

Asset turnover can be found in a company’s financial statements, specifically the income statement and balance sheet. Net sales are typically reported on the income statement, while total assets can be found on the balance sheet.

For advanced asset turnover, the InvestingPro platform provides:

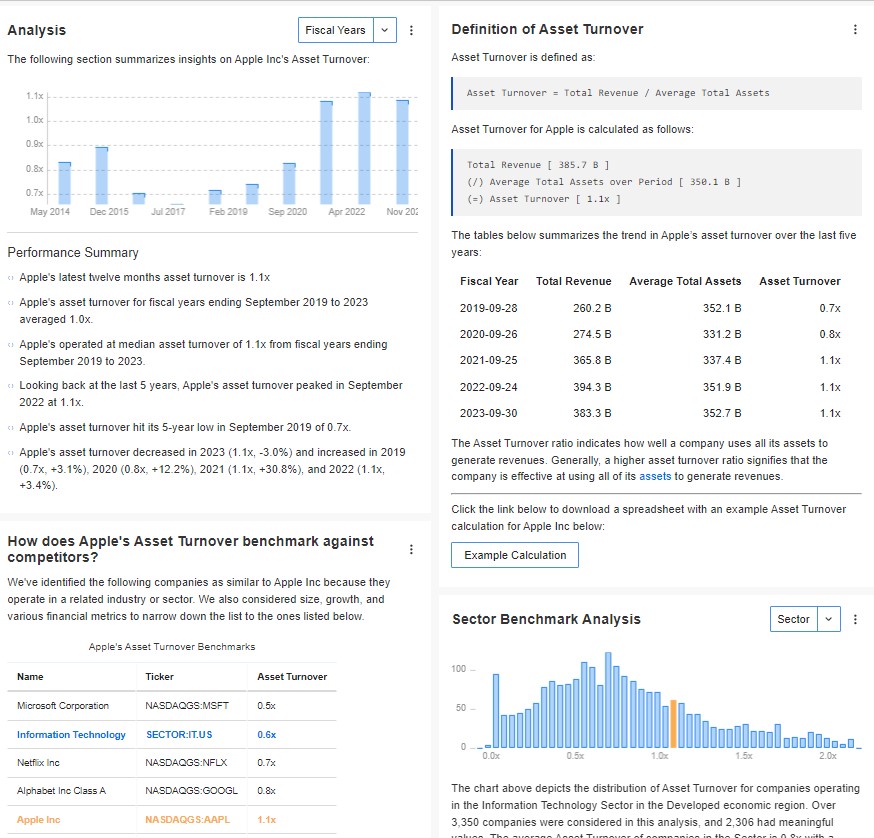

Benchmark Against Competitors: InvestingPro allows users to compare a company’s asset turnover ratio with its competitors in the same industry. This comparison offers insights into how efficiently a company utilizes its assets relative to its peers.

Benchmark Analysis: Users can conduct benchmark analysis to evaluate a company’s asset turnover performance over time. By comparing current asset turnover ratios with historical data or industry averages, investors can identify trends and assess whether the company’s efficiency is improving or declining.

What is a Good Asset Turnover

The ideal asset turnover ratio varies by industry and business model. Generally, a higher ratio is better, indicating that a company efficiently utilizes its assets to generate revenue. However, what constitutes a “good” ratio depends on factors like industry norms, company size, and specific business strategies.

Unlock Premium Data With InvestingPro 📈💸

Gain instant access to price to sales ratio data within the InvestingPro platform. Plus:

✓ Access to 1200+ additional fundamental metrics

✓ Competitor comparison tools

✓ Evaluate stocks with 14+ proven financial models

Asset Turnover FAQs

Q. Can asset turnover be too high?

Yes, excessively high asset turnover may indicate that a company is too aggressive in managing its assets, potentially sacrificing long-term growth or quality for short-term gains.

Q. How often should asset turnover be calculated?

Asset turnover can be calculated quarterly, annually, or over any desired period. It’s essential to use consistent timeframes for accurate comparisons.

Q. What if a company has negative asset turnover?

Negative asset turnover indicates that a company’s sales are less than its average total assets. This is a rare scenario and typically indicates serious operational issues or accounting errors.