What is Accrued Interest Payable?

Accrued interest payable is the amount of interest that a borrower owes on a loan or debt but has not yet paid. This financial obligation is recorded on the company’s balance sheet as a liability because it represents an amount due to the lender. It typically arises when loans or bonds carry an interest rate, and the interest accumulates over time but is not paid until the end of a specified period, such as a month, quarter, or year.

This concept is vital for ensuring accurate financial reporting, as it reflects the company’s actual financial position and obligations at a given time. Accrued interest payable is commonly seen in businesses that issue bonds or take out loans and must account for periodic interest payments.

How to Calculate Accrued Interest Payable?

The calculation of accrued interest payable requires knowing the loan or bond’s principal amount, the annual interest rate, and the period over which the interest has accrued.

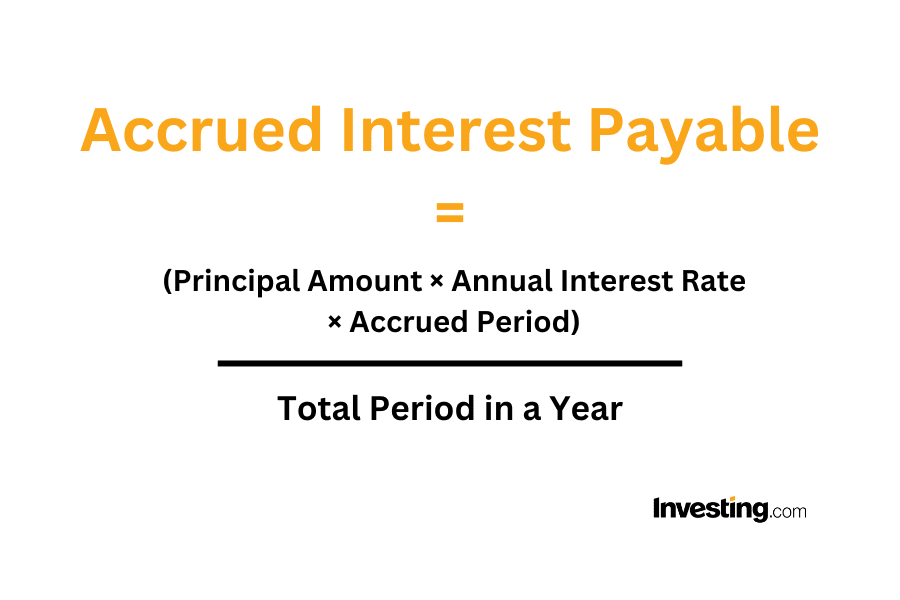

Formula for Accrued Interest Payable:

Accrued Interest Payable = Principal Amount × Annual Interest Rate × Accrued Period / Total Period in a Year

Here’s what the components mean:

- Principal Amount: The initial amount borrowed or the face value of the bond.

- Annual Interest Rate: The rate at which interest accrues annually, expressed as a percentage.

- Accrued Period: The time elapsed since the last interest payment or since the loan was issued.

- Total Period in a Year: The number of periods in a year (typically 365 days or 360 days for finance calculations).

Example Calculation of Accrued Interest Payable

Consider that a company issues a bond with the following details:

- Principal Amount (Face Value): $500,000

- Annual Interest Rate: 8% (0.08 in decimal form)

- Payment Frequency: Semi-annual (interest paid twice a year)

- Accrued Period: 4 months since the last payment

The task is to calculate the accrued interest payable for the 4-month period.

The formula for accrued interest payable is:

Accrued Interest Payable = Principal Amount × Annual Interest Rate × Accrued Period / Total Period in a Year

Accrued Interest Payable = 500,000 × 0.08 × 4/12 = 13,333.33

The accrued interest payable after 4 months is $13,333.33. This amount will appear as a liability on the company’s balance sheet until the next scheduled payment is made.

Why is Accrued Interest Payable Important?

Accrued interest payable plays a crucial role in financial management and reporting, providing insight into a company’s financial obligations and ensuring compliance with accounting standards. Below, we explore the key reasons why this metric is significant for businesses, investors, and lenders.

Accurate Financial Reporting

Accrued interest payable ensures that financial statements reflect the company’s true obligations. Omitting accrued interest would understate liabilities and distort net income. It avoids understating liabilities, which can otherwise give a false sense of profitability, along with helping stakeholders assess the company’s obligations with greater precision.

Compliance with Accounting Standards

Modern accounting frameworks, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), mandate the recognition of accrued expenses, including interest. Recording accrued interest payable is essential for meeting these standards and avoiding potential regulatory issues.

Transparency for Investors and Lenders

Recording accrued interest payable provides transparency to investors, creditors, and other stakeholders. This clarity allows them to make informed decisions about the company’s financial stability and risk profile.

How It Helps Stakeholders:

- Investors: Assess the company’s ability to manage debt and generate sufficient cash flow.

- Lenders: Evaluate whether the company can meet its interest obligations on time.

- Management: Monitor liabilities to maintain financial discipline and plan for future payments.

Cash Flow Management

Accrued interest payable is a critical tool for effective cash flow planning. By understanding how much interest has accrued and when it is due, businesses can allocate resources to ensure timely payments without disrupting operations.

Enhances Debt Management

Accrued interest payable acts as an early indicator of the company’s growing financial obligations. By monitoring this liability, businesses can take proactive steps to manage their debt, such as refinancing or renegotiating terms.

How to Interpret Accrued Interest Payable?

Accrued interest payable can indicate various aspects of a company’s financial management:

High Accrued Interest Payable

A significant amount may suggest that a company has substantial debt or has delayed interest payments. This could be a red flag if the company lacks sufficient cash flow to cover its obligations.

Low Accrued Interest Payable

A low balance often indicates that the company is actively paying its interest obligations on time or has minimal debt exposure.

Key Consideration: The interpretation of accrued interest payable must account for the company’s debt structure, payment schedule, and liquidity position. Comparing the figure to industry peers and historical trends provides better context.

What Is a Good Accrued Interest Payable?

A ‘good’ accrued interest payable depends on the context of the company’s financial operations. Here’s how to determine whether the figure is reasonable:

- Alignment with Debt Obligations: A good accrued interest payable aligns with the company’s expected interest payments based on its loan agreements or bond terms.

- Manageable Proportion of Liabilities: The accrued interest should be a manageable percentage of total liabilities, ensuring the company has sufficient resources to meet its obligations.

- Consistent Payment Schedule: Companies that maintain a predictable schedule of interest payments typically have accrued interest that aligns with their cash flow management.

Limitations of Accrued Interest Payable

While accrued interest payable is a critical metric, it has certain limitations:

- Limited Insight Into Debt Levels: It reflects only the unpaid interest and not the total debt or principal amount, which may provide a more comprehensive view of financial risk.

- Ignores Interest Type Variations: The metric does not differentiate between fixed and variable interest rates, which can influence future obligations.

- Potential Misinterpretation: A high accrued interest figure might not always indicate financial trouble. For example, it could result from a temporary delay in payment or a planned payment cycle.

- Dependent on Accurate Reporting: Errors in recording interest payments or miscalculations can distort the accrued interest payable figure, leading to flawed financial analysis.

How to Find Accrued Interest Payable?

InvestingPro offers detailed insights into companies’ Accrued Interest Payable including sector benchmarks and competitor analysis.

InvestingPro: Access Accrued Interest Payable Data Instantly

Unlock Premium Data With InvestingPro 📈💸

Gain instant access to Accrued Interest Payable data within the InvestingPro platform

🛠 Access to 1200+ additional fundamental metrics

🔍 Competitor comparison tools

📊 Evaluate stocks with 14+ proven financial models

Accrued Interest Payable FAQ

Is accrued interest payable a liability?

Yes, it is recorded as a current liability on the balance sheet because it represents an obligation the company must settle in the near term.

How often is accrued interest payable recorded?

It is typically recorded at the end of each accounting period, such as monthly, quarterly, or annually, depending on the company’s reporting practices.

Does accrued interest payable include principal repayments?

No, it only accounts for unpaid interest. Principal repayments are classified separately as part of the loan or bond liability.

What happens if accrued interest payable is not paid on time?

Delays in payment can result in penalties, damage the company’s credit rating, and increase the overall cost of borrowing.

Can accrued interest payable be zero?

Yes, if the company has recently made an interest payment or has no outstanding interest obligations, the accrued interest payable could be zero.