The post-election market run has been accompanied by improving economic data and increasing confidence. The result has the punditry asking a question that seemed crazy in January:

Will the Dow hit 20K?

Before reading this week’s installment, “Sherman, set the WABAC machine to” mid-year, 2010. The Dow was at 10K and many famous pundits were predicting a fall to 5000. In order to appreciate the psychology of the time, please read my post and especially the comments at Seeking Alpha. You will see some very colorful criticisms of my work! You will enjoy a few good laughs. I’ll comment more on this below, but it is a great place to start.

Last Week

Once again, last week’s calendar of economic news was nearly all good, supporting the market gains.

Theme Recap

In my last WTWA (two weeks ago), I predicted a period of stronger economic news and the possibility of a more positive market reaction. This is what has happened, but most commentators still are not emphasizing the main theme. It is not all about the Fed.

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. He captures the continuing rally and the move to new highs.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis grounded in data and several more charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something very positive. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

This week’s news was quite good—almost all positive. I make objective calls, which means not stretching to achieve a false balance. If I missed something for the “bad” list, please feel free to suggest it in the comments.

The Good

- Rail traffic finally scores a slight positive. Steven Hansen provides the current data, as well as the more negative long-term perspective.

- Senate passes stopgap funding. This is not getting a lot of attention, but it is a big shift from the past eight years, especially 2011, when the last correction came for this very reason. (The Hill).

- OPEC reached a production limit agreement. Whether this will attract cooperation from non-OPEC countries is open to question. We might also ask whether a floor under energy prices is a positive. That said, the oil price/stock correlation has been a factor since the energy collapse. Months ago, I suggested that we were entering a sweet spot for oil pricing. The OPEC participants see a cap of about $60/barrel, which makes sense.

- Jobless claims down ticked, and remain near all-time lows. See Calculated Risk for the story and charts.

- Productivity rose over 3%.

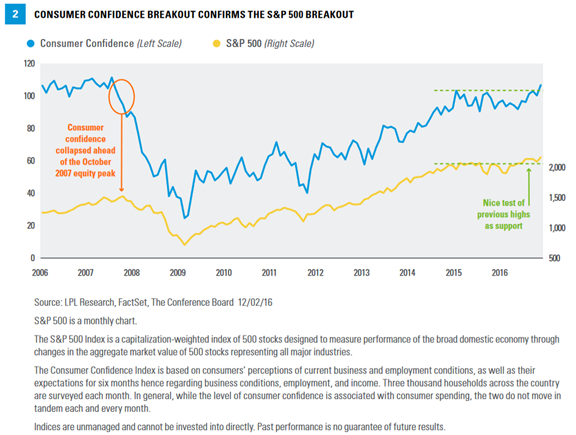

- Michigan sentiment spiked to 98 on the preliminary estimate. LPL shows why this is important.

- Borrowers continue to move out of negative equity on their homes. 384K in Q3 (Calculated Risk).

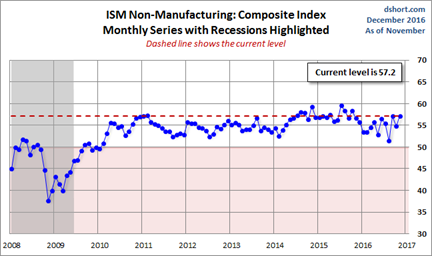

- ISM non-manufacturing strengthened to 57.2. Doug Short has the story and this chart:

- Factory orders gained 2.7%.

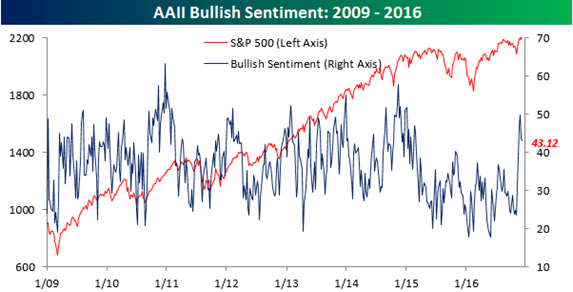

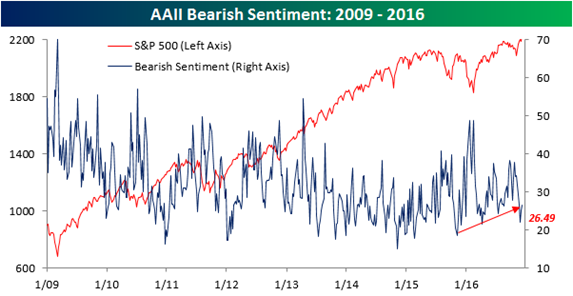

- Sentiment remains neutral to negative which is a short-term positive on a contrarian basis. Bespoke notes that Individual Investors are Still Not on the Bus:

The Bad

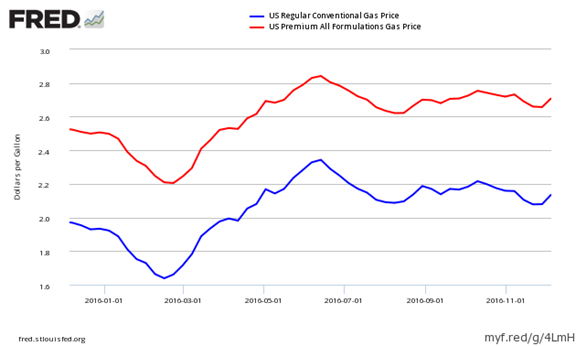

- Gas prices rose over five cents. (GEI).

- Interest rate components of long leading indicators are weakening. (New Deal Democrat). This is mostly a positive story, but the long-term interest effects are worth watching. NDD’s report of high frequency indicators is a regular read for me, and should be for other frequent traders.

The Ugly

Secret outside influence on U.S. elections. Foreign countries frequently have an interest in the most important elections. There is nothing new or unusual about that. Voters can weigh the opinions and arguments in the same way they use other information. Actions that are secret are another matter, especially when following the “dirty tricks” approach.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week, but opportunities abound and nominations are welcome!

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a big week for data.

The “A” List

- FOMC rate decision (W). An increase is widely expected. The statement and Yellen’s press conference may yield hints about next year.

- Housing starts and building permits (F). Softening pace expected in this important sector.

- Retail sales (W). November data following a very strong October.

- Industrial production (W). Any improvement in this economic weak spot?

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- PPI (W). Interest in inflation measures is increasing, but prices are not.

- CPI (Th). See PPI above. Eventually these will be important.

- Philly Fed (Th). The first look at December data is expected to be positive.

- Business inventories (W). Significant for Q4 GDP, but little change is expected.

- Crude inventories (W). Recently showing even more impact on oil prices. Rightly or wrongly, that spills over to stocks.

With the FOMC meeting at mid-week, FedSpeak is on mute. Expect plenty more news on possible Trump policies.

Next Week’s Theme

The strong data continues, as does the market rise. We still do not see a reflection in forward earnings, but the earnings recession has ended. The Fed is about to raise rates, and no one cares. It is not all about the Fed, and more are learning that. As the market hits new highs, including a big round number on the Dow, the focus this week will be on DOW 20K.

In my 2010 articles I tried to emphasize the right focus for investors. Too many were paralyzed by fear from the frequent disaster predictions. Their upside risk was huge. This section was crucial:

Asking the Right Questions

The bias is inherent in the situation. The problems are known. If you write for a major publication, you are rewarded for analyzing the negativity. If you go on TV, you are expected to parrot the analysis of problems. This makes you seem smart.

By contrast, the solutions are vague and unknown. If you even talk about them, all the “hot shots” are skeptical.

That should be your clue to pay attention. Repeating the known news does not make you money. Try asking these questions:

What if unemployment falls to 8%?

What if the annual budget deficit is reduced?

What if housing prices and sales show a clear bottom?

What if mortgage rates remain low?

What if politicians negotiate a compromise on tax increases?

What if Europe stabilizes?

What if China and other emerging countries resume a solid growth path?

What if earnings for US companies continue to surge, leaving the 10-year trailing earnings in the dust?

What if the US rationalizes immigration?

If you have not thought about these possibilities, you have a fixation on negativity. My Dow 20K concept is designed to set you free — to get you thinking about the long sweep of history and the potential for success. If even a few of these things happen, what would be the market reaction?

This list of worries seems so old….

Two years later the New York Times ran a story with the analysis from a big firm. The reasoning was like mine, but missing the first 30% of the move.

Josh Brown takes note of the Barron’s cover. Since magazine covers are often viewed as contrary indicators, he adroitly includes a few others that might have been viewed as signals of a top. Great insight, and great fun.

Scott Grannis shows the wall of worry climb (but I still like my own version better!)

Eddy Elfenbein highlights the sharp contrast between now and January as well as the impact of the banking sector.

Remember how the start of 2016 was one of the worst market starts in Wall Street history? Howard Silverblatt noted this stat: At the market’s February, low, the S&P 500 was down 10.5% YTD, yet the Financials were down 17.7%. Since then, the S&P 500 has rallied 21.5%, while the Financials are up 45.6%. It’s as if the entire market were the dog being wagged by the banking sector’s tail.

None of this really answers the DOW 20K question, but the information is great. As usual, I’ll have a few ideas of my own in today’s “Final Thoughts”.

Quant Corner

We follow some regular great sources and the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

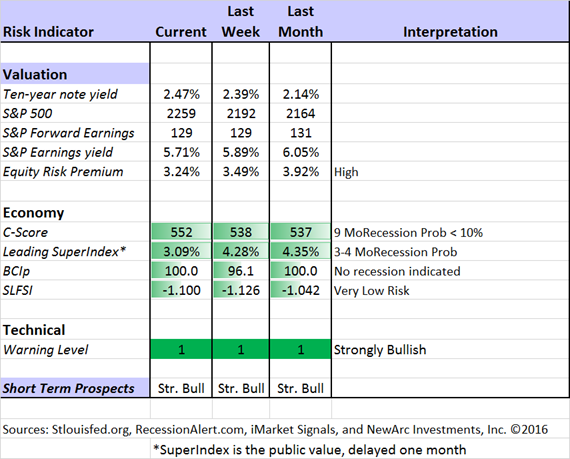

The Indicator Snapshot

The increased yield on the ten-year note has lowered the risk premium a bit. I suspect much more to come. By this I mean that the relative attractiveness of stocks and bonds will continue to narrow.

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has several interesting approaches to asset allocation. Try out his new public Twitter Feed. His most recent research update suggests some “mixed signals” from labor markets.

Doug Short: The World Markets Weekend Update (and much more).

Georg Vrba: The Business Cycle Indicator and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

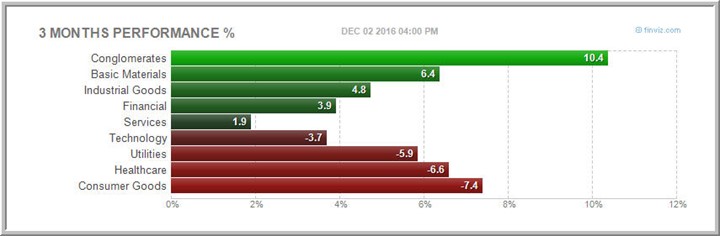

There is a Correlation Nosedive says Nick Colas (via Josh Brown). This signals an opportunity for those who can identify the best stocks and sectors. The phrase “stock-picker’s market” is oft-repeated. Now it makes some sense.

Dr. Brett analyzes the divergences and the implications.

Brian Gilmartin reports on the recent Chicago CFA luncheon where “Dan Clifton of Strategas Partners gave a great presentation on the coming fiscal stimulus and what it might look like and what it might mean for the US economy in 2017”. This means plenty of money for share buybacks and earnings increases. Brian (who has been very good on both earnings and the market) reaches this conclusion:

In year-end meetings with clients, I’m telling clients from both sides of the aisle that the SP 500 could be up 20% next year. Prior to the election and since last Spring ’16, the SP 500 was already looking at its best year of expected earnings growth in 5 years. The proposed President-elect and Congressional fiscal policy could be another level of earnings growth above what was already built into the numbers, before November 8th.

Personally, the $1 trillion repatriation estimate that Dan Clifton threw out seemed on the lighter side to me. Apple (NASDAQ:AAPL) alone has $250 billion sitting on its own balance sheet, which is 1/4 of the expected total.

This is something we all should be monitoring.

How to Use WTWA (especially important for new readers)

In this series, I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide several free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and less risk.

- Holmes and friends – the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions on this subject. What scares you now?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and the top sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar is fully invested in aggressive sectors. The more cautious Holmes also remains fully invested, but with continued profit-taking and position switching. The group meets weekly for a discussion they call the “Stock Exchange.” This week we talked about maximizing gains. Last week the topic was minimizing risk. (We report exits from announced Holmes positions if you ask to be on that list. Write to holmes at newarc dot com).

Special thanks to our guest expert, Blue Harbinger, who provided first-rate fundamental analysis, providing counterpoint for our technical models.

Top Trading Advice

Brett Steenbarger continues to provide almost daily insights for traders. Sometimes the ideas draw upon his expertise in psychology. Sometimes they emphasize his skills in training traders. Sometimes there are specific trading themes. They all deserve reading. This week I especially liked the following, each reflecting one of the main themes:

- Recovering from a tough session.

- Identifying what kind of trader you are.

- Trading or fading momentum.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Morgan Housel’s post on The Art and Science of Investing. I am delighted that he is keeping his promise to keep writing, leading the effort at a new, multi-contributor blog. This entry, as is the case with much of the best investing work, does not emphasize immediately “actionable” advice, designed to attract plenty of page view. The concept is great, and the post is worth a careful read. Here is the thesis:

This drives people crazy, because the more important a field is, the more scientific and predictable we want it to be. People take scientists seriously because they can count of them. Art is taken less seriously because it comes and goes.

But most fields outside academia are both science and art.

Including investing.

An example?

There is scientific data showing the best way to invest is to buy the cheapest set of companies you can find. There’s equally persuasive data showing the best way to invest is to buy the fastest-growing set of companies, which tend to be expensive. Some investors obsess over brand and intangibles. Others say ignore those and only look at fundamentals. Neither is right or wrong. You just have to appreciate that each strategy lives in its own context, and that market trends come and go. It’s an art.

I love this concept! There are many ways to profit from trading and investing. Arguments about approach may either distract or enlighten.

Stock Ideas

Brad Thomas suggests two REITs for the new Commander-in-Chief. Besides the recommendations, Brad analyzes some potential losers.

Still wondering about winners from the election? Marc Gerstein’s stock screening methods generate a great list of stocks and sectors.

Looking for safe yield? Who isn’t!! Blue Harbinger provides a first-rate analysis of Saratoga Investment Corp. (NYSE:SAR). There are plenty of traps in the Business Development Company (BDC) universe. Mark’s analysis shows how carefully you must consider the data in finding sound choices. He carefully considers the implications from higher rates.

Our trading model, Holmes, has joined our other models in a weekly market discussion. Each one has a different “personality” and I get to be the human doing fundamental analysis. We have an enjoyable discussion every week, with four or five specific ideas that we are also buying. This week Holmes likes Molson Coors (NYSE:TAP). Check out the post for my own reaction, and more information about the trading models.

While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas have worked well so far. My hope is that it will be a good starting point for your own research. Holmes may exit a position at any time. If you want more information about the exits, just sign up via holmes at newarc dot com. You will get an email update whenever we sell an announced position.

But Tom Armistead warns that there is too much enthusiasm about Deere (NYSE:DE).

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. If you are a serious investor managing your own account, you should join us in adding this to your daily reading. Every investor should make time for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading. My personal favorite this week is the Bloomberg analysis of when it is right to wait before claiming Social Security benefits. While it is an individual choice and calculation, delay is good for many. (See also “Watch out for” below.)

Seeking Alpha Editor Gil Weinreich’s Financial Advisors’ Daily Digest is a must-read for financial professionals. The topics are frequently important for active individual investors. Gil is on a well-deserved vacation, but his last post is very helpful. He takes a nice look at the current risks and rewards from the market rotation away from bonds.

Watch out for…

Structured products. Larry Swedroe (ETF.com) provides a careful analysis of what the investor is really getting. Most have inflated notions about the returns and are not properly informed about risks. In many cases, a simple fixed-income security would be better. This is a complicated story, but it is worth reading carefully if you, like so many, are considering these investments.

Final Thoughts

Will we reach DOW 20K? And stay there? I expect us to touch that level soon. When the market gets close to such numbers there is a magnetic attraction. Sellers see it as inevitable, so they back away. It becomes a self-fulfilling prophecy. Whether the level holds will be a trickier question. It will, but perhaps not right away. No one really knows.

My purpose in the DOW 20K project, including buying the domain name, was to help individual investors to focus on the right problem: Missing the upside because of the paralysis of fear. Consider the following:

- For many years, anyone forecasting more than an 8% gain in the market was tagged as super-bullish.

- Since 2010 there have been incessant warnings of another market crash, a decline of 50% or more.

- A market doubling in 6 ½ years represents 11% compounded growth.

It was not a prediction of rush to 20,000, but an emphasis on taking the right perspective. There are always market worries. The big negative predictions always get the attention. It is always difficult to stay the course.

Is DOW20K the end? Definitely not. The fundamentals are all better than in 2010, and the worries are different. I’ll write soon about the methods behind the original call and the current implications. For now, I’ll just say that the upside/downside risk is still attractive.

Investors need not just “buy and hold.” Recessions are the biggest risk, so I watch that closely. The right allocation among asset classes deserves a regular review.

This is a good time to ask yourself about how have you done? If you are wondering whether you might do better with a financial advisor, check out my latest paper, The Top Twelve Investor Pitfalls – and How to Avoid Them. If you regularly navigate these problems, you can fly solo! Readers of WTWA can get a free copy by sending an email to info at newarc dot com. We will not share your address with anyone.