Street Calls of the Week

- Fed officials gather for their annual symposium in Jackson Hole next week

- Remain under pressure to fight inflation, without creating a market tantrum

- I expect the Fed to push back against rising expectations of a dovish policy pivot

The U.S. Federal Reserve may send the market a hawkish message when global central bankers meet at the Jackson Hole Economic Symposium next week.

The highlight will be Fed Chair Jay Powell's speech on Thursday morning at around 9AM ET.

Fed chiefs have, in the past, used their keynote speech to signal important shifts in monetary policy or a change in their economic outlook.

In my view, Powell will signal that the U.S. central bank will continue to raise interest rates and keep them higher for longer than expected, as it fights to bring down the highest inflation in decades.

So, we could see a major U-turn in market pricing and Treasuries particularly.

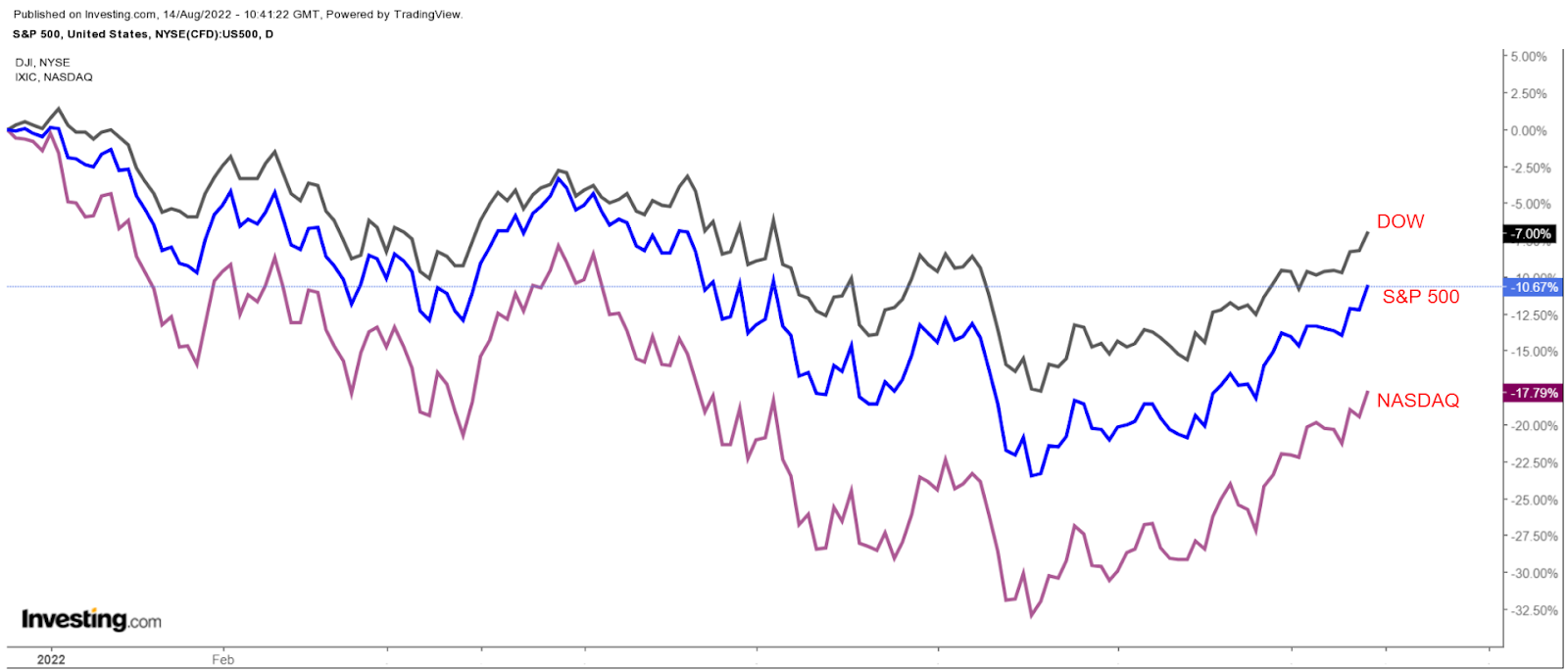

U.S. stocks have rallied off their mid-June lows—with the Nasdaq Composite exiting bear-market territory last week—on hopes the Fed will become less aggressive on interest rate hikes in the months ahead.

Investors have been too quick to price in a less hawkish outlook. Here are two reasons why the Fed will not stop tightening monetary policy anytime soon.

1. Strong Labor Market

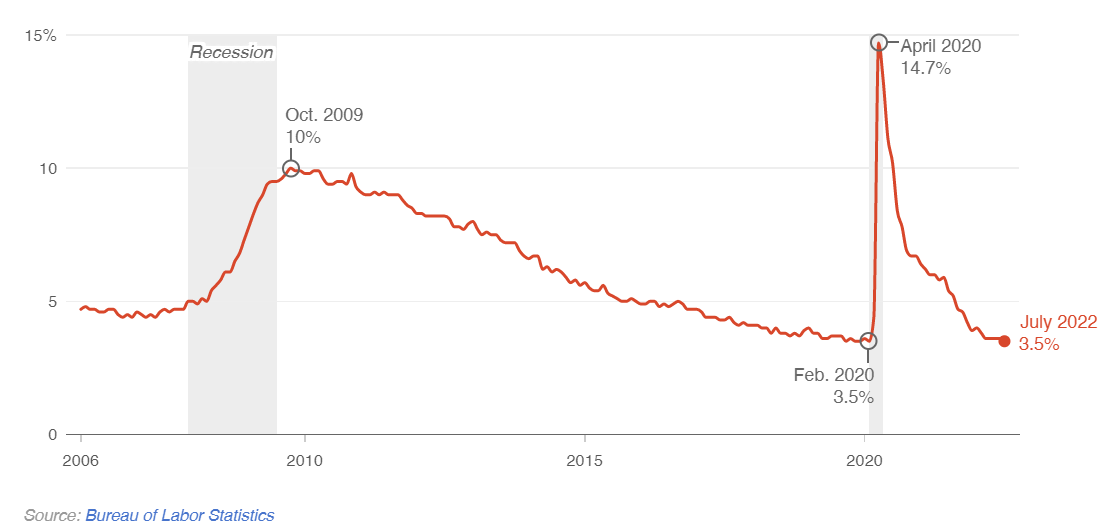

Despite fears of a recession, the U.S. labor market continues to be strong as job openings are hovering near all-time highs and the unemployment rate is standing near historical lows.

According to the St. Louis Fed's FRED database, there are nearly 10.7 million unfilled jobs as of June, that's down from a peak of around 11.9 million in March, but up from 9.8 million openings in June 2021 and roughly 6.1 million in June 2020.

Underlining the strength of the jobs market, U.S. employers have hired far more workers than expected in the last several months.

Indeed, the monthly nonfarm payrolls report has topped forecasts in six of the first seven months of 2022, with average jobs growth of roughly 471,000/month. In comparison, the historical average jobs gain was around 190,000 per month between 2015-2019.

Furthermore, at 3.5%, the unemployment rate is now back to its pre-pandemic level and tied at the lowest rate since 1969.

Another sign of a tight labor market is the fact that employers continued to raise wages at a strong pace last month. Average hourly earnings rose 0.5% in July after increasing 0.4% in June.

That saw the year-on-year increase surge to 5.2%, adding more fuel to a worrying inflation outlook that gives the Fed enough cushion to stay on its aggressive rate hike path.

I can already picture Powell at Jackson Hole, saying that the strong labor market implies that the economy can indeed withstand higher rates.

Inflation Still Close To 40-Year High

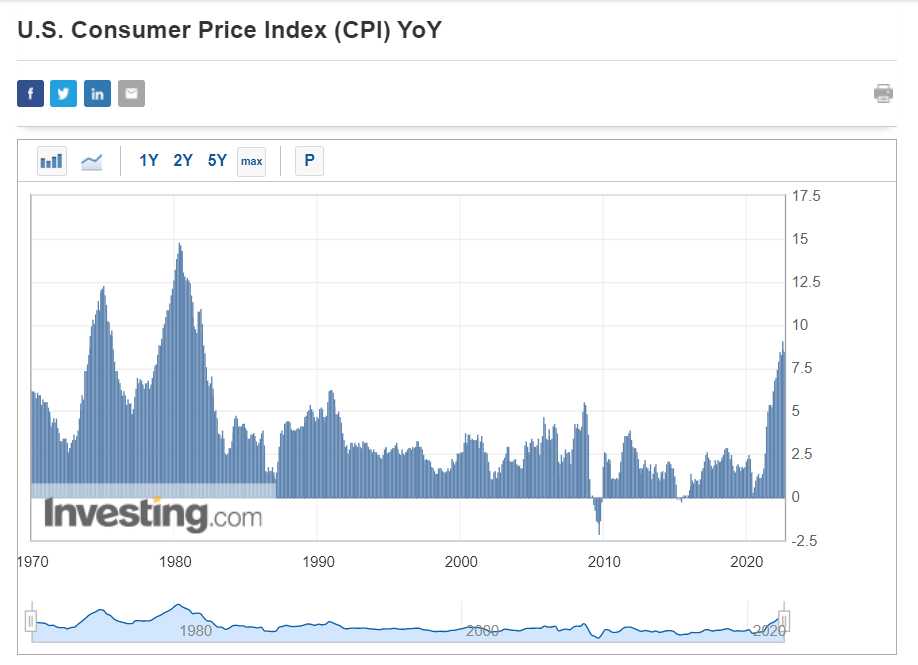

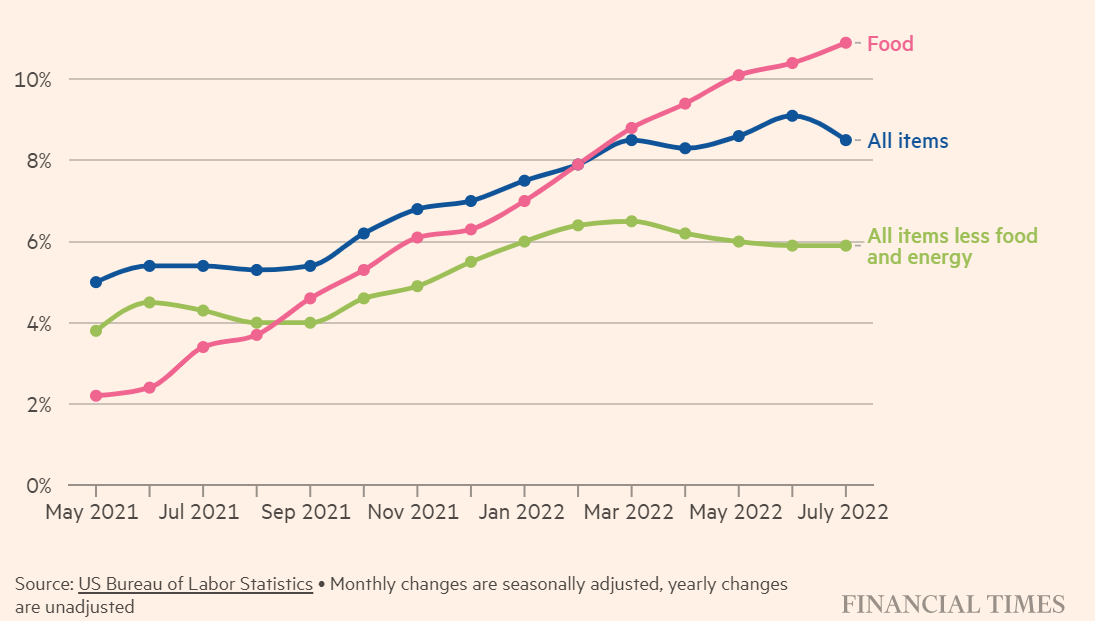

U.S. CPI was unchanged in July, as gasoline prices dipped. That brought down the annual rate of inflation to 8.5% versus the prior reading of 9.1% in June, which was the highest since 1981.

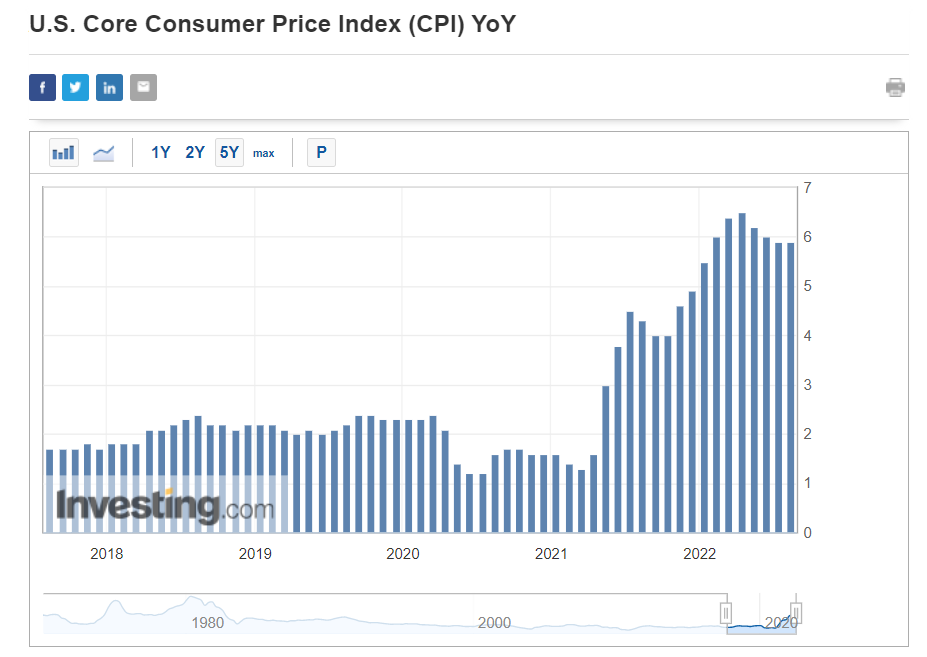

Meanwhile, core inflation—which strips out volatile energy and food prices—increased 0.3% in July and is up 5.9% over the last 12 months, according to BLS.

While the latest figures imply that inflation has peaked or is close to peaking, U.S. consumer prices remain close to levels not seen since 1982.

Despite the recent decline, the BLS said gasoline prices were 44% higher over the past 12 months, while grocery costs surged 13.1% over the last year, the largest annual increase since 1979.

In addition, rising housing rents and wages, which are usually only negotiated once a year, will likely result in stickier inflation remaining elevated for longer.

While July’s dip was a positive development, it is still too early to say if the trend will be sustained as U.S. inflation remains up well over historical levels.

Fed officials have made clear that they need to see clear and convincing evidence that price pressures are subsiding before slowing or suspending rate increases. Minutes released Wednesday from the Fed’s July 26-27 board meeting reiterated that sentiment, noting inflation remains “unacceptably high.”

Taking that into account, the U.S. central bank has all the ammunition it needs to continue raising interest rates until it sees CPI coming back down to its 2% target.

Disclosure: At the time of writing, Jesse has no position in any stocks mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.