The headlines have focused on the year-to-date gains for the S&P 500 as well as the relatively minor losses for the Dow Jones Industrials. Simply stated, most investors are more comfortable hearing about the performance of popular benchmarks than the tribulations of the Russell 2000 or Japan’s Nikkei 225 or the S&P Europe 350 (NYSE:IEV).

On the flip side, when small-company stocks in the Russell 2000 are haplessly flapping their wings, there is a reasonable possibility that the wealth destruction may spill over into the largest company names in the Dow and S&P 500. The same can be said for a significant drawdown in large-cap European stocks in the S&P Europe 350 or small-caps in an index of smaller corporations in the euro-zone. Rare is the year when a high correlation between stocks of all stripes is absent.

It is worth noting that many of the strongest year-over-year gainers have had the roughest month-over-month setbacks. Small European corporations and small U.S. stocks had been some of the premier performers before July knocked a wind out of their respective sails. In contrast, many of the more beleaguered stock ETFs across a one-year span have found themselves in the enviable position of serving up positive month-over-month results. Emerging markets had been left for dead by many who grew tired of the limited risk-reward prospects. Today, inexpensive valuations as well as hope for economic resurgence have bolstered Asia and Latin America.

| A Significant Shift In Stock ETF Leadership? | |||||||

| 1 Year % | 1 Mo % | ||||||

|

42.1% | -4.1% | |||||

|

28.9% | -5.1% | |||||

|

26.4% | -6.0% | |||||

|

21.2% | -7.6% | |||||

|

14.3% | -4.2% | |||||

| SPDR S&P 500 (ARCA:SPY) (SPY) | 15.8% | -1.8% | |||||

|

12.3% | 2.5% | |||||

|

11.7% | 0.6% | |||||

|

10.8% | 2.4% | |||||

|

9.3% | 1.4% | |||||

|

7.5% | 1.6% | |||||

Unfortunately, stock leadership may not be the only issue at hand. Stocks across the board may have difficulty if safety-seeking investment dollars continue finding their way into longer-term U.S. Treasuries as well as highly regarded sovereign debt. The Germany 10-Year bond yield at 1.10% now rests at an all-time record low. Indeed, it is difficult to imagine buying every dip as if we were still in 2013. After all, debt instruments, gold and safe haven currencies are all showing resilience here in 2014.

Granted, there are a number of things with the potential to spook stock investors. Russia-Ukraine dampens enthusiasm for European equities and has the potential to drag on U.S. equities. Similarly, exorbitant valuations in the small-cap arena can eventually bog down “overvalued” larger-caps that have ignored questionable fundamentals for years due to easy monetary policy. The ultra-accommodative Federal Reserve, however, is slowly removing air from the lend-n-spend tire.

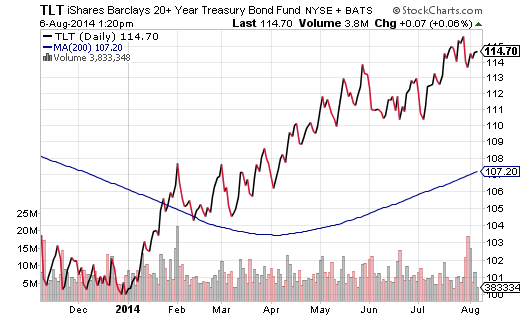

From my vantage point, investors need to heed the bond market’s admonition. In the 6-month period between 8/7/13 and 2/6/2014, the S&P 500 SPDR Trust and long-dated Treasuries via iShares Barclays 20+ Year Treasury (ARCA:TLT) had a strong negative relationship. Its rolling 6-month correlation resided close to -0.70%. Stocks up, bonds down… and vice versa.

Now take a look at the 6-month period 2/7/2014 through 8/6/2014. Both SPY and TLT have nearly appreciated in lock-step. Positive relationships between these assets do not typically last as long as they already have, implying that something has to give. The S&P 500 SPDR Trust could succumb to the pressures associated with normal stock market corrections. Conversely, iShares 20+ Treasury might fall victim to rocketing long-maturity yields and simultaneous price depreciation. The least likely outcome would be SPY and TLT continuing to move in the same direction as one another.