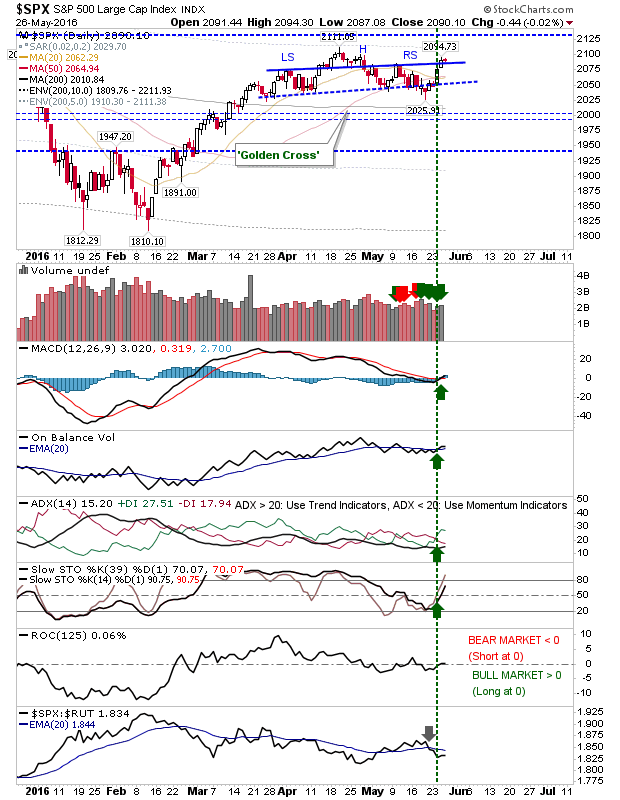

There wasn't much to say about today as indices worked on consolidating the last couple days of gains. The real action came from supporting technicals, as they looked to mark a shift from a generally bearish technical picture to a net bullish one.

The S&P got to resistance of what was looking a reversal head-and-shoulder pattern. This pattern won't be negated until 2,111 is breached, but today's action is a step in the right direction. The only negative is the continued relative under performance against Small Caps.

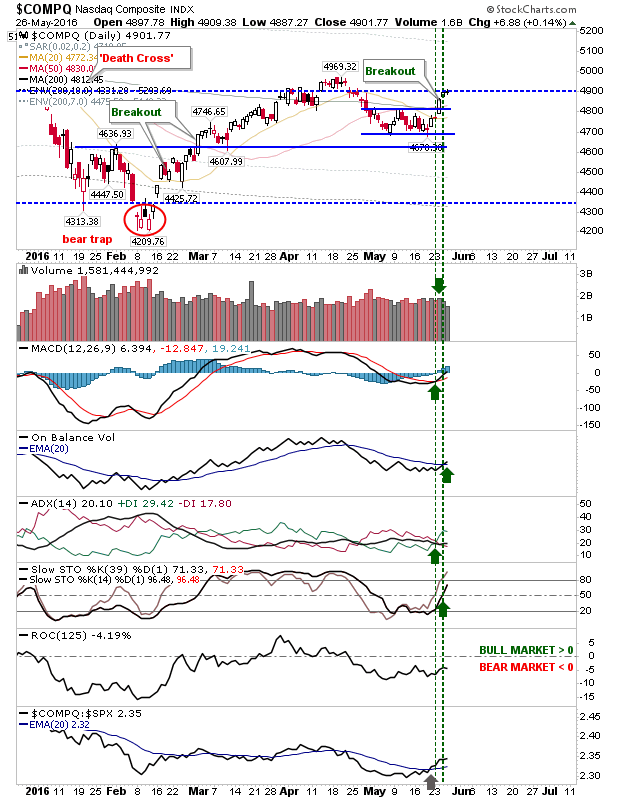

The Nasdaq is challenging the 4,900 level which had played as resistance in 2015 but is less significant now. Technicals are now net bullish, although Rate-of-Change still hasn't broken above the zero line.

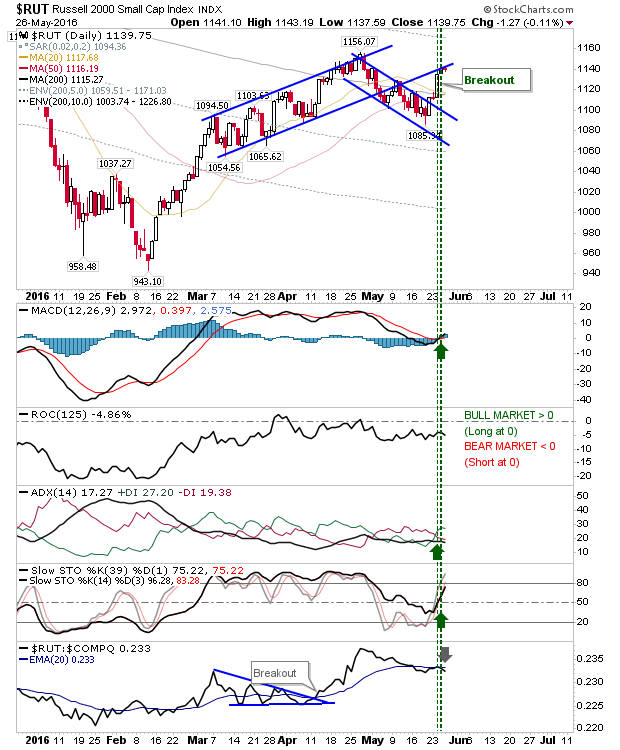

The Russell 2000 remains tagged to former channel support turned resistance. The disappointment was in the relative performance, which lost ground against (not so-) speculative Tech stocks. While the index pushed above its 200-day MA, it might still be a little early to hold a sustainable move above this moving average.

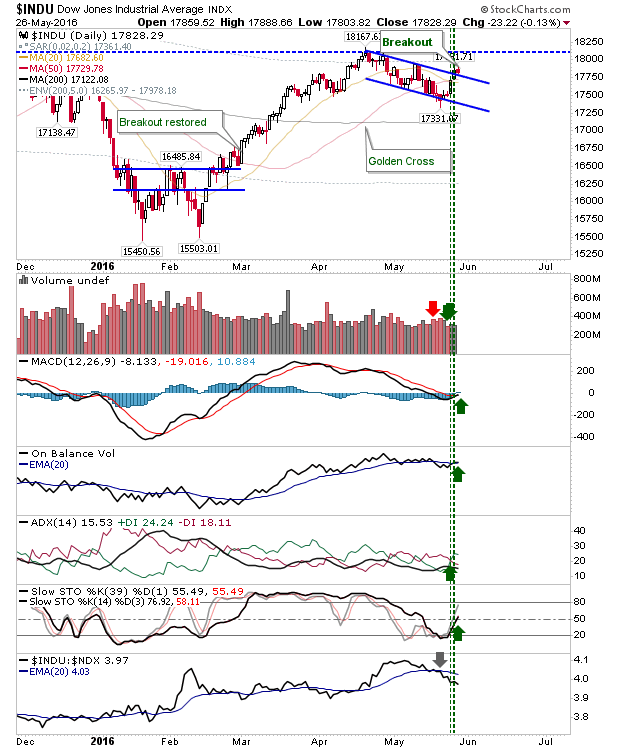

The Dow cleared the downward channel with fresh bullish technicals. The MACD trigger 'buy' nipped above the bullish zero line.

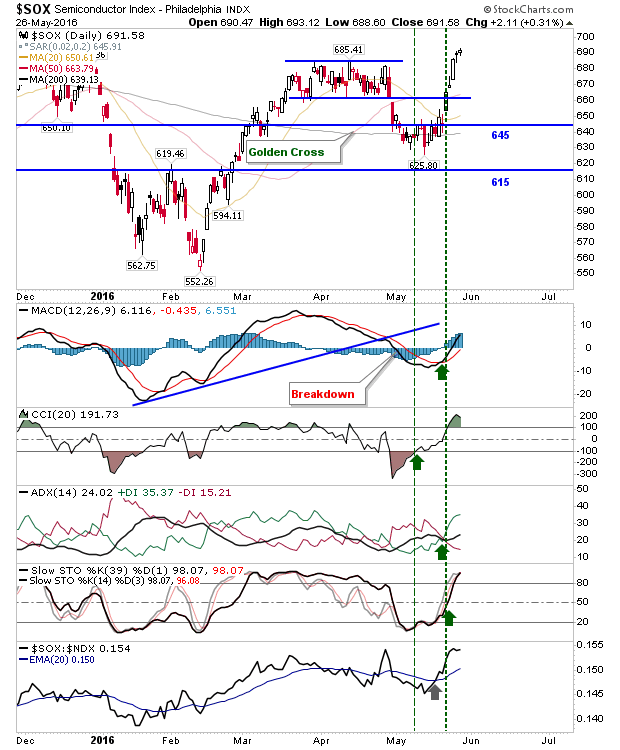

As a final note, the Semiconductor Index even managed to add a little more in healthy action.

Going forward, look to buy pullbacks, unless technicals revert to net bearish (an effective technical 'stop').