Saying the US dollar had a good week even though it lost 18.5% against the Swiss franc may be a bit like the old joke about asking Mrs. Lincoln, "besides that, how was the play?"

The Swiss National Central Bank's unexpected decision to abandon its cap will be a day recorded in foreign exchange history, ranking up there with Nixon's closing of the gold window and the UK leaving the ERM. In all three cases, officials balked at the costs/risks of pursuing their national strategies.

The dollar managed to recover nearly half of its losses seen in the immediate aftermath of the SNB's surprise. The 50% retracement is seen near CHF0.8825, and the greenback rose to CHF0.8810 before running out of steam. The SNB's move not only spurred an incredible rally in the Swiss franc, which at one point appreciated about 40% against the euro, but also injected volatility into numerous currency pairs. Central and Eastern European currencies were particularly hard hit and the currency pegs in Denmark and Hong Kong were challenged.

The US dollar also fell for the second consecutive week against the yen. Not coincidentally, the S&P 500 and Nikkei have both fallen in the first two weeks of the year. The dollar recouped some of its losses before the weekend, leaving it down less than 1% against the yen. The price action reinforced the technical significance of the JPY115.50 area. If the equity markets turn higher, the dollar could recover into the JPY118-JPY119.50 range in the near-term.

Ahead of the ECB meeting on January 22, the euro may remain on the defensive. We have warned of the risks that the market is disappointed and/or a "sell the rumor buy the fact" type of activity ensues in response to the ECB's announcement. Given the confirmation of negative December CPI print and the preliminary opinion from the European Court of Justice, there is a strong possibility the ECB announces a sovereign bond buying program. Nevertheless, there is a non-negligible risk that the ECB indicates it will be forthcoming after it works out the remaining technical difficulties.

A bounce could carry the euro into the $1.1750-$1.1830 area, where we suspect there will be many sellers. Upon reviewing the SNB's reserve growth in December, we half-jokingly suggested that the SNB was the only buyer of euros. By giving up the cap, the SNB may still buy euros, but not to defend any level. The next technically important area comes in near $1.12 on the way to $1.10.

Sterling is interesting. It looks like it is trying to carve out a near-term low ahead of $1.50. It appears to be benefiting from flows out of the euro area. The news stream this coming week will be mixed, but on balance, we suspect somewhat supportive. The jobs market likely improved, and weekly earnings likely rose further into positive territory when adjusted for inflation. The MPC minutes will show the two hawkish dissents continued, even though headline CPI is well below 1% and may fall into negative territory in the coming months. The expected softness in December retail sales may be shrugged off as November data was strong, and the data is released a day after the ECB meeting, which will likely be the dominating influence. New offers probably lie in the $1.5250-$1.5300 area.

The Australian dollar drew a good bid from the SNB's move of its interest rate target deeper into negative territory given its relatively high yields. Technical support is seen near $0.8140. It needs to overcome $0.8300 to signal a move to $0.8400.

The Canadian dollar is considerably more vulnerable. The Bank of Canada meets this coming week, and although it is most unlikely to cut rates, its economic assessment could signal more losses for the Canadian dollar. The central bank will likely cut its growth forecast sharply, which in turn indicates a longer period before the output gap is closed. Technically, there is scope for the US dollar to move toward CAD1.2100-50 range. A rally into that area will likely stretch the technical indicators and could spur some profit-taking, especially if the CPI figures on January 23 show the core rate rising despite a fall in the headline rate.

After setting new lows early last week, oil prices stabilized just off the trough over the last few sessions. Technical indicators we look at like the RSI, MACDs, and Stochastics, suggest there is room for further consolidation. The front-month March futures contract was turned back from its 20-day moving average on January 15. It has not closed above this average since late September. It is found now near $51.80 and is still falling. Despite having fallen to $44.80 on an intra-day basis, the March contract has not closed below $46.

U.S. 10-Year Treasury yields finished the week below the mid-October flash crash low. That area, roughly 1.86%-1.90%, will now likely function as resistance. Two factors will likely continue to weigh on yields on a trend basis. First, headline inflation in the US is unlikely to bottom until at least Q2. Second, the negative yields in Europe and falling euro may also encourage flows into the U.S. debt market.

The S&P 500 consolidated the week's losses before the weekend. This year, it has found support in the 1988-1991 area. The trend line drawn off the record high and the January 9 high caught last week's high near 2057. At the end of the week ahead, it comes in near 2028. Technical indicators are not generating strong signals, but have not negated the bearish divergence that allowed us to anticipate last week's decline.

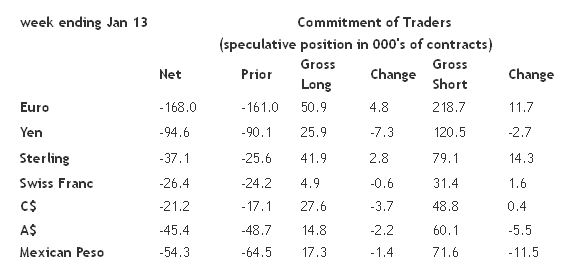

Observations from the speculative positioning in the futures market:

1. There were three significant position adjustments in the CFTC reporting week ending January 13. The gross short euro position increased by 11.7k contracts to 218.7k. The gross long sterling position rose 14.3k contracts to 120.5k. The gross short Mexican peso position fell 11.5k contracts to 71.6k.

2. The last time a SNB official reaffirmed the importance of the franc's cap coincides with this report of the Commitment of Traders. Two days before the cap was abandoned, speculators were short 31.4k contacts, a 1.6k increase from the prior week. Anyone who had a stop likely was stopped out. Many say that the end of the cap was inevitable, but there were only 4.9k gross long contracts, a marginal (0.6k) decline.

3. There was only one gross long position that was adjusted by more than 5k contracts. It was the long yen position, which was cut by 7.3k contracts to 25.9k. Besides the adjustment to the gross short positions already discussed, there was only one adjustment more than 5k contracts. In the latest reporting period, 5.5k gross short Aussie future positions were covered, leaving 60.1k.

4. The net short U.S. 10-year Treasury futures position fell to 182k from 243k. The gross shorts were cut by 34.3k contracts to 520.4k. The gross long position rose by 27.3k contracts to 338.9k.