How is it possible that the worst ten-day start in the U.S. stock-market's history was followed by what Bloomberg termed the 'sharpest about face in nine decades'? While markets never move based on any one factor, the primary answer is central banks. This article examines the following questions:

- Just how far have central banks gone in their recent attempt to keep asset prices elevated?

- Why are central banks so concerned about keeping things propped up?

- What are the shorter-term investment implications and the potential end game?

- How can we navigate this period of hyper central bank intervention?

Central Banks Are Buying Corporate Stocks And Bonds

In an April 20 article, we chronicled the Federal Reserve’s 26-day interest guidance shift that occurred between January 6 and February 1, 2016. The Fed’s extreme shift on rates fell into the rare category. Central banks across the globe are starting to tread into much more radical policy waters.

Do you think it would be concerning if the Fed announced they were going to start buying S&P 500 ETFs like (NYSE:SPY) in an effort to “stimulate” the economy? That is exactly what is happening in Japan. From Bloomberg:

They may not realize it yet, but Japan Inc.’s executives are increasingly working for a shareholder unlike any other: the nation’s money-printing central bank. While the Bank of Japan’s name is nowhere to be found in regulatory filings on major stock investors, the monetary authority’s exchange-traded fund purchases have made it a top 10 shareholder in about 90 percent of the Nikkei 225 Stock Average, according to estimates compiled by Bloomberg from public data. It’s now a major owner of more Japanese blue-chips than both BlackRock Inc (NYSE:BLK)., the world’s largest money manager, and Vanguard Group, which oversees more than $3 trillion.

Distorting The Stock Market's Sanity

While investors prefer to see their investment portfolios rise instead of fall, when government institutions start distorting markets there will eventually be negative consequences. From Bloomberg:

A majority of analysts surveyed by Bloomberg predict the Ban[k] of Japan will boost its ETF buying — a move that could come as soon as Thursday. “For those who want shares to go up at any cost, it’s absolutely fantastic that the BOJ is buying so much,” said Shingo Ide, chief equity strategist at NLI Research Institute in Tokyo. “But this is clearly distorting the sanity of the stock market.”

The ECB Will Start Buying Corporate Bonds In June

The “non-traditional” central bank policies have not been limited to Japan. The European Central Bank (ECB) is getting ready to launch a new form of quantitative easing (QE). QE typically involves central banks injecting electronic money into the financial system via the purchase of government debt. However, when central banks start buying corporate debt, they are helping pick winners and losers in the private sector. Some companies will be receiving assistance from the ECB, while others will get no assistance. From Reuters:

The European Central Bank will begin purchases of euro zone corporate bonds in June, ECB President Mario Draghi said on Thursday…The ECB said last month it would start buying corporate bonds issued by companies that are based in the euro zone, have an investment-grade rating and are not banks…The plan has raised questions about the risks the ECB will take onto its balance sheet by buying unsecured private debt.

Extraordinary Measures

The Bank of Japan is not only buying publicly traded stocks via ETFs, but recently announced a negative interest rate policy. From CNBC:

The Bank of Japan blindsided global financial markets Friday by adopting negative interest rates for the first time ever, buckling under pressure to revive growth in the world’s third-largest economy…The bank also clearly communicated a dovish bias, with officials saying they would undertake additional easing if necessary using quantitative and qualitative tools, as well as interest rates.

The concept of negative interest rates was described by Bloomberg on March 18:

Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year. Now Japan is trying it, too. For some, it’s a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it’s an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire. If negative interest rates work, however, they may mark the start of a new era for the world’s central banks.

Extraordinary Measures Should Only Be Used In Extraordinary Times

Concerns about negative interest rates have been expressed from many corners of the economy and markets. From The Wall Street Journal:

The top two executives at Swiss banking giant UBS Group AG teamed up Tuesday to blast the negative interest rate environment brought on by the easy money policies of central banks, an indication that patience is wearing thin in some quarters over these emergency measures… “The introduction of negative interest rates—now not only in Switzerland, but also in large parts of Europe and in Japan—is an extraordinary measure and should only be used in extraordinary times,” said UBS Chairman Axel Weber in remarks to the bank’s annual shareholders meeting…“We can all only hope that the times of such drastic measures by the central bank pass as quickly as possible,” said Mr. Weber, a former Bundesbank president who has been critical in the past about negative interest rates. “Unfortunately, I have to say, unfortunately, there is little indication that negative interest rates will soon be a thing of the past.”

Why Central Banks Are So Concerned About Keeping Asset Prices Elevated

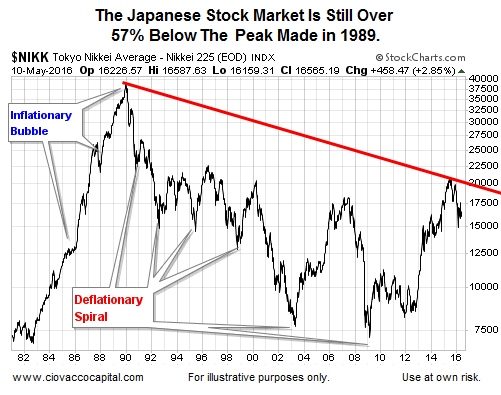

On December 29, 1989, a massive inflationary bubble began to pop in Japan. As prices dropped, investors with cash sat on their wallets waiting for lower asset prices. The desire to “get out” became much stronger than the desire to “get in” and prices continued to fall. In early 1990, Japan started a process that central bankers have nightmares about – a deflationary spiral. As the chart of the Japanese stock market below shows, a deflationary spiral is very hard to stop once it starts. In fact, over 26 years later the Nikkei is nowhere near its 1989 high.

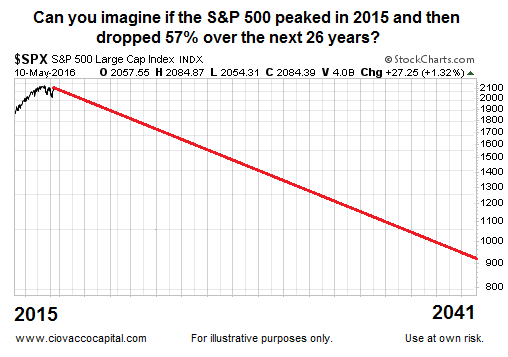

Can you imagine if the S&P 500 peaked last spring and did not revisit that high for over 26 years? Japan has been desperately trying to reverse deflationary trends. From a 2013 Bloomberg article:

It’s been 22 years since annual inflation in Japan exceeded 2 percent, according to data compiled by Bloomberg. In the last five years of the 1980s, when Japan’s gross domestic product climbed from $1.3 trillion to $3 trillion and the Nikkei 225 Stock Average peaked at almost 39,000, the monthly readings for consumer price gains averaged 1.2 percent, the data show. The Nikkei 225 closed today at 15,407.94. “It’s difficult to say whether we are really exiting deflation,” Mitani said. “Consumer prices are starting to rise, but a large reason for that is based on the weakening yen and rising energy prices. We can’t say that looking at recent results, we have really exited deflation.”

Investment Implications: Artificially High Prices Until Inflation Picks Up

To put some human context around the problems associated with a deflationary spiral, assume you retired in 2015 at age 55. Hypothetically, if the S&P 500 peaked in 2015, similar to the Japanese stock market in 1989, 26 years later you would be 81 years old and the year would be 2041. If you invested $500,000 of your retirement portfolio in the S&P 500 in 2015, it would be worth about $215,000 when you celebrate your 81st birthday in 2041.

The human, social, and political ramifications of such a prolonged deflationary spiral are difficult to imagine. Therefore, given that global central banks may be nearing the end of the traditional “inflate to create the wealth effect” road, it would not be surprising to see even more radical policies in the future, including additional forms of asset purchases (QE) in the United States.

As noted in a May 2016 video, the Fed’s dual mandate, and more importantly basic economic principles, tell us central banks will try to inflate as long as they possibly can. When inflation starts to become a problem on the high end of the price stability spectrum, it will be much harder for central banks to keep things propped up. Therefore, investors must be open to:

- A continuation of extremely dovish and radical policies from global central banks.

- The possibility of asset prices remaining artificially elevated, including the possibility of U.S. markets pushing to new all-time highs.

In his May investment outlook, Bill Gross of Janus Funds summarized the situation this way:

Private banks can fail but a central bank that can print money acceptable to global commerce cannot. I have long argued that this is a Ponzi scheme and it is, yet we are approaching a point of no return with negative interest rates and QE purchases of corporate bonds and stock. Still, I believe that for now central banks will print more helicopter money via QE (perhaps even the U.S. in a year or so) and reluctantly accept their increasingly dependent role in fiscal policy. Investment implications: Prepare for renewed QE from the Fed. Interest rates will stay low for longer, asset prices will continue to be artificially high. At some point, monetary policy will create inflation and markets will be at risk. Not yet, but be careful in the interim.

Tactical Approach Until Fundamentals Overtake Central Banks

There are two main issues that can overtake central bank policies; one we have mentioned, inflation; the other is economic fundamentals. As noted in this video clip, easy-money policies were being implemented by the Fed during both the dot-com bust recession/bear market and 2007-2009 financial crisis, and yet asset prices continued to fall due to overwhelming fundamental issues. The role of inflation in terms of limiting central bank easy-money actions was outlined on May 2.

Data And Charts Can Assist With Bull/Bear Tipping Point

When financial markets determine that rising inflation/weak fundamentals are more important than central bank policies, it will be reflected in all the hard data tracked by our market model. Conversely, if asset-price friendly policies from central banks take precedence over fundamental concerns, it will show up in numerous ways in the hard data, including the possibility of seeing U.S. stocks push to new all-time highs. The data and charts can help us stay more tactical until a clearer long-term trend begins to emerge, as described on May 6.

Fed Will Take Whatever Means Necessary

If you have trouble with the concept of asset prices pushing higher given numerous fundamental concerns (earnings, margins, productivity, valuations, etc.), keep in mind that in a 2002 speech Deflation: Making Sure “It” Doesn’t Happen Here, Ben Bernanke reminded us that the Fed would take whatever means necessary to prevent significant deflation in the United States. The Bank Of Japan and European Central Bank have already moved into “whatever means necessary” territory; the Federal Reserve may not be far behind. The relevant blurb from Bernanke’s speech:

The second bulwark against deflation in the United States, and the one that will be the focus of my remarks today, is the Federal Reserve System itself. The Congress has given the Fed the responsibility of preserving price stability (among other objectives), which most definitely implies avoiding deflation as well as inflation. I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States and, moreover, that the U.S. central bank, in cooperation with other parts of the government as needed, has sufficient policy instruments to ensure that any deflation that might occur would be both mild and brief.