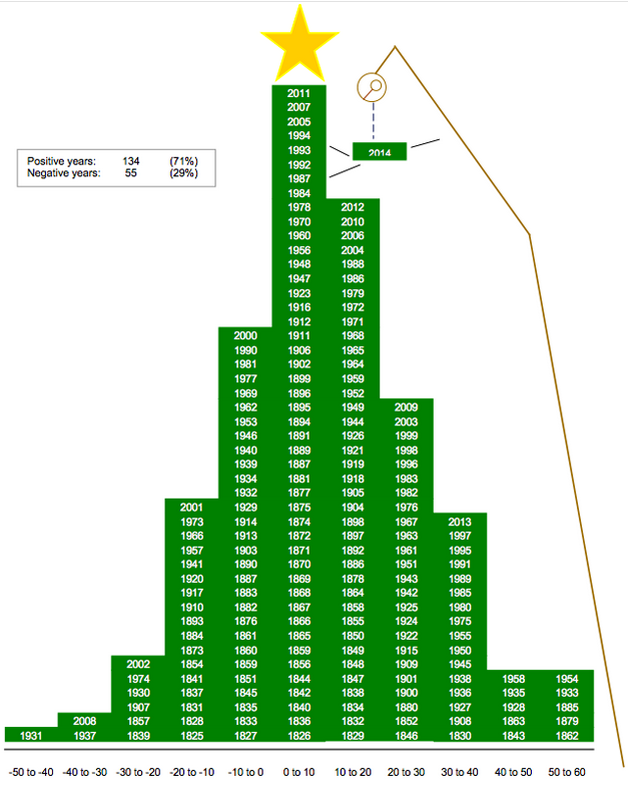

Near the end of December last year, Sterne Agee’s chief market technician Carter Braxton Worth put together this nifty little “Christmas Tree” showing how “the market” (well, the US market, anyway) has performed since the year 1825. To do so, he used data from Roger G. Ibbotson and Yale University up until 1895, then used the DJIA until 1927 and, finally switched to the S&P 500 from 1928 forward.

His chart shows that the US stock market has produced a January 1 to December 31 gain in 134 (71%) of those years and failed to produce a calendar year gain in 55 (29%) of those years. This is pretty close to what I wrote in my book, Bringing Home the Gold, 25 years ago when I said the market goes up about 2/3 of the time and down only about 1/3 of the time.

Yet, during all those years, there was always some bad news that frightened ordinary investors away from the market. That’s why it doesn’t pay to be short the market just because Iran is seeking, with the help of some too eager-for-a-deal, any-deal, U.S. negotiators, to build a nuclear bomb and delivery system or because the U.S. unemployment rate reaches 10% or, indeed, because the Japanese bombed Pearl Harbor. (That was December 7, 1941. You’ll notice that the markets rose in the 20-30% range in both 1942 and 1943.)

The Christmas Tree is really just a standard distribution chart, and its lessons should be heeded. The first of those is that you never

“know” when to be short or out of the market based upon the external news scenario. In fact, as I recently wrote, “Bull markets climb a wall

of worry.” If investors weren’t nervous they’d all buy all the time and pretty soon no one would sell — until, of course, that inevitable moment

when a small boy tugs at mommy’s skirt and says, “But the emperor isn’t wearing any clothes,” after which all hell would break loose.

A second lesson is that you cannot predict the future from the past, though you can see parallels. I can find no instance in this chart where

there were back-to-back losses within the same distribution range that were greater than 10% — of course, if you were down 9% one year, 12% the next and 22% the next (as happened in 2000, 2001 and 2002) you could be forgiven for thinking the markets were no place for mere

mortals — just in time to see a 28% rise in 2003 and up markets for the next four years as well.

The point is, if you remain well-diversified among a number of asset classes you will never do as well as today’s market darling or sector but you will make considerably more year in and year out. Yet, when we are in a down market, people panic and assume the market must keep going down the next x number of months or years, as well. So they sell, typically at or near the bottom and don’t re-enter the arena until the news is good and they see that other friends and neighbors are re-entering as well.

I am quite willing to let the market tell me when I might want to reallocate assets from equities to bonds, from US markets to overseas markets, from one weakening sector to another, strengthening, sector. But I'm never completely out of “the market.” We hew to an asset allocation strategy and time the market only insofar as we see our trailing stops, mental or actual, go from a trickle to a waterfall.

Readers who have been with us a few years have seen numerous instances, like right now, where we are moving more into fixed income, markets that are more fairly valued, and the strongest defensive sectors and industries. We ride roller-coasters at theme parks. We

don’t ride them in the market.

Is This Market Ready to Crash?

In light of all the above, does my move into safer holdings mean I think the market is ready to crash? I haven’t a clue when the market will correct. I only know that this one is getting long in the tooth, that valuations of U.S. companies have risen to the point where a correction is “more likely” to occur, and that there are asset classes and geographic regions where that witches brew doesn’t yet exist. All things are cyclical.

What I am buying instead of most new U.S. holdings will one day be overvalued or under duress, as well. When that time comes, or before, I would like to see greater value in U.S. markets so I can begin buying these, typically during the time that most investors have thrown in the towel. What I do know is that the NASDAQ closed above 5000 on March 2nd and promptly retreated. What I do know is that the U.S. dollar is making it very difficult for large American companies — the kind that comprise the DJIA and the S&P 500 — to grow their earnings.

So I am moving offshore, getting more defensive, and buying more anchors in the form of U.S. and foreign bonds. If I’m being more defensive, why am I buying some U.S. high yield bond funds, you may well ask. The answer is that, while I don’t see American firms growing their revenues significantly, they have borrowed enough at incredibly low interest rates that their coffers are once again full. They have the money to meet their debt obligations; as bondholders we are less concerned with the income statement than we are with the balance

sheet.

If they can pay their debts, I’m happy to be a creditor and receive 5 or 6% rather than 1% in a CD. Besides, I am never completely out of the U.S. markets. Even if I think that’s a good decision, history has shown that it loves to turn on a dime and confuse investors and destroy capital at will. But what I am keeping in the U.S. is going into the strongest sectors like consumer discretionary, health care and technology, as well as into two areas I believe will recover as our population gets back to work: energy and U.S. real estate.

The consumer discretionary sector includes retail, media, travel and leisure, entertainment and so on. When people believe their job is secure and they will be able to save as well as do fun things again, this sector benefits. Healthcare is obvious: the developed world, where the populace can afford health care either directly, via insurance or a national health scheme, is aging. The bulge of baby boomers is here and they need meds, therapy and surgery almost as much as they need to get off their, um, couches, and exercise, play, and enjoy the taste of real food.

Now let’s talk tech…We are switching our holdings in this area from the big-cap monsters of American technological ingenuity to the smaller up-and-comers. This leaves me decidedly uncomfortable, which probably means it’s a good thing to do right about now. Tough as it is to leave the joys of Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOGL), Oracle (NYSE:ORCL) et al in favor of lesser-known firms, these giants have a problem: the U.S. dollar. The big tech firms today are getting 70% or so of their revenues from non-U.S. clients. America got the tech revolution early; the real growth today is in distant locations.

I’m hard-pressed to imagine significant growth (in the currency with which most Americans invest, anyway) in earnings for the behemoths. I’ll still keep some Cisco (NASDAQ:CSCO), MSFT and others but we will be exchanging our big-cap SPDR Select Sector - Technology ETF (NYSE:XLK) (our 2nd-largest position in our Aggressive Growth portfolio) for the PowerShares Small Cap Info Tech ETF (NASDAQ:PSCT). It is comprised of the more speculative, but I believe currently better-positioned, names like Synaptics (NASDAQ:SYNA), Cirrus Logic (NASDAQ:CRUS), CACI International (NYSE:CACI), Coherent (NASDAQ:COHR) and Manhattan Associates Inc (NASDAQ:MANH).

In our Growth and Value Portfolio, we already own both the Schwab US REIT ETF (NYSE:SCHH) and the IQ US Real Estate Small Cap ETF (NYSE:ROOF) I’ve read all the academic studies that say that residential real estate and suburban retail and commercial space are passé because Millennials all want to live in hip urban neighborhoods and walk or bicycle to work. Well, didn’t we all?!! Of course, when you’re single or experimenting with living together you want to be near work, restaurants, bars and cultural attractions. That’s where you meet members of the opposite sex! Duuuhh. It isn’t as if the younger generations are the first to discover urban living (or sex, for that matter.) But once we decide to start a family or tire of the noise and less than dependable garbage pickup, we look to buy our own house, a place where the walls are thick and there is room to play. I disagree with the naysayers; U.S. real estate is a great long-term holding.

That Brings Us to Energy

If you have patience, ice water in your veins, and/or plan to go camping for the next 6 months without Internet or phone, I can’t imagine a better sector to be in than energy. As an energy investor of 40 years, I’ve seen this all before. Every time the sector cycles back up I’ve been glad I bought when I did.

We may be approaching another great buying opportunity here; my advice is to stick with the global Titans this time, as well. I think the proven reserves and balance sheets of every debt-ridden sub-major big enough to have an impact upon the big firms is currently being scrutinized by burning-the-midnight-oil analysts at each of those majors. Buying oil on the stock market is today cheaper than exploring for it and, to the point of today's surplus, doesn't add to global supply, but does add to the strength of these companies. We own BP (NYSE:BP) and have options on Total (NYSE:TOT), Royal Dutch Shell (NYSE:RDSa) and, via SPDR Energy Select Sector Fund (ARCA:XLE), both Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX), the two biggest components.

We’ll be buying more.

...And Then There is Gold

Most of the time, gold is a dreadful investment. Look at any chart of gold juxtaposed against the S&P and you’ll see that. But every now and again, when gold is depressed like, say, oil is, and world events and many stock markets afford little value, gold is worth a nibble. We don’t buy gold producers, we buy gold royalty firms. And we are already buying Franco Nevada (NYSE:FNV) Royal Gold (NASDAQ:RGLD) and Silver Wheaton (NYSE:SLW). These are the “financiers” to the precious metals business. They assess a find the explorer has mined and, if it meets their hurdles, the royalty companies lend mine completion funds and take their “interest” in a percent of the gold that is mined.

Why buy “maybe” when you can buy “for certain?”