McDonald’s Corporation (NYSE:MCD) Consumer Discretionary - Hotels, Restaurants and Leisure | Reports April 22, Before Market Opens

Key Takeaways

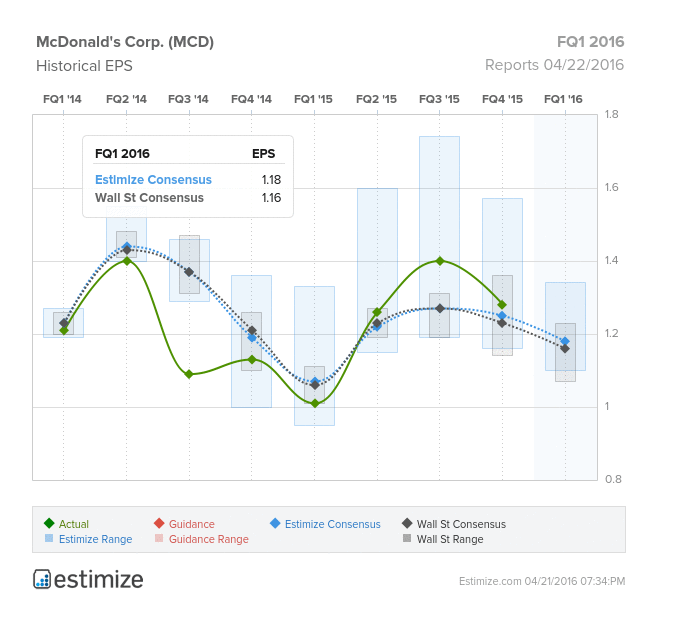

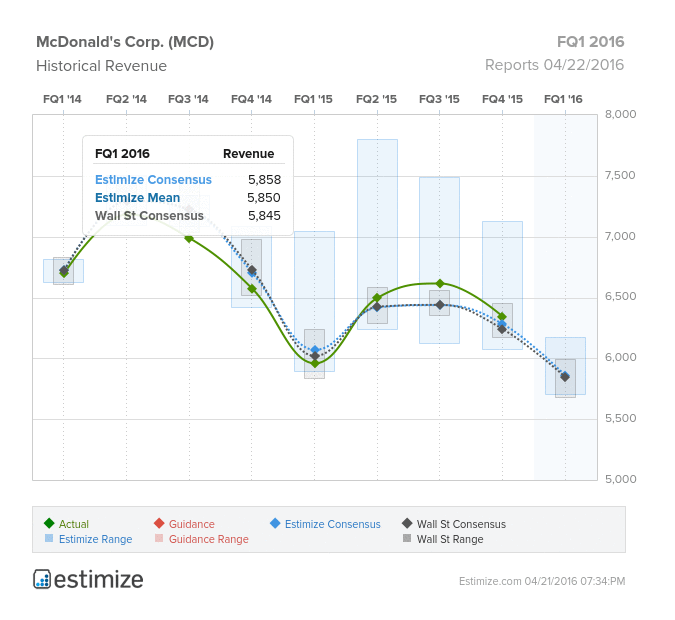

- The Estimize consensus is calling for EPS of $1.18 on $5.86 billion in revenue, 2 cents above Wall Street on the bottom line and $13 million below on top.

- New CEO Steve Easterbrook has led McDonald’s to a remarkable turnaround in 2015

- All Day Breakfast and the McPick 2 promotion have been two of the company’s biggest revenue drivers lately.

- What are you expecting for MCD?

The golden arches are scheduled to report first quarter earnings this Friday, before the market opens. After missing in each quarter of 2014, McDonald’s has made a quick turnaround and is well positioned to beat for a 4th straight quarter. The Estimize consensus is calling for EPS of $1.18 on $5.86 billion in revenue, 2 cents above Wall Street on the bottom line and $13 million below on top. Compared to a year earlier, per share estimates are predicted to increase 16% but sales are forecasting a 2% loss. It’s not surprising that the stock has been climbing given McDonald’s quick reversal of fortunes. In the past 12 months shares have soared 30.63% on renewed confidence. On average however, shares are largely unchanged leading up to and through earnings season.

Last year, McDonald’s took an aggressive stance to reset its core business which had otherwise been failing. The first step, and perhaps most successful, was a change in leadership. In March 2015, McDonald’s appointed Steve Easterbrook as CEO, and they haven’t looked back since. The company has topped expectations in each quarter under the new CEO and is well positioned to do so again. Last quarter, McDonald’s boasted a 5% increase in global comp sales and a 7% increase in operating income. Unfortunately, revenue decreased 7% during the same period, largely due to currency headwinds. Exchange rate volatility is expected to be an ongoing hinderance for McDonald’s moving forward.

Some of McDonald’s most notable initiatives include the debut of All Day Breakfast and the introduction of its McPick 2 promotion. McDonald’s has noted that All Day Breakfast was the primary drive of increased traffic last quarter. The ingenuity of day long breakfast differentiates McDonald’s from direct competitors like Wendy's and Burger King but also compete against traditional breakfast establishments such as Denny’s and IHOP.

Do you think MCD can beat estimates?