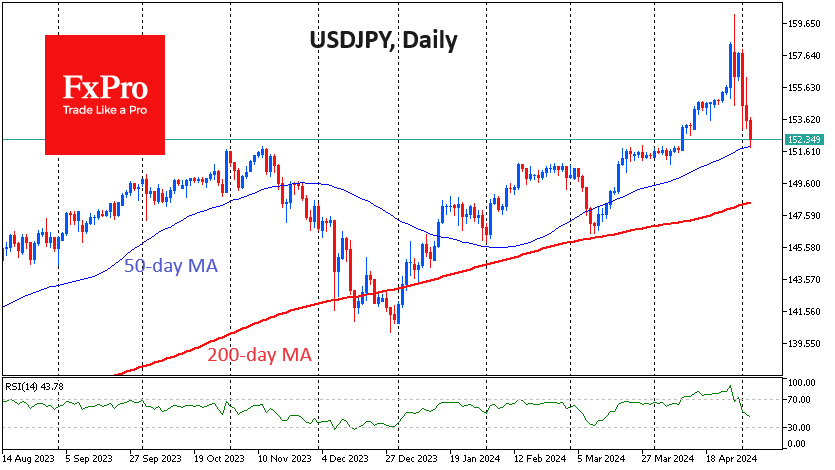

USDJPY was slipping below 153 on Friday morning, a three-week low and having lost over 4.5% from a peak of 160.2 at the start of trading on Monday. Behind the pair's rise is a long-term fundamental factor: a huge and widening interest rate differential with a shrinking trade surplus. Currency interventions of the Japanese Ministry of Finance cause the decline. Let's try to understand at what levels USDJPY interventions will stop.

The yen's growth impulses are diminishing. In October 2022, USDJPY went from a peak at 151.8 to a bottom at 127.3 (-16.3%) in about three months. The pullback in November 2023 was half as short (January) and half as deep (7.6%).

Yen growth impulses without direct intervention are also becoming less pronounced. There have also been two sustained declines in USDJPY, in July 2023 (around 5%) and March 2024 (around 2.7%), on speculation that the Bank of Japan will turn to active monetary tightening.

The authorities are in no hurry to burn foreign exchange reserves, content with more modest success than in the 1990s. The time with the least FX liquidity is chosen for intervention, allowing for more visible effects on the charts for less money.

We also note that the Bank of Japan has been dramatically slow in tightening monetary policy. After a rate hike in March, there was no further tightening as many expected.

This slowness is quite in the spirit of false hope from Japan's monetary policy in recent years. The financial and monetary authorities hardly aim to put the yen on a growth path but only to slow its decline. This will allow Japan to increase the competitiveness of its exports further, revitalising domestic demand at the expense of inflation.

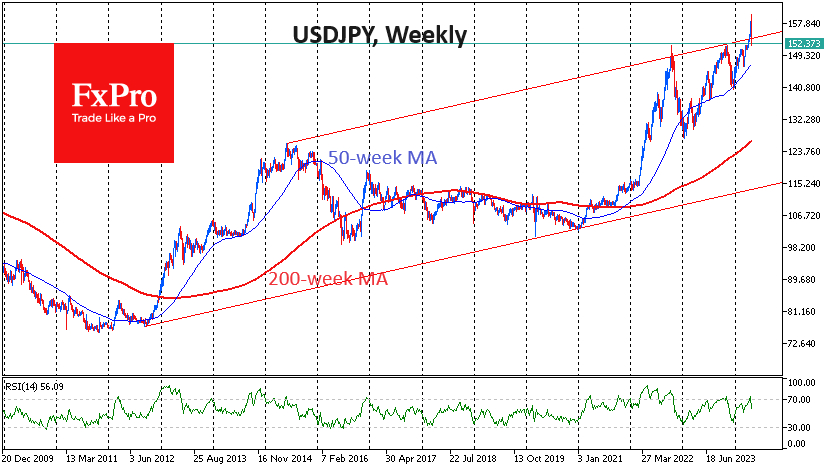

We assume that the interest in Yen appreciation will abruptly subside as USDJPY approaches the 50-week moving average. This is how it was in 2023. At the end of the year, that curve will be around 150 and is now passing through 147.

A more ambitious target of a USDJPY decline towards 122, where the pair has had two peaks in 2007 and 2015, cannot be completely ruled out.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How Low Can the USD/JPY Go?

Published 05/03/2024, 09:54 AM

How Low Can the USD/JPY Go?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.