Investing.com - European markets opened higher on Wednesday, as investors awaited the release of euro zone inflation data due later in the day, amid fresh corporate earnings reports.

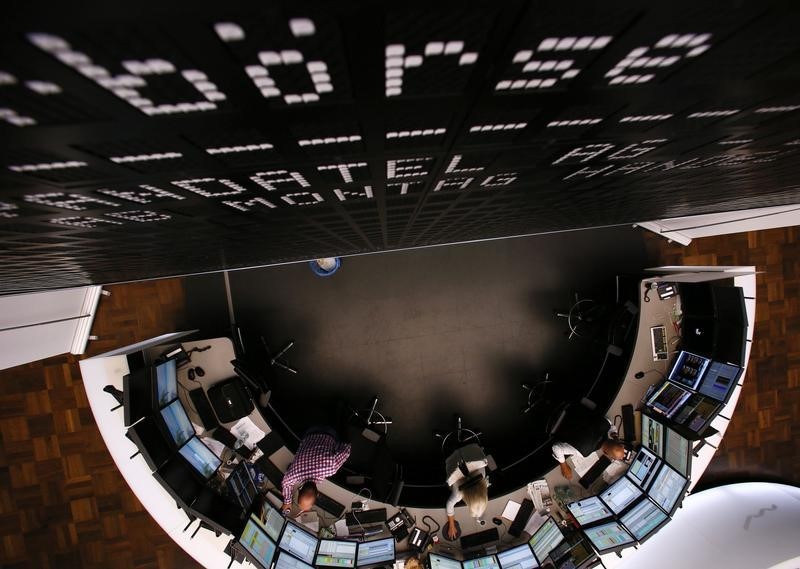

The EURO STOXX 50 rose 0.21%, France’s CAC 40 gained 0.36%, while Germany’s DAX 30 was up 0.45% by 03:30 a.m. ET (07:30 GMT).

Market participants were looking ahead to the preliminary report on euro zone consumer price inflation for January.

Last week, European Central Bank President Mario Draghi said the central bank's policymakers were still waiting for a sustained rise in inflation toward its target of around 2%.

Financial stocks were mixed, as French lenders Societe Generale (PA:SOGN) and BNP Paribas (PA:BNPP) fell 0.12% and 0.42%, while Germany's Commerzbank (DE:CBKG) and Deutsche Bank (DE:DBKGn) gained 0.04% and 0.62%.

Among peripheral lenders, Unicredit (MI:CRDI) slipped 0.10% and Intesa Sanpaol rose 0.29% in Italy, while Spanish banks BBVA (MC:BBVA) and Banco Santander (MC:SAN) gained 0.12% and 0.59% respectively.

Elsewhere, Hennes & Mauritz AB (ST:HMb) shares jumped 1.26% even after the retailer reported a 32% net profit decline in the fourth quarter.

The company also made headlines after announcing the removal of a range of socks amid claims a pattern on them resembles Allah written in Arabic upside-down.

The news came only weeks after the company was accused of racism over an ad showing a black child dressed in a sweatshirt reading 'coolest monkey in the jungle.'

Infineon Technologies AG NA O.N. (DE:IFXGn) added to gains, as shares rallied 1.32% after reporting a 27% climb in its first-quarter net profit. However, the electronic parts supplier also cut its outlook for its fiscal year 2018, citing currency headwindst.

In London, FTSE 100 inched up 0.02%, helped by SSE (LON:SSE), whose shares surged 1.78% amid reports the energy supplier is in early talks with the UK competition watchdog over its proposal to merge and spin off its UK household supply operations with those of rival Npower.

BAE Systems (LON:BAES) was also on the upside, as shares rallied 1.06%, boosted by news the U.S. army selected the company to develop advanced precision guidance kits for artillery shells.

Meanwhile, Capita PLC (LON:CPI) was the worst performer on the index as shares dove 34.69% after the company issued a profit warning for 2018 and its new Chief Executive Jonathan Lewis declared the group “too complex”, “driven by a short-term focus” and “lacking operational discipline and financial flexibility”.

Financial stocks added to losses, with Barclays (LON:BARC) dipping 0.03% and HSBC Holdings (LON:HSBA) dropping 0.38%, while Lloyds Banking (LON:LLOY) declining and the Royal Bank of Scotland (LON:RBS) declined 0.45% and 0.55% respectively.

Mining stocks were also broadly lower on the commodity-heavy index. Shares in BHP Billiton (LON:BLT) fell 0.22% and Anglo American (LON:AAL) slumped 0.50%, while Rio Tinto (LON:RIO) retreated 0.75%.

In the U.S., equity markets pointed to a higher open. The Dow Jones Industrial Average futures pointed to a 0.36% gain, S&P 500 futures signaled a 0.36% rise, while the Nasdaq 100 futures indicated a 0.39% increase.