By Tatiana Bautzer and Guillermo Parra-Bernal

SAO PAULO (Reuters) - Escalating political turmoil and a widening graft scandal are driving more Brazilian companies to sell businesses, promising a strong pipeline of mergers and acquisitions after dealmaking hit its slowest pace in a year in the second quarter, bankers said.

While stricter legal scrutiny related to the corruption scandal helped slow second-quarter M&A, bankers said funds and multinational firms were still seeking Brazilian assets. Despite economic and political headwinds, merger activity could be reignited by falling borrowing costs and an increasingly stable currency.

Pressure from creditors could also speed up asset sales by companies restructuring almost 180 billion reais ($56 billion) of debt, bankers said.

"M&A is relatively resilient to the macroeconomic and political environment as strategic players seek opportunities with long-term potential," said Patricia Moraes, head of Brazil banking for JPMorgan Chase & Co (NYSE:JPM), which topped Thomson Reuters local advisory rankings last quarter.

Uncertainty surrounding the timeframe for an economic recovery from Brazil's worst recession on record, as well as concerns about the stability of President Michel Temer's administration, have deterred some buyers and sellers from committing to deals.

Companies announced $7.052 billion worth of Brazil-related mergers last quarter, down 76 percent from the prior quarter, the rankings showed. A year earlier, when tougher due diligence procedures were implemented, announced M&A deals totaled $6.861 billion.

Last quarter, the number of announced deals fell to 132 from 141 in the prior three months and 135 a year earlier.

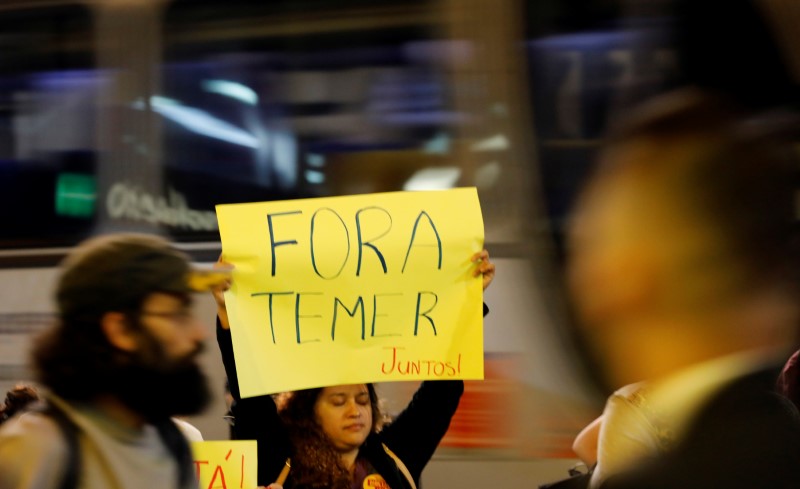

Brazilian markets tanked in mid-May after members of the billionaire Batista family accused Temer of seeking to obstruct the massive corruption probe known as Operation Car Wash. The market turmoil compounded the impact of Brazil's recession, keeping buyers and sellers at odds over valuations.

Temer has called a corruption charge filed against him by Brazil's top prosecutor a "fiction" as he faces possible removal from office.

Fallout from Operation Car Wash has led to increased due diligence concerning companies ensnared in the scandal, such as building group Odebrecht SA. Usual timeframes for such proceedings have doubled over the past year, to up to six months.

"Deals are going though an adjustment," said Alessandro Farkuh, head of M&A for Banco Bradesco BBI SA. "There's a lot of work but, because of the country's situation, M&A negotiations are taking place in an unusual way."

CONSOLIDATION

More assets are on the block as companies seek to cut debt or improve their capital and tax structures, said Eduardo Miras, co-head of Brazil investment banking at Morgan Stanley & Co (NYSE:MS), Brazil's No. 1 M&A bank this year.

"Some companies are being forced to sell," Miras said. "Opportunistic buyers and strategic players with a long-term view find themselves with a flurry of good Brazilian assets."

Car Wash-related M&A deals include J&F Investimentos SA's planned sale of a dairy producer and the maker of the popular Havaianas flip flops, Alpargatas. Members of the Batista family, which controls J&F, admitted to bribing 1,893 politicians.

Roderick Greenlees, global head of investment banking at Itaú BBA SA, said he expected deals to pick up in the third and fourth quarters amid growing interest from multinational firms and buyout funds, which are more likely to meet buyers' prices for attractive companies.

"Some premium assets are being sold because of the current situation, which in general keeps us excited about the dealflow ahead," Greenlees said.

JPMorgan and Morgan Stanley topped value rankings for the second quarter and the first half, respectively. JPMorgan worked on Itaú's $2 billion purchase of a minority stake in brokerage XP Investimentos SA.

Itaú BBA led the rankings for the number of deals after working on seven transactions last quarter and 18 this year.

In the first six months, the total of 273 Brazilian M&A-related transactions was worth $36.177 billion, more than three times the amount recorded in the same period of last year, the data showed.

For years, investment banks have derived nearly half of their annual Brazil revenues from M&A advisory. As dealmaking suffers, banks have turned to structured lending, transactional banking or, in some cases, securities trading.

Following is a table with Brazil M&A ranking for the second quarter and the first six months. Numbers are expressed in U.S. dollars, unless specified.