By Sam Nussey

TOKYO (Reuters) - SoftBank Group Corp (T:9984), a prolific investor in global technology startups, reported a sharp rise in quarterly profits and said it would be interested in parking funds in ride-hailing firms Uber Technologies [UBER.UL] or Lyft Inc in the future.

This is the first time Softbank has publicly indicated an interest in Uber, after having so far put funds into its rival Grab in Southeast Asia and China's Didi Chuxing. Last month, a media report said Uber shareholders and its board were mulling a stock sale to SoftBank and other investors.

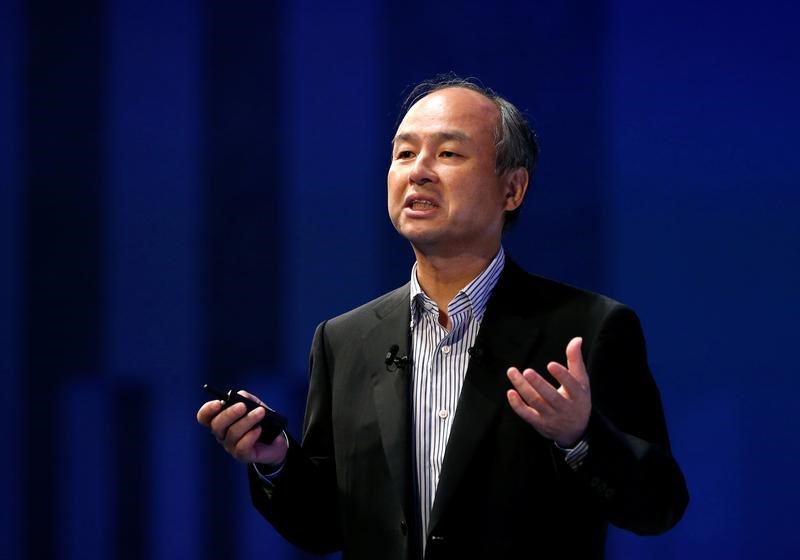

"We are interested in discussing with Uber, we are also interested in discussing with Lyft, we have not decided which way," SoftBank's CEO and founder Masayoshi Son said.

"Whether we decide to partner and invest into Uber or Lyft, I don't know what will be the end result," he told reporters at SoftBank's first-quarter earnings briefing on Monday.

SoftBank said its quarterly operating profit rose 50 percent from a year ago to 479 billion yen ($4.32 billion) after it included Vision Fund, the world's largest private equity fund, as a new reportable segment and booked a 105 billion yen gain on its stake in graphics chip maker Nvidia (O:NVDA).

Vision Fund, backed by investors including Saudi Arabia's sovereign wealth fund, Apple (O:AAPL) and Foxconn (TW:2317), has raised more than $93 billion. Its backers expect technology investments that will match or beat the 44 percent internal rate of return that SoftBank says Son has delivered by investing in internet firms in the last 18 years.

Longer term "if all goes well Vision Fund should contribute several hundred billion yen in annual revenue", Son said.

Thomson Reuters Starmine SmartEstimate puts SoftBank's full-year profit at 1.16 trillion yen, based on estimates from 20 analysts. SoftBank, however, has not released a forecast for the current business year ending March, citing uncertainty.

SoftBank's wireless unit Sprint Corp (N:S), the No.4 U.S. wireless carrier by subscribers, is exploring options to boost finances through means such as a merger with T-Mobile US Inc (O:TMUS) or a tie-up with cable provider Charter Communications Inc (O:CHTR).

Sprint, in which SoftBank has about an 80 percent stake, last week reported a quarterly profit for the first time in three years as a result of cost-cutting efforts.

"There are multiple possible business consolidation partners and negotiations are ongoing," Son said. He did not comment further as an announcement was likely in the "near future".

SoftBank shares ended up 2.4 percent before the quarterly results were announced, versus a small 0.5 percent gain in the wider index (N225)