(Bloomberg) -- Speculative traders were finally warming up to this year’s sizzling stock rally. Then they got burned.

A slew of hedge funds and speculative quants are in the throes of unwinding bullish trades built at the start of summer, after the intensifying U.S.-China trade war sparked one of the fastest routs in the decade-long bull market.

Volatility-targeting funds will sell about $50 billion of U.S. equities over the two sessions through Wednesday, while trend followers may unload another $15 billion, according to Pravit Chintawongvanich at Wells Fargo (NYSE:WFC) & Co. Leverage to American stocks among both breeds of trader reached the highest since late 2018 on the eve of the recent mayhem, according to the strategist’s estimates.

Selling by systematic investors, a deterioration in fundamentals and seasonal factors could be laying the ground for a broad retreat, according to Nomura Holdings Inc.

“We would expect any near-term rally to be no more than a head fake -- and think that any such rally would be best treated as an opportunity to sell in preparation for the second wave of volatility,” wrote Masanari Takada, a quantitative strategist at the bank.

It’s the nature of this year’s stock market: Swings between panic and euphoria on the tip of a presidential tweet, wreaking havoc on buy and sell signals tracked by quants of all stripes.

The S&P 500 rose 0.3% in early trading on Tuesday as China stabilized its currency, offering some respite after Beijing retaliated against U.S. plans to expand tariffs.

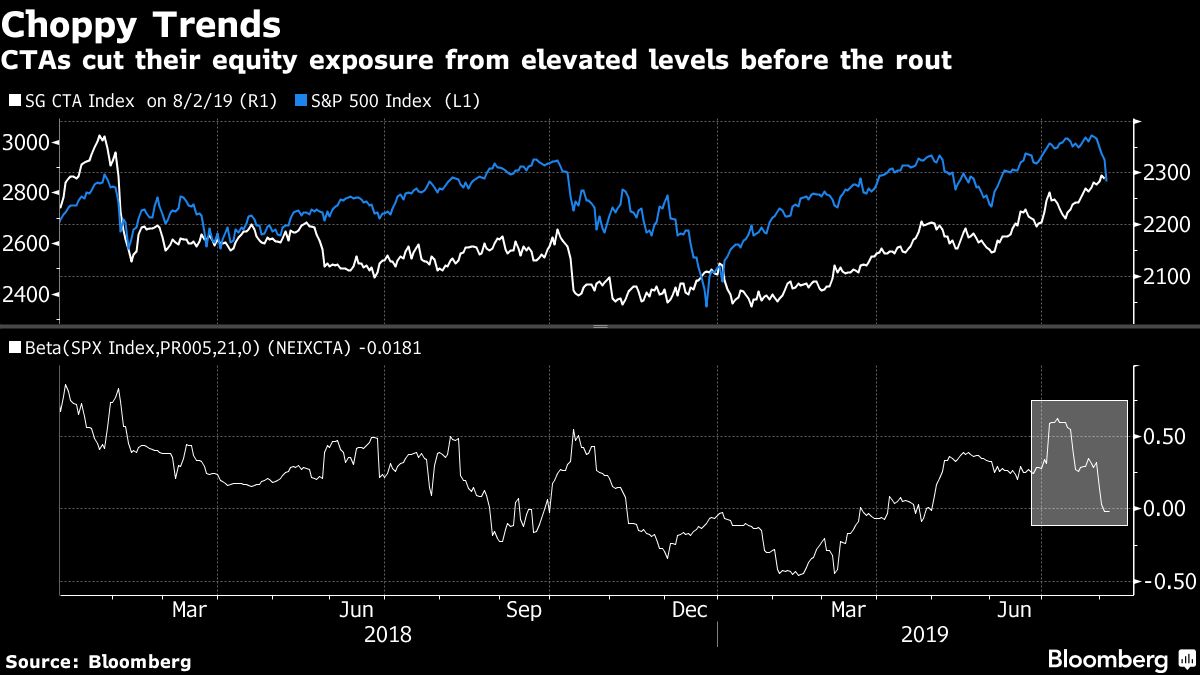

Risk-control strategies allocate exposures in line with price swings, while trend-following quants -- known as commodity trading advisers -- track momentum. As such, some selling is inevitable by design after the Chicago Board Options Exchange Volatility Index, or VIX, rose Monday to the highest since January.

If markets remain rocky, Takada at Nomura estimates risk-parity funds could sell as much as $20 billion of developed-market shares in total this month while buying an equal amount of investment-grade bonds when they re-balance at the end of August.

Deutsche Bank AG (DE:DBKGn) warned Friday that systematic traders may dump more than $70 billion of shares in the coming weeks should equity turbulence persist.

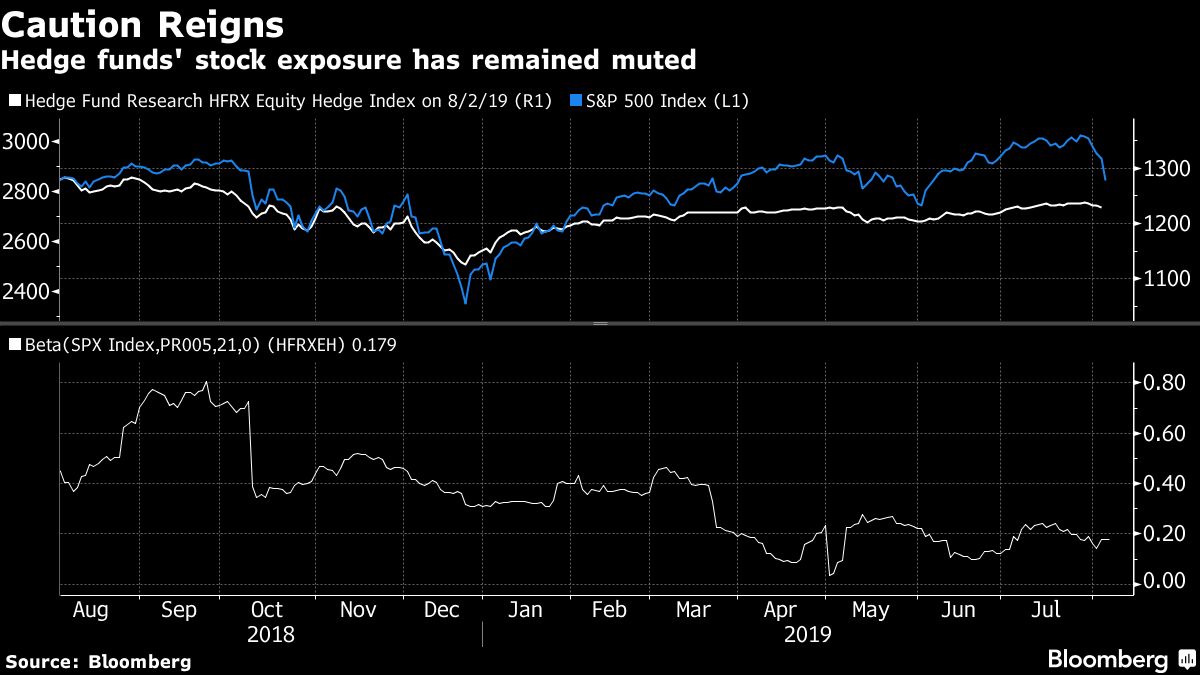

Still, tracking pots of fast money on Wall Street is far from straightforward, given wide-ranging strategies and inputs. While hedge funds may have boosted stock bets over the summer, one gauge of exposures shows still-muted positioning, based on estimates of returns attributable to the benchmark, or beta.

As for commodity trading advisers, a similar measure shows exposures to U.S. shares reached the highest in almost 18 months in early July -- before sharply plunging.

Beyond quants and hedge funds, equity funds have lost $152 billion this year, while bond products have amassed $278 billion of inflows, according to a Bank of America Corp (NYSE:BAC). report citing EPFR Global data. It’s a sign that discretionary positioning overall remains far from aggressive.

Even as a key breed of quantitative investor offloads billions this week, Wells Fargo’s Chintawongvanich stresses there’s no need to panic.

“Although this is a significant amount, it does not necessarily spell doom for equities in the next two days,” he wrote in a note, referring to the $50 billion that he estimates may be sold by volatility-linked funds. “Volatility has jumped so much, there is now a higher bar to further de-risking.”