Investing.com – The euro halted its recent decline against the U.S. dollar on Wednesday, rising from a 4-day low ahead of a key interest rate decision by the Federal Reserve.

EUR/USD hit 1.2245 during early Asian trade, its lowest since June 17; the pair subsequently consolidated around 1.2276, gaining 0.04%.

The pair was likely to find resistance at 1.2466, Monday's high, and support at 1.2115, the low of June 14.

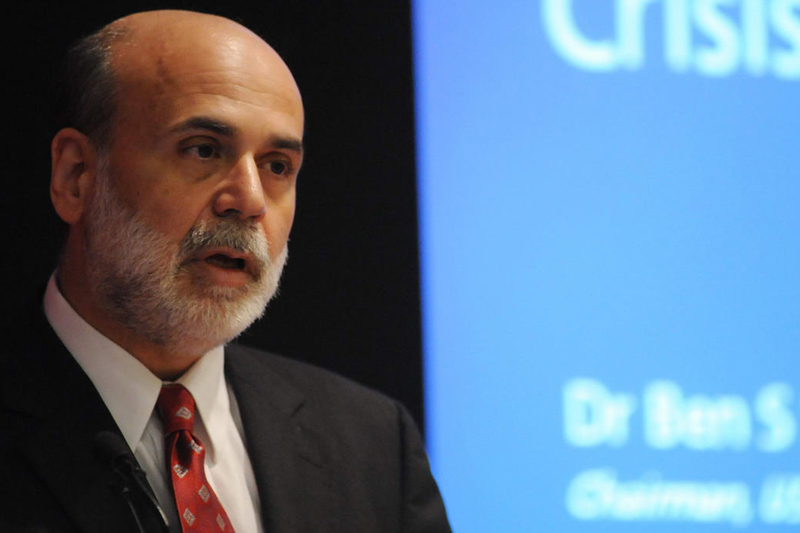

Later in the day, the Fed was expected to leave its benchmark interest rate at a record low and reiterate a pledge to leave it there for some time, in light of the fragile U.S. economic recovery and ongoing threats posed by Europe's debt crisis, high unemployment and a frail housing market.

The single European currency slid versus sterling, meanwhile, with EUR/GBP dropping 0.11% to reach 0.8274.

Earlier Wednesday, the Gfk market research group said in a report that German consumer confidence should improve in July, despite discussions over a national austerity package.

EUR/USD hit 1.2245 during early Asian trade, its lowest since June 17; the pair subsequently consolidated around 1.2276, gaining 0.04%.

The pair was likely to find resistance at 1.2466, Monday's high, and support at 1.2115, the low of June 14.

Later in the day, the Fed was expected to leave its benchmark interest rate at a record low and reiterate a pledge to leave it there for some time, in light of the fragile U.S. economic recovery and ongoing threats posed by Europe's debt crisis, high unemployment and a frail housing market.

The single European currency slid versus sterling, meanwhile, with EUR/GBP dropping 0.11% to reach 0.8274.

Earlier Wednesday, the Gfk market research group said in a report that German consumer confidence should improve in July, despite discussions over a national austerity package.