Investing.com – Last week saw the U.S. dollar fall to a three-year low against a basket of currencies, in a holiday shortened week as concerns over U.S. monetary and fiscal policy added to the pressure from low yields.

Financial markets in countries including the U.S. and U.K. were closed on Friday for the Good Friday holiday.

Standard & Poor's announcement earlier in the week that it was putting the U.S.'s triple A credit rating on a negative outlook weighed on the U.S. currency, which has weakened in recent months on the view that the Federal Reserve is likely to trail other central banks in tightening monetary policy.

The euro rallied to a 16-month high against the greenback as signs that the region’s economy is gathering momentum fueled speculation the European Central Bank will raise interest rates further this year.

The single currency’s gains came despite the continuing possibility of a Greek debt restructuring, which would exacerbate fiscal problems facing weak euro zone countries.

Meanwhile, broad dollar weakness pushed the Swiss franc to an all-time high and the yen close to a one-month high.

The Australian dollar soared to a 29-year high while the Canadian currency pushed up to its strongest since late 2007 as gains in stock and commodity prices drove investors into higher-yielding currencies.

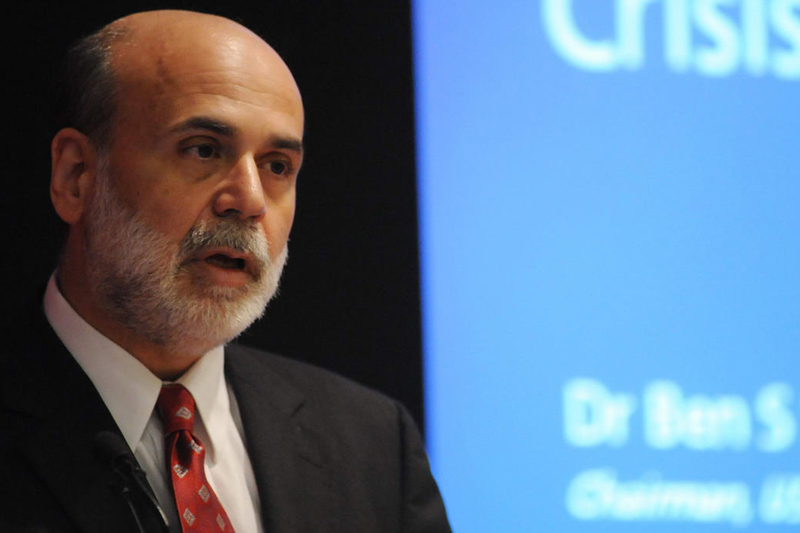

Looking ahead, in a week that will be shortened by holidays in many places, the highlight will be on Wednesday, when Fed Chairman Ben Bernanke holds a press conference after the bank’s rate setting meeting, the first ever regularly scheduled briefing by a Fed chief in the U.S. central bank's 97-year history.

The Bank of Japan, meanwhile, is to meet on Thursday with monetary policy and the damage from Japan's triple disasters still at issue.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 25

Markets in the euro zone, the U.K., Switzerland, Australia and New Zealand will all be closed for the Easter Monday holiday.

Meanwhile, the U.S. is to publish government data on new home sales, a leading indicator of economic health.

Tuesday, April 26

Australia is to publish an index of leading economic indicators, designed to predict the direction of the economy.

Switzerland is to publish official data on its trade balance, the difference in value between imported and exported goods and services, as well as an index of consumer-based economic indicators complied by UBS Bank.

Elsewhere, in the U.K. the Confederation of British Industry is to publish a report on industrial order expectations, a leading indicator of economic health, while Bank of England policymaker Andrew Sentence is to speak at an event in Manchester. His comments will be closely watched for any clues to the future possible direction of monetary policy.

Also Tuesday, the U.S. is to publish reports on house price inflation and consumer confidence, as well as official data on manufacturing activity in Richmond.

Wednesday, April 26

Japan is to publish official data on retail sales, the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Australia is to publish government data on consumer price inflation, which accounts for a majority of overall inflation. Meanwhile, New Zealand is to release a report on business confidence, while later in the day the Reserve Bank of New Zealand is to announce its official cash rate.

In the euro zone, market research group Gfk is to publish data on German consumer climate. Also Wednesday, Germany is to publish preliminary data on consumer price inflation while the single currency bloc is to release official data on industrial new orders, a leading indicator of industrial production.

Elsewhere, the U.K. is to publish preliminary data on first quarter gross domestic product, the broadest measure of economic activity and the primary gauge of the economy's health.

The U.S. is to publish official data on durable goods orders, a leading indicator of production and crude oil inventories. Also Wednesday, the Federal Reserve is to announce its federal funds rate. The announcement is to be followed by the first ever regularly scheduled briefing by a Fed chief in the U.S. central bank's 97-year history.

Thursday, April 27

Japan is to release a flurry of data, with government reports on manufacturing, household spending, consumer price inflation, unemployment and industrial production. In addition, the Bank of Japan is to hold its monthly rate setting meeting which is to be followed by a press conference to discuss the interest rate decision and the economic outlook.

In the euro zone, German is to publish official data on employment change and import prices while France is to publish official data on consumer spending. Elsewhere, in the U.K., market research group Gfk is to publish data on consumer confidence.

Also Thursday, the U.S. is to publish advance data on first quarter gross domestic product, the broadest measure of economic activity and the primary gauge of the economy's health. The country is also to publish government data on initial jobless claims and a report on pending home sales.

Later in the day, New Zealand is to publish official data on its trade balance, the difference in value between imported and exported goods and services over the month.

Friday, April 29

In the euro zone, Germany is to publish official data on retail sales, while both Italy and the wider economic zone are to publish preliminary data on consumer price inflation as well as a report on the unemployment rate. Meanwhile, the ECB is to publish a report on M3 money supply and private lending.

Elsewhere, Switzerland is to publish the results of an economic index, compiled by the KOF Economic Research Agency, designed to predict the future direction of the economy.

Canada is to publish official data on gross domestic product, the primary gauge of the economy’s health, while Australia is to produce official data on private sector credit.

Meanwhile, markets in both Japan and the U.K. will remain closed for public holidays.

The U.S. is to round up the week by releasing a flurry of data, with a government report on personal spending, personal income and personal consumption expenditures.

The country is also to publish a report on manufacturing activity in the in the Chicago area, while the University of Michigan is to publish revised data on consumer sentiment and inflation expectations. Later in the day, Fed Chairman Ben Bernanke is to speak at a public engagement. His comments will be closely watched for any clues to the possible future direction of monetary policy.

Financial markets in countries including the U.S. and U.K. were closed on Friday for the Good Friday holiday.

Standard & Poor's announcement earlier in the week that it was putting the U.S.'s triple A credit rating on a negative outlook weighed on the U.S. currency, which has weakened in recent months on the view that the Federal Reserve is likely to trail other central banks in tightening monetary policy.

The euro rallied to a 16-month high against the greenback as signs that the region’s economy is gathering momentum fueled speculation the European Central Bank will raise interest rates further this year.

The single currency’s gains came despite the continuing possibility of a Greek debt restructuring, which would exacerbate fiscal problems facing weak euro zone countries.

Meanwhile, broad dollar weakness pushed the Swiss franc to an all-time high and the yen close to a one-month high.

The Australian dollar soared to a 29-year high while the Canadian currency pushed up to its strongest since late 2007 as gains in stock and commodity prices drove investors into higher-yielding currencies.

Looking ahead, in a week that will be shortened by holidays in many places, the highlight will be on Wednesday, when Fed Chairman Ben Bernanke holds a press conference after the bank’s rate setting meeting, the first ever regularly scheduled briefing by a Fed chief in the U.S. central bank's 97-year history.

The Bank of Japan, meanwhile, is to meet on Thursday with monetary policy and the damage from Japan's triple disasters still at issue.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 25

Markets in the euro zone, the U.K., Switzerland, Australia and New Zealand will all be closed for the Easter Monday holiday.

Meanwhile, the U.S. is to publish government data on new home sales, a leading indicator of economic health.

Tuesday, April 26

Australia is to publish an index of leading economic indicators, designed to predict the direction of the economy.

Switzerland is to publish official data on its trade balance, the difference in value between imported and exported goods and services, as well as an index of consumer-based economic indicators complied by UBS Bank.

Elsewhere, in the U.K. the Confederation of British Industry is to publish a report on industrial order expectations, a leading indicator of economic health, while Bank of England policymaker Andrew Sentence is to speak at an event in Manchester. His comments will be closely watched for any clues to the future possible direction of monetary policy.

Also Tuesday, the U.S. is to publish reports on house price inflation and consumer confidence, as well as official data on manufacturing activity in Richmond.

Wednesday, April 26

Japan is to publish official data on retail sales, the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Australia is to publish government data on consumer price inflation, which accounts for a majority of overall inflation. Meanwhile, New Zealand is to release a report on business confidence, while later in the day the Reserve Bank of New Zealand is to announce its official cash rate.

In the euro zone, market research group Gfk is to publish data on German consumer climate. Also Wednesday, Germany is to publish preliminary data on consumer price inflation while the single currency bloc is to release official data on industrial new orders, a leading indicator of industrial production.

Elsewhere, the U.K. is to publish preliminary data on first quarter gross domestic product, the broadest measure of economic activity and the primary gauge of the economy's health.

The U.S. is to publish official data on durable goods orders, a leading indicator of production and crude oil inventories. Also Wednesday, the Federal Reserve is to announce its federal funds rate. The announcement is to be followed by the first ever regularly scheduled briefing by a Fed chief in the U.S. central bank's 97-year history.

Thursday, April 27

Japan is to release a flurry of data, with government reports on manufacturing, household spending, consumer price inflation, unemployment and industrial production. In addition, the Bank of Japan is to hold its monthly rate setting meeting which is to be followed by a press conference to discuss the interest rate decision and the economic outlook.

In the euro zone, German is to publish official data on employment change and import prices while France is to publish official data on consumer spending. Elsewhere, in the U.K., market research group Gfk is to publish data on consumer confidence.

Also Thursday, the U.S. is to publish advance data on first quarter gross domestic product, the broadest measure of economic activity and the primary gauge of the economy's health. The country is also to publish government data on initial jobless claims and a report on pending home sales.

Later in the day, New Zealand is to publish official data on its trade balance, the difference in value between imported and exported goods and services over the month.

Friday, April 29

In the euro zone, Germany is to publish official data on retail sales, while both Italy and the wider economic zone are to publish preliminary data on consumer price inflation as well as a report on the unemployment rate. Meanwhile, the ECB is to publish a report on M3 money supply and private lending.

Elsewhere, Switzerland is to publish the results of an economic index, compiled by the KOF Economic Research Agency, designed to predict the future direction of the economy.

Canada is to publish official data on gross domestic product, the primary gauge of the economy’s health, while Australia is to produce official data on private sector credit.

Meanwhile, markets in both Japan and the U.K. will remain closed for public holidays.

The U.S. is to round up the week by releasing a flurry of data, with a government report on personal spending, personal income and personal consumption expenditures.

The country is also to publish a report on manufacturing activity in the in the Chicago area, while the University of Michigan is to publish revised data on consumer sentiment and inflation expectations. Later in the day, Fed Chairman Ben Bernanke is to speak at a public engagement. His comments will be closely watched for any clues to the possible future direction of monetary policy.