HONG KONG (Reuters) - Hong Kong's Securities and Futures Commission (SFC) will propose a regulatory regime known as a "sandbox" for crypto exchanges in the Asian financial hub, its Chief Executive Ashley Alder said on Thursday.

Regulators around the world have been looking closely at how to oversee digital assets and cryptocurrencies, and whether existing frameworks are sufficient.

"Sandboxes" typically afford fintech firms special regulatory waivers for a limited period of time.

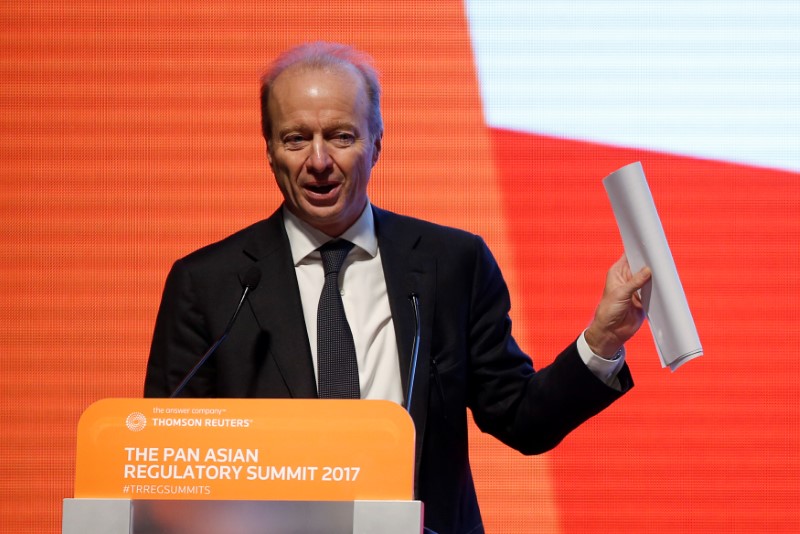

Alder said the SFC would announce later on Thursday a "new exploratory approach" to how virtual asset trading platforms, commonly known as crypto exchanges, might be regulated.

"Those exchanges that want to be regulated by us will be set apart from those that don't," he said, adding that in the "sandbox" stage no formal regulatory approval will be given to any exchange.

"This is essentially an opt-in approach for exchanges and platform operators, and they will first explore the conceptual framework with us in a strict sandbox environment," Alder told a fintech conference in Hong Kong.

He said the SFC would set out new rules under which all funds, which invest more than 10 percent of a mixed portfolio in crypto assets, will have to comply, whether or not those crypto assets are securities.

The securities regulator said in February it would crackdown on cryptocurrency exchanges that operate in the former British colony without a license or violate local securities laws.