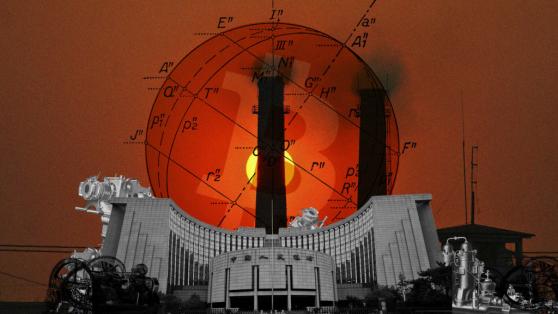

- For the first time, the Chinese government is acknowledging the value of cryptocurrencies after months of a crypto crackdown.

- Li Bo, a deputy governor of the People’s Bank of China, noted that crypto-assets like Bitcoin should be used as alternative investment options.

- He went further to reiterate that crypto-assets are not currency, which is a major distinction between them and the digital yuan.

With the digital yuan already in development, China leads the way for countries seeking to develop their own CBDCs.

China’s stance on cryptocurrency in the last few years has been largely unfavorable, following the massive crackdown on Bitcoin miners and top fintech companies.

However, the country seems to have taken a U-turn with a deputy governor of the People’s Bank of China (PBOC) recognizing the value of cryptocurrencies like Bitcoin during the Boao Forum for Asia.

China Changes Its Stance On Bitcoin?

China’s crackdown on Bitcoin miners and its hard stance on major fintech firms cast a shadow of doubt over the country’s quest to become the world’s leading cryptocurrency nation. However, it seems the tide could be turning as Li Bo, a deputy governor of the People’s Bank of China, has shown support for cryptocurrency and digital assets.

He asserted that Bitcoin and some stablecoins should be considered as alternative investment options for investors looking to diversify their portfolios. Li Bo also noted that cryptocurrencies should not be relegated to the background as they “play a major role in the future,” signaling a massive institutional interest from the government.

He went further to make a distinction between crypto-assets like Bitcoin and the proposed digital yuan, saying that, as an investment option, a crypto-asset “is not a currency in itself.”

The comments by Li Bo were reiterated by Zhou Xiaochuan, a former governor of the Central Bank of China, who noted that both digital assets and digital currencies should “be closely integrated with the real economy and serve the real economy.”

The former governor of the Central Bank of China went further to underscore the need for distinguishing digital assets and digital currencies.

On the Flipside

- Bitcoin’s value slumped by over 10% to reach a low of around $51,000 over the weekend.

- The dip has been linked to the power blackouts in China’s Xinjiang region, home to some of the largest mining pools, which caused a major decline in hash rates.

- The dip resulted in the frantic liquidation of up to $10 billion by around 927,000 traders.

Digital Yuan – The Steady March Toward A CBDC

China is in pole position among several countries frantically trying to develop their central bank digital currencies (CBDCs) as the world inexorably marches toward digitization. China’s proposed digital yuan is to be issued and regulated by the PBOC. The recent comments by Li Po and Zhou Xiaochuan indicate a harmonious relationship between Bitcoin and the digital yuan.

Speaking on whether or not the digital yuan is intended to threaten the dollar’s status as the world’s reserve currency, Li Bo said during the Boao Forum for Asia that it is not the PBOC’s intention for the digital yuan to replace the US dollar.

He stated that the process of adoption for the digital yuan will be a natural one that will be decided purely by the demands of the market. With a full-scale trial of the digital yuan scheduled for the Winter Olympics in Beijing, it will be interesting to see how it all turns out.