By Pete Schroeder

WASHINGTON (Reuters) - U.S. financial regulators and lawmakers who appeared at a congressional hearing on Thursday generally agreed that the Volcker rule, which restricts banks' ability to make bets with their own money, needs to be reconsidered.

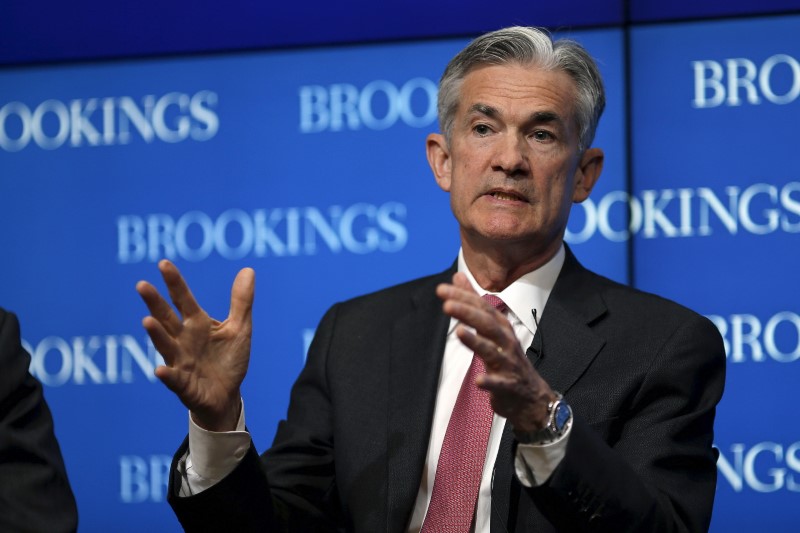

The rule should focus only on banks that do a lot of trading, said Federal Reserve Governor Jerome Powell, who leads banking regulation for the central bank.

"We believe we have the authority to draw a line between those with the big trading books (and other banks)," he told the Senate Banking Committee. "We could have that group regulated one way and have everyone else regulated less, a lot less."

Powell was one of five regulators testifying before the committee, days after the U.S. Treasury Department unveiled a plan to revamp or undo many rules enacted after the 2007-2009 financial crisis. Wall Street banks have fought Volcker vigorously, saying it is overly complicated and hurts market liquidity.

The Treasury plan is part of a broader effort by Republican President Donald Trump to cut regulations that he says are holding back economic growth. Democrats and consumer advocates largely oppose the plan, saying it would lead to more reckless behavior by the banking industry.

At the hearing, Democratic Sen. Elizabeth Warren, a fierce critic of Wall Street, described the Treasury’s recommendations as "basically cut-and-paste" from bank lobbyists.

But Sen. Heidi Heitkamp, a moderate Democrat from North Dakota, indicated clear support for re-examining Volcker.

"What I’m hearing today," she said, "is no one wants to go back, but everybody wants to tailor a rule or find a rule that can in fact accomplish the goal without overly burdening all banks."

Powell was joined by Keith Noreika, the acting comptroller of the currency, in calling for changes. Even Federal Deposit Insurance Corporation Chairman Martin Gruenberg, the sole holdover from Trump’s Democratic predecessor, Barack Obama, said he was open to some small revisions.