- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

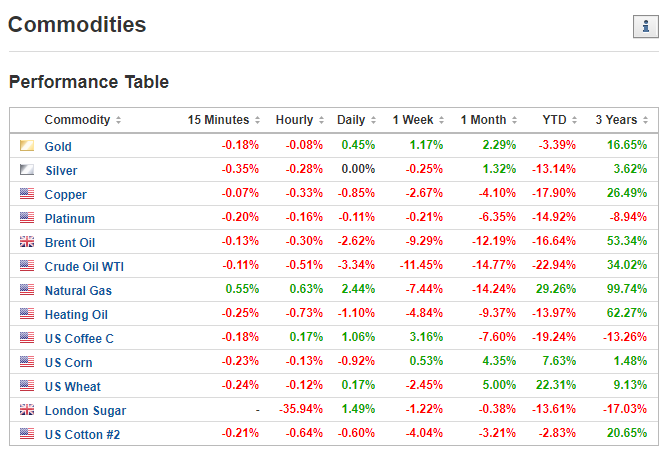

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Commodity

What Is A Commodity?

At its simplest level, a commodity is a basic good or material of a generally uniform quality that is available from multiple producers.

Major commodity markets include agriculture, metal, and energy. Large agricultural commodity markets trade such things as corn, wheat, soybeans, cattle, coffee, sugar and lumber; metal markets include trade of gold, copper, silver, and platinum; and energy markets trade oil, natural gas, and gasoline among other energy-related products.

These items, as well as others, are bought and sold on commodity spot and futures markets by producers, manufacturers, consumers, and speculators.

What Is Commodity Market

Commodity spot markets are cash markets that immediately deliver the physical commodity from the seller to the buyer. Examples of spot market sellers--or producers--include farmers, ranchers, miners, and drillers. Buyers resell the commodity or use them to create products that are then marketed to consumers.

Commodity futures and options are contracts to buy and sell a commodity at an agreed-upon future date. A futures contract locks in the time that the commodity must be delivered as well as the price upon delivery. Options contracts give the buyer or seller the right to exercise a contract to buy or sell a commodity at a specific price and date.

Both types of contracts are often used to hedge, i.e., manage risk, against exposure to price fluctuations that can occur due to weather, natural disasters, economic dynamics, political events, etc.

Futures and options contracts are traded on exchanges, e.g., the Chicago Board of Trade, the New York Mercantile Exchange and the London Metals Exchange.

Commodities Speculators

Commodity speculators prefer futures and options markets because nothing has to be stored or shipped until the expiration of the contract. Thus, buying, holding, and selling a contract can be profitable without ever taking physical possession of the commodity.

Although speculators have no intention of producing or using a commodity, their activity makes the markets more liquid for the entities that are actually doing so.

Another way for investors to participate in commodity markets is by using an Exchange Traded Fund (ETF) that trades in one or even multiple commodities. These securities are available on stock exchanges and behave just like a stock, with the price linked to the value of the commodity on futures exchanges. An ETF is a convenient investment vehicle for speculators who don’t have access to the spot or futures markets.

Commodities at Investing.com

Investing.com provides the latest general commodity futures market price information on the Commodities page, which includes sortable columns. Other tables on the page highlight the details of each type of commodity futures markets. Clicking on each commodity takes the user to a page with important information, including charts, history, technical analysis, news, and analysis, e.g. Gold.