- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can Oracle Shine Above The Clouds?

Key Takeaways

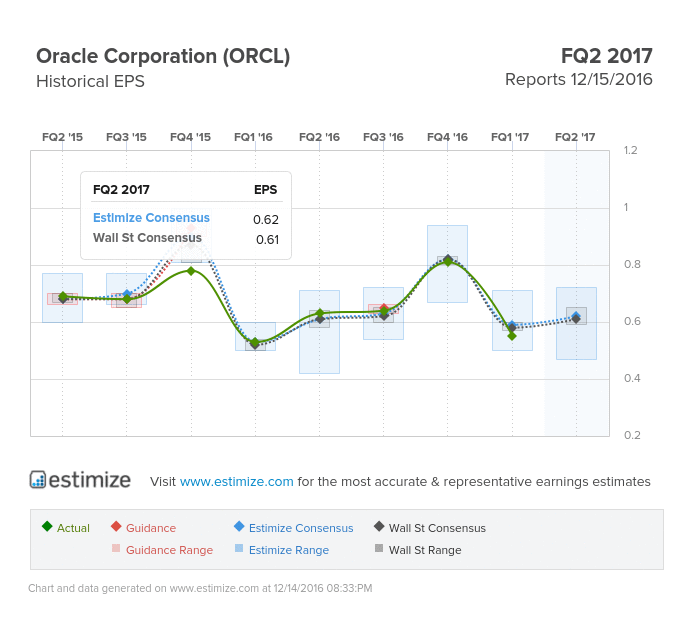

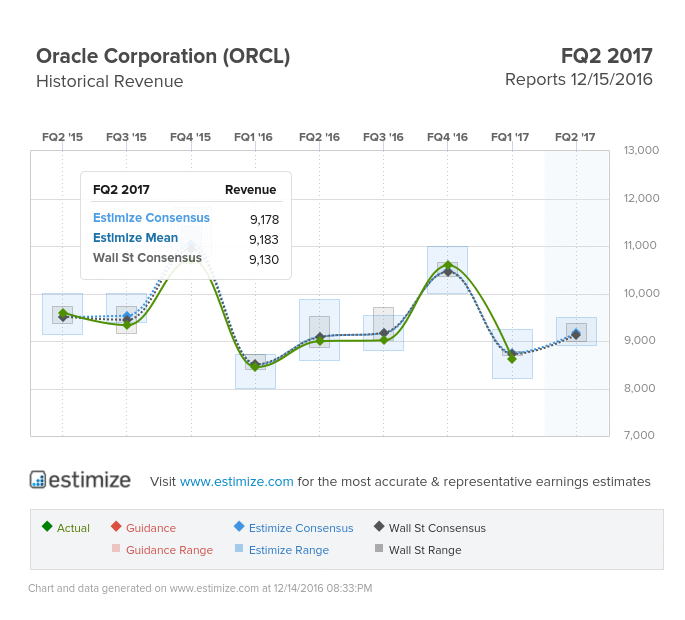

- The Estimize consensus is calling for earnings per share of 62 cents on $9.18 billion in revenue, 1 cent higher than Wall Street on the bottom line and $50 million on the top

- After a long back and forth with investors, Larry Ellison got his way and closed the deal to purchase Netsuite for $9.2 billion

- Strong growth in SaaS and PaaS will help offset weakness in Oracle’s legacy licensing business

Oracle (NYSE:ORCL) is scheduled to report its fiscal second quarter earnings today after the closing bell. The tech giant is typically one of the earlier reports in the season that doesn’t officially kick off until Alcoa’s report on January 9. Oracle is coming off a weak first quarter, failing to meet analysts estimates on both the top and bottom line. The expected rollout of new products and the integration of Netsuite should help reverse the persisting weakness over the past few quarters.

Analysts aren’t optimistic that Oracle’s strategic initiatives will pay off this quarter. The Estimize consensus is calling for earnings per share of 62 cents, down 2% from a year earlier. That estimate has ratcheted down 8% likely in response to the Netsuite deal valued at $9.2 billion. Revenue for the period is forecasted to jump 2% to $9.17 billion, reflecting the progress being made in shifting to a subscription based model.

Oracle’s transition to cloud computing in its Saas, PaaS and Big Data divisions has been encouraging. While the company enjoys a leading position in enterprise and database management systems, they are also gaining ground in the rapidly growing cloud sector. New products and the acquisition of NetSuite should help capture greater market share in spite of falling licensing revenue. Further strategic acquisitions will also play a significant role in expanding the company’s product portfolio.

Most of the upside this quarter will come from sales growth in SaaS and PaaS services which management predicts will climb 78% to 82%. Revenue from software, cloud (includes SaaS and PaaS) net software licenses and software supports is forecasted in the range of 3% to 5%.

Despite a dedicated focus on cloud computing, it won’t be all smoothing sailing. The software provider is operating in a top heavy industry, facing competition from the likes of Google, Salesforce and Amazon.

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.