A combination of Financial Sector Risk in Europe, Geopolitical concerns, and Federal Reserve Board policy debate have injected a degree of apprehension into markets.

Moreover, while WTI continues to hold on to gains, not unexpectedly, the latest OPEC oil patch musings are taking an inferior position as traders kick the oil can down the road until there is more clarity on the OPEC deal, perhaps at the November meeting in Vienna.

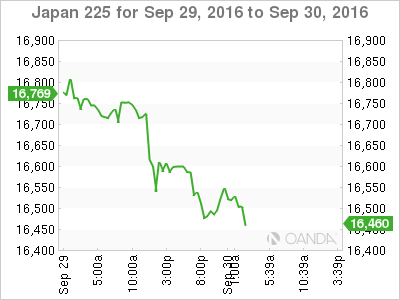

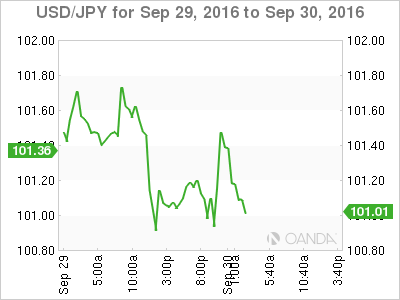

With escalating Macro concerns, the market is turning risk unfriendly. In particular, rumblings in the European-banking sector were reverberating throughout the NY session and we have seen the axiomatic risk off effect with USD/JPY falling near 101, with USD dollar buying versus risk-sensitive currencies like the Aussie dollar and other EM Asia Currencies.

While pre-US election risk jitters were expected, the mounting concerns over the stability of the European financial sector were not and this has raised more than a few eyebrows as risk managers scurry to reduce industry exposure.

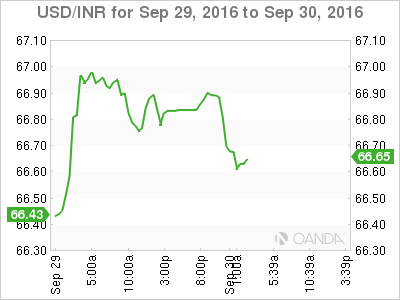

In APAC, regional geopolitical concerns also frothed after news broke that India carried out a surgical strike across the Line of Control. And while full-scale military escalation is unlikely, it’s always a risk and the market remains clearly focused on that possibility. USD/INR has eased somewhat ahead of USDINR 67.00, as opportunists place nervous long Rupee bets.

Indeed, very mixed signals in currency markets as uncertainty rule the day.

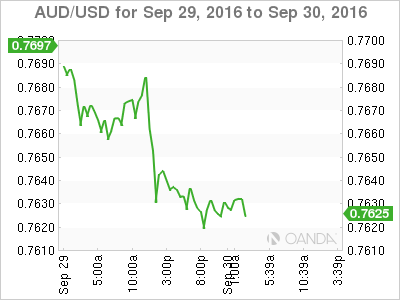

Australian Dollar

Very whippy markets exist after risk rallied in response to the OPEC deal, then hammered back to reality on a combination of risk reversal regarding European financials, Geo-Political concerns and a decent round of US economic data.

With long positions likely overextended in the wake of the OPEC risk euphoria, all eyes will be on the closing levels with the key .7600 level lining up as a significant near-term pivot point, so all eyes will be on today’s closing levels.

What appeared, after only 24 hours, to be a relatively straightforward bet post-OPEC decision, the long Aussie risk has ratcheted higher as another “too big to fail” scenario start to unfold in Europe.

Japanese Yen

With risk aversion in play, the relatively buoyant US economic data offered temporary support to USD/JPY. And, coupled with the risk-off dynamic as well as a high level of uncertainty creeping into the Yen landscape, I would expect upticks sold at least until the dust settles in the European Financial sector and Federal Reserve Board implements a rate hike. Then, the conundrum gets ironed out. The high level of uncertainty may see traders opt for the side-lines, ahead of unexpected weekend headline risk.

While it is not the time to hit the panic button, it is best to remember that where there’s smoke there’s usually fire.

The data from the CPI prints came in as expected; August’s Preliminary Industrial Production came in higher than anticipated.

Kuroda was on the wires this morning, but offered little new insight.

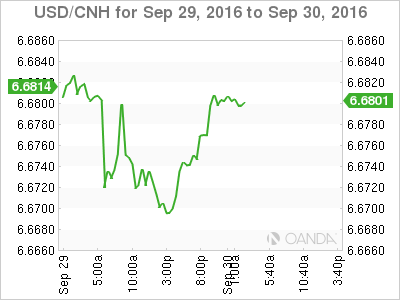

The iron fist takes is taking hold as the PBOC continues to quell Yuan speculation ahead of the SDR. As the mainland markets are closed from Oct 1 through 7, the PBOC took an unexpected tack of not easing onshore liquidity ahead of the holiday. In addition to the steady Yuan guidance theory, the other school of thought has the PBOC intentionally adjusting credit conditions as asset bubble risks become frothy again.

MYR

A lack of a convincing follow through on oil prices, coupled with whiffs of global risk aversion, has EM Asia back peddling to a degree. Until the landscape clears, expect to chop around in the current ranges as we head into the weekend.