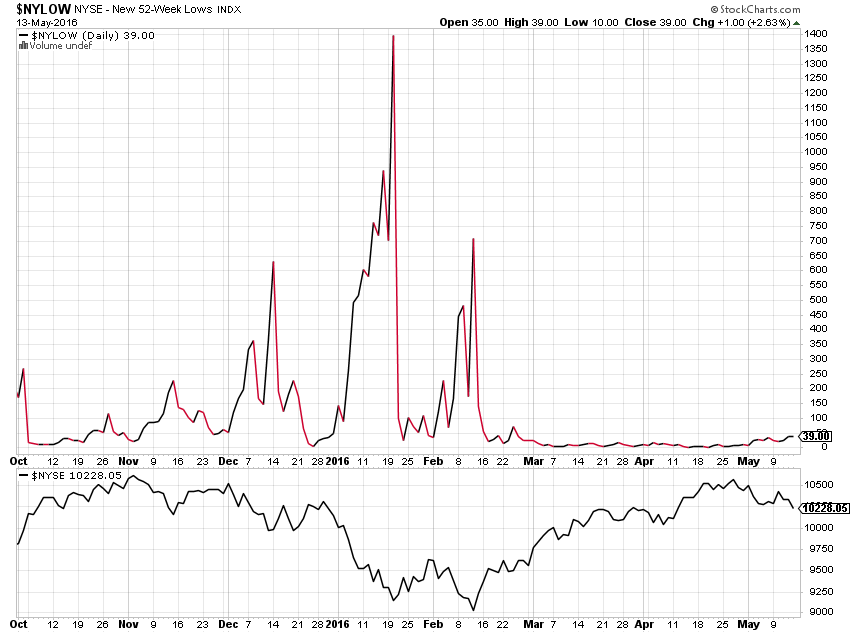

Market breadth continues to deteriorate. The number of stocks on the 52-week low list is growing, but it is still relatively low. Even Apple (NASDAQ:AAPL) appeared there last week.

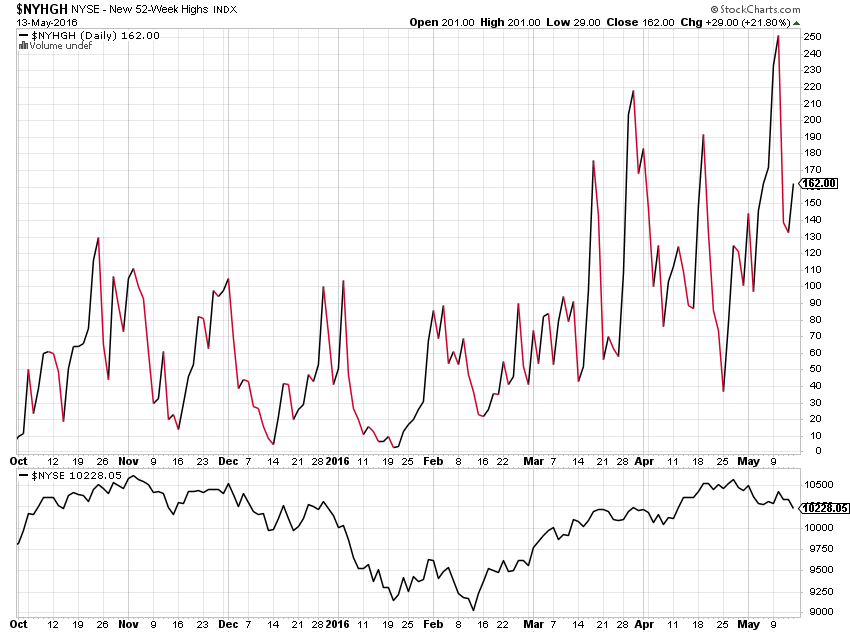

The number of stocks making new 52-week highs has been vanishing – mostly high-yield stocks, defensive names and Amazon (NASDAQ:AMZN).

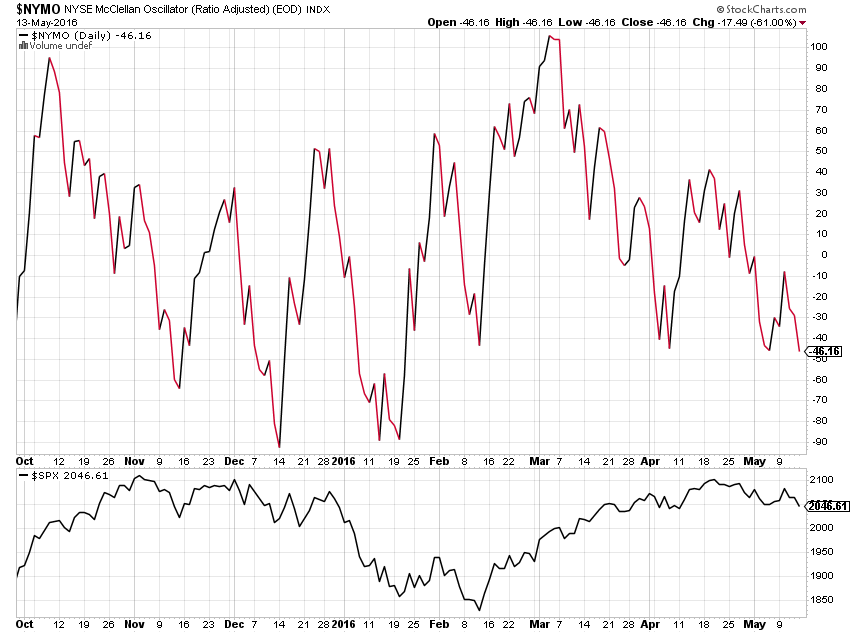

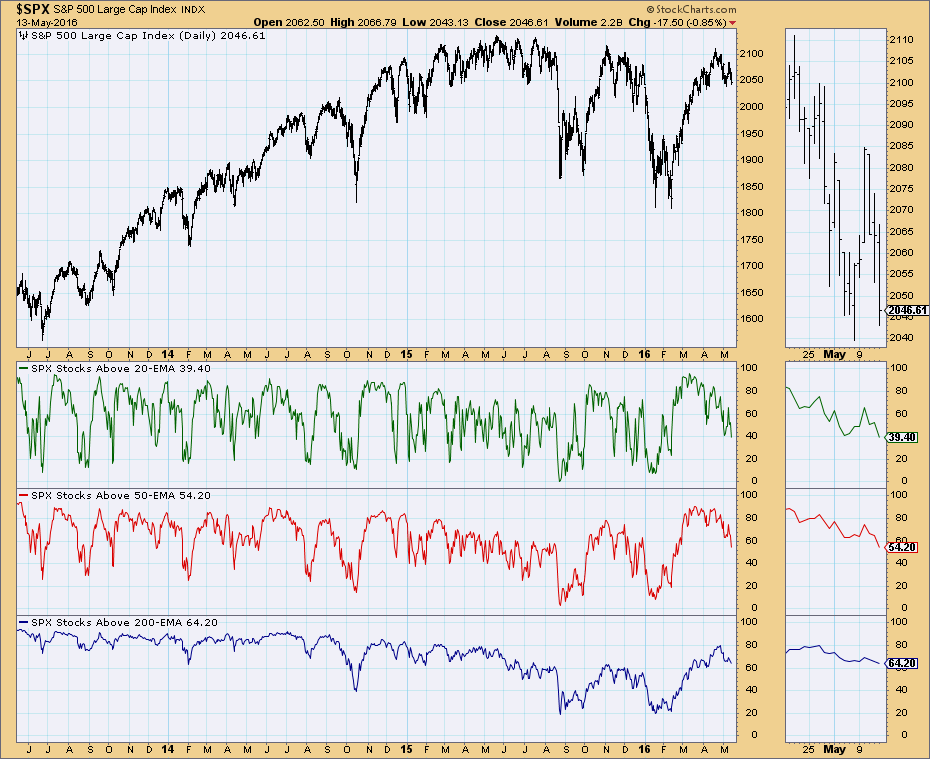

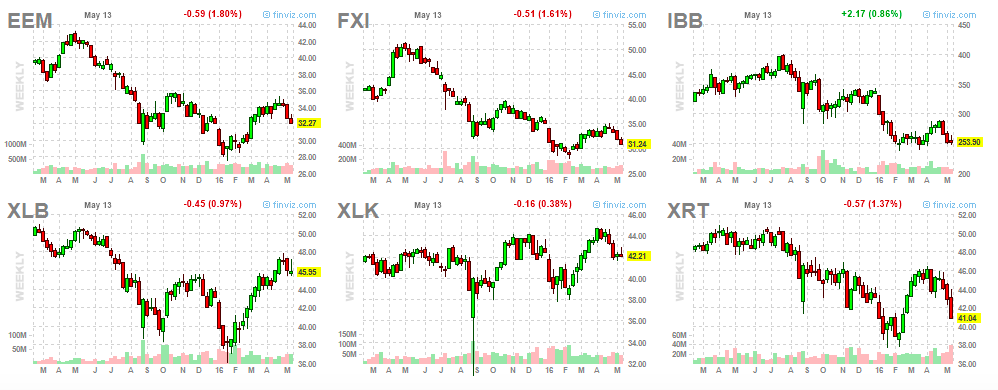

There’s a lot more distribution than accumulation. Tech and biotech started to break down a couple weeks ago. Last week, we saw extreme weakness in retailers, China, and emerging markets; even basic materials, which have been leading the market higher since February, are getting pounded.

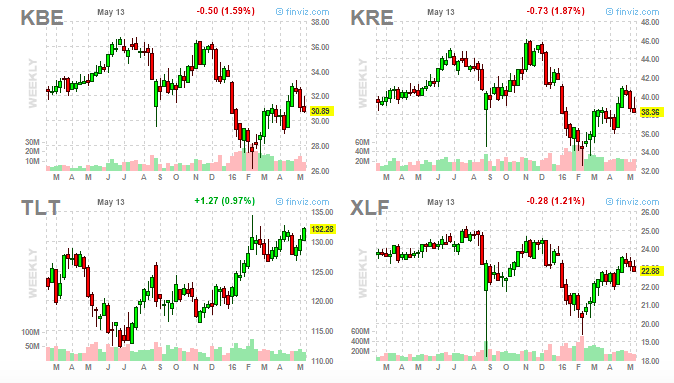

US treasuries are gaining ground, which means that interest rates are declining – this is bad news for bank stocks.

Crude oil continues to hold ground and it looks like it is ready to break out again. I wouldn’t trust its breakout in this environment. There have been many false breakouts in the past couple weeks.

There are more and more signs that stock indexes are likely to go lower in a short-term perspective. Long swing and position trades don’t work too well in this market environment. If you are a long-only trader, you basically have three options – 1) sit on the sidelines with a large cash position, 2) decrease your time frame and trade intra-day or 3) get chopped off.

There are still plenty of stocks that are acting constructively, but none of them are in a rush to break out. Most are working on their bases. If a stock doesn’t decline when almost everything around it is getting hit, there must be someone that is accumulating it. It is a potential future leader. The SL50 list does a good job highlighting those types of stocks.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.