Netflix (NASDAQ:NFLX)

Information Technology - Internet & Catalog Retail | Reports January 18, After Market Closes

Key Takeaways

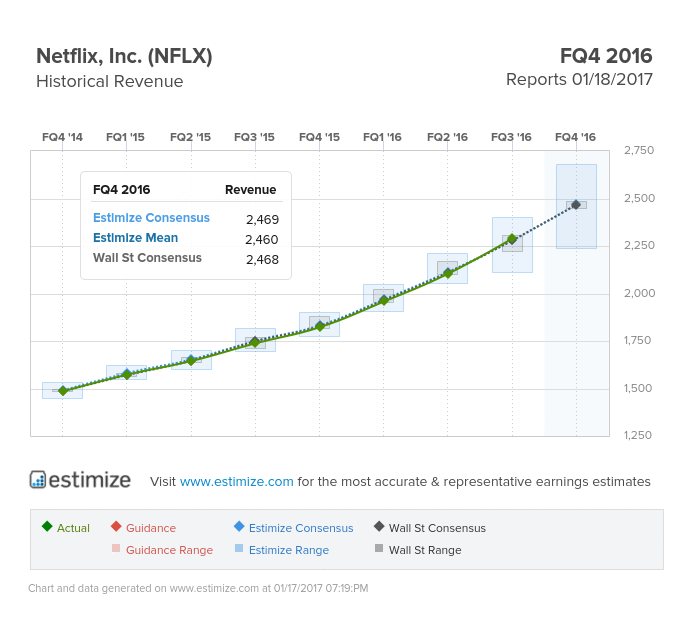

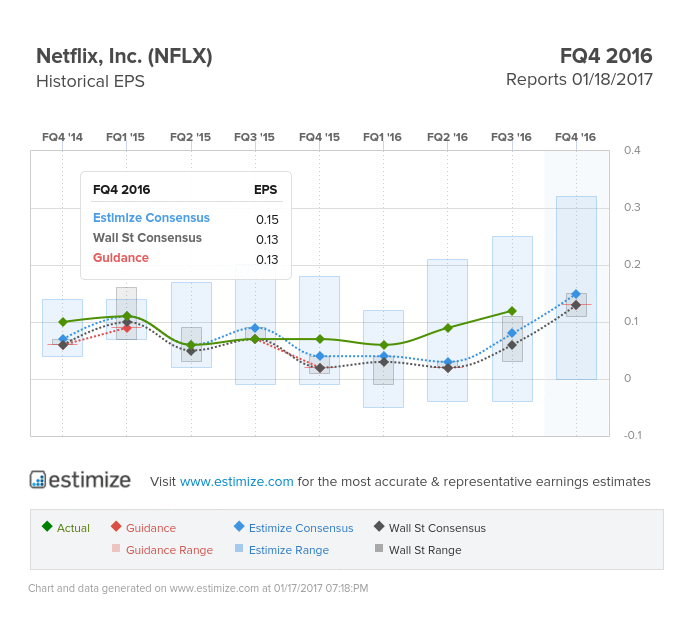

- The Estimize consensus is calling for earnings per share of 15 cents on $2.47 billion in revenue, 2 cents higher than Wall Street on the bottom line and right in line on the top

- Netflix guided an additional 5.2 million members for the fourth quarter, which compares favorably to FactSet’s forecast of about 5 million

- Amazon.com's (NASDAQ:AMZN) push to expand its video business along with Apple's (NASDAQ:AAPL) dive into original programming poses a considerable threat to Netflix’s core business

Netflix caught Wall Street off guard last quarter with its third quarter report that topped analysts expectations. Earnings for the quarter came in at 12 cents per share, 4 cents higher than the generally more bullish Estimize consensus, while revenue beat estimates by $10 million. The company said it gained a total of 3.57 million new memberships, broken down between 370,000 in the U.S. and 3.2 million internationally. Since then, shares have jumped by 33%. Investors will need to see a comparable beat tomorrow afternoon in order to sustain the bull run in motion.

Looking toward the fourth quarter, the Estimize consensus expects Netflix to post earnings per share of 15 cents, 95% higher than the same period last year. That estimate has increased by nearly 40% since its most recent report in October. Revenue for the period is forecasted to jump by 35% to $2.47 billion, marking a significant acceleration from previous quarters. The stock stock tends to do well during earnings season, rising by 3% through the print and 6% in the month following a report.

For Netflix, earnings season is often predicated on whether membership growth met or exceeded expectations. The company guided an additional 5.2 million members during the quarter; 1.45 million in the U.S. and 3.75 million internationally. This compares favorably to the FactSet forecast of 1.44 million new domestic subscriptions and 3.73 internationally. This breaks down to about $1.4 billion in revenue from domestic streaming, almost $1 billion in international streaming and a meager $130 million from DVD shipping business.

To increase growth and appeal to wider audience, Netflix continues to introduce new original programming. Its most recent series, the Crown, took home a number of awards at this year’s Golden Globes, the most notable being “Best Drama TV Series”. The company plans to increase its hours of original programming to 1,000 in 2017, but this comes at a cost. As content costs continue to rise ($6 billion this year), it won’t be surprising to see a another price hike implemented.

Meanwhile, Netflix faces additional pressure from Amazon’s recent push to expand its offerings and original content. Apple (NASDAQ:AAPL) also announced it would launch original TV shows to challenge Netflix and Amazon’s dominance. It was previously rumored that Apple might be in the market to purchase Netflix and that could very well still be true if its new efforts fall flat. Netflix is likely to be at the center of takeover rumors this year regardless of financial performance.