A big release of US economic data overnight and a larger than expected increase in US oil inventories is set to drive trade in the Asian session. Markets will be slightly more nervous around the Friday release of the Nonfarm Payrolls number (expected at 200,000) after ADP employment growth came in at 154,000 well below the market consensus of 195,000. This caused a temporary blip in the US dollar, but the ISM Service PMI and Factory Orders both came in higher than expectations and helped see the Bloomberg Dollar Index gain another 0.5%. It is still early days, but the Atlanta Fed’s GDPNow estimate is predicting a 1.7% gain in US 2Q GDP, a dramatic improvement from 1Q’s 0.5% increase. Such a number would certainly support the tentative gains we are seeing in the USD.

The weekly US Department of Energy report saw crude oil inventories climb higher than expected, adding another 2.8 million barrels. The declines in gasoline inventories and in the inventories at Cushing, Oklahoma also reversed and gained last week as well. While oil imports also increased from the prior week. One might ask how the oil price then finished the session 0.4% higher. Despite the clearly disappointing DOE report, the market is becoming quite concerned about the Canadian wild fires raging through the oil sands heartland of Alberta and what this may do to Canadian oil output.

USD/CAD was one of the best performing FX crosses overnight, gaining 1.2%. It has managed to close above the red line (Kijun-sen) for the first time since mid-January and is also sitting on a key resistance level of $1.2870. If the US dollar continues to gain and oil continues to decline, the USD/CAD could be on the verge of a major reversal.

It was another dismal performance for energy and materials stocks in overnight markets, with the materials sector in FTSE losing over 3%. Apart from oil, there was little good news in the commodity space as Iron ore lost 5.2% as it held on just above the US$60 level at US$60.1 and copper lost 1.4%. No doubt these developments helped the Aussie lose another 0.4% overnight.

Asian markets are looking to follow the US and European markets down with the ASX primed to open 0.3% lower. The biggest drag on the ASX is set to be the energy and materials sectors again today, but there could be some buying coming into BHP Billiton Ltd (NYSE:BHP) and Rio Tinto PLC (NYSE:RIO) after their massive one-day loss yesterday as investors bet on mean reversion. (AX:NAB)’s earnings results this morning are largely in line with market expectations and should help cushion the banks a bit today, but market sentiment is not positive at the moment which could drag on the sector nonetheless.

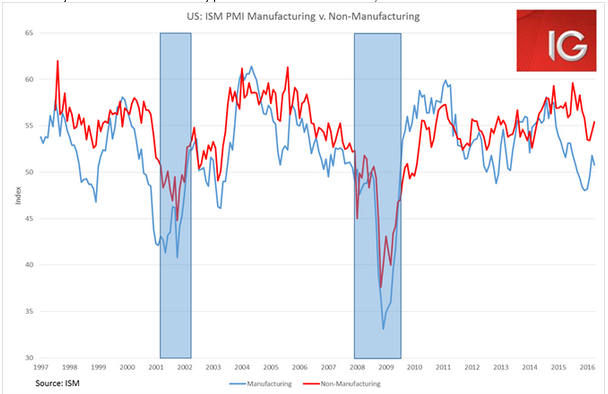

Even though the ISM manufacturing pulled back a bit last month, the services PMI rallied to a four-month high.

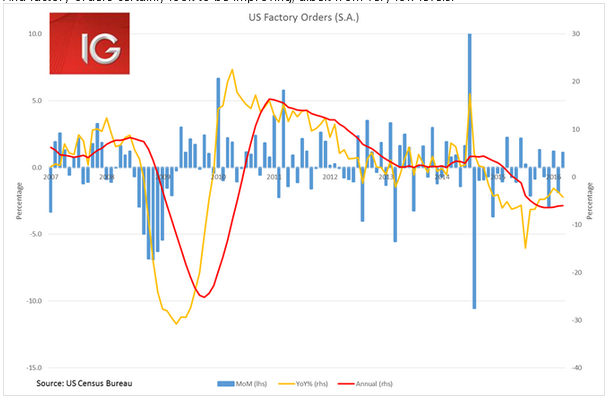

And factory orders certainly look to be improving, albeit from very low levels.